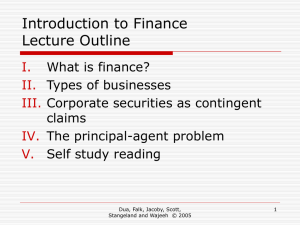

Chapter 1 What is Corporate Finance? Corporate Finance deals with the following questions What long-term investments should be undertaken (Capital Budgeting)? building, machinery equipment Where will you get the long-term financing to invest (Capital Structure)? Bring other owners (issue equity/stocks) Borrow (issue debt/bonds) How will you manage the company’s short-term cash flow (Working Capital Management)? Collecting from customers paying suppliers Jacoby, Stangeland and Wajeeh, 2000 1 The Balance-Sheet Model ASSETS Current Assets Fixed Assets Tangible Intangible LIABILITIES Current Liabilities Long-Term Debt Shareholders’ Equity Jacoby, Stangeland and Wajeeh, 2000 2 The Balance-Sheet Model ASSETS LIABILITIES Net Working Capital Long-Term Debt Fixed Assets Tangible Intangible Shareholders’ Equity Jacoby, Stangeland and Wajeeh, 2000 3 Forms of Business Organization The Sole Proprietorship Formed by a single individual Simplest and least regulated Owner keeps all profits and pays taxes as personal income Owner has an unlimited liability Cease to exist once the owner dies or withdraws Cannot raise equity beyond the owner’s wealth (limits growth) Jacoby, Stangeland and Wajeeh, 2000 4 Forms of Business Organization The Partnership Formed by 2 or more individuals/legal entities General Partnership An agreement b/w partners to provide work/cash and share profits/losses Unlimited liability Limited Partnership Limited liability for some partners (not involved in management) Simple and easy to form Owners pay taxes as personal income Cease to exist once a general partner dies or withdraws difficult to raise equity Jacoby, Stangeland and Wajeeh, 2000 5 Forms of Business Organization The Corporation A distinct legal entity owned by one or more individuals/legal entities More complicated (articles of incorporation, bylaws) Liquidity and marketability of ownership Control (shareholders, directors, managers) Limited liability Continuity of Existence Double taxation Jacoby, Stangeland and Wajeeh, 2000 6 Goals of the Corporate Firm The Agency Problem Goal of the shareholders (principals) Maximize the shareholders’ wealth Goal of the managers (agents) Maximize the corporate wealth Jacoby, Stangeland and Wajeeh, 2000 7 Separation of Ownership and Control Board of Directors Assets Shareholders Debt Debtholders Management Equity Jacoby, Stangeland and Wajeeh, 2000 8 Shareholders’ Control Devices Shareholders elect the board of directors, who hire/fire the management Management compensation plans The takeover threat Competition in the managers job market Shareholders Ability to Control the Firm Depends on Monitoring costs Costs of applying control devices Benefits of controls Agency Costs Jacoby, Stangeland and Wajeeh, 2000 9 Financial Markets and the Corporation Money Markets For short-term debt instruments Capital Markets For long-term debt and equity Primary Markets Original sale of securities by gov’t and corporations, via public offerings requires registration with the OSC with proper disclosure involve considerable accounting, legal, and selling costs private placements avoid regulation and costs Secondary Markets Where securities are bought/sold after original sale. 2 types: Dealer markets (OTC) - no physical location Auction Markets (TSE, MSE, VSE) Jacoby, Stangeland and Wajeeh, 2000 10