(1- T c )+

advertisement

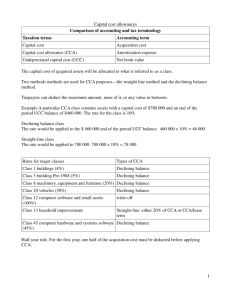

Chapter 7 Capital Budgeting & NPV Recall: Value of an Asset = PV(Future CFs) Note: CF g accounting income (earnings) Examples: Value of a Project = PV(future CFs generated by project) Value of Firm’s Equity = PV(dividends) g PV(earnings) Capital Investment g Depreciation Jacoby, Stangeland and Wajeeh, 2000 1 For the NPV of a project - use only Incremental CF Is a CF incremental? YES - if occurs as a result of accepting the project No - if occurs independent of the decision Example: Determine which is an incremental CF: a marketing survey done 2 years ago R&D expenses spent last year Sunk Costs are NOT Incremental CF apparently, the machine required for the new project is found in the company’s warehouse the company already owns the office building for the new project Opportunity Costs ARE Incremental CF buyers of the GMC’s new truck, are potential buyers of GMC’s SUV advertising of the new product will increase the sales of an older product wage increase resulting from a labour shortage due to accepting the project Side Effects ARE Incremental CF 2 The Appropriate Discount Rate The Fisher Relation: Nominal Rate (rn) Vs. Real Rate (rr): (1+ rn) = (1+ rr)(1+p) where p is the inflation rate What rate should we use? Nominal CFs should be discounted with rn Real CFs should be discounted with rr Risk and discount rates: higher risk CFs require a higher return 3 Inflation Your time-0 endowment is: $2,000,000 You can invest at a nominal rate of rn=5% p.a. At time-0, the cheapest house in Beverly-Hills costs $2,000,000 Real-estate prices are expected to grow at p=10% p.a. Can you afford buying a house in Beverly-Hills next year? At time-1 your money grows to: $2,000,000 (1.05) = $2,100,000 The cheapest house in B.H. will cost: $2,000,000 (1.10) = $2,200,000 Conclusion: the real value of your money has depreciated 4 Inflation The Fisher Relation: (1+ rn) = (1+ rr)(1+p) Your real rate is: rr = [(1+ rn)/(1+p)] - 1 = [(1.05)/(1.10)] - 1 = - 4.55% Real CF (Ct,r) vs. Nominal CF (Ct,n): Ct,n = Ct,r (1+p)t In our example: t=1, p =0.10, C1,n = $2,200,000 (actual cost), and Ct,r = Ct,n/(1+p)t = [$2,200,000 / 1.101] = $2,000,000 (time-0 value) What rate should we use? Ct,n should be discounted with rn: PV = [$2,200,000 / (1+0.05)1] = $2,095,238.10 Ct,r should be discounted with rr: PV = [$2,000,000 / (1 - 0.0455)1] = $2,095,238.10 5 Calculating the Net Operating Cash Flow (NOCF) Recall: CF g accounting income We are interested in the PV of Net (after-tax) Operating CF (NOCF): NOCF = R E - Taxes (1) Revenues where, Operating Costs Taxes = [R - E - D]Tc Plug (2) into (1): NOCF = R - E - Tc[R - E - D] = (R - E)(1- Tc) + (2) TcD 6 EBDT(1- Tc) Tax Shield of D Calculating NOCF - An Example Income Statement 100 70 Without Depreciation (D) 100 70 EBDT Depreciation (D) 30 10 30 0 30 0 EBT Taxes (@40%) 20 8 30 12 30 8 NI 12 18 Revenues Expenses CF-based (with D) 100 70 Pay less taxes ($4) 22 Tax-Shield of CCA: Tc % D = NOCF=(R - E)(1- Tc)+TcD=EBDT(1- Tc)+TcD=30(1- 0.4)+0.4%10= $22 Conclusion: CCA Tax-Shield is equivalent to cash inflow Jacoby, Stangeland and Wajeeh, 2000 = $4 7 Capital Cost Allowance (CCA) Revenue Canada’s rules of depreciating assets for tax purposes Assign every asset to its asset class (pool) Find its maximum CCA rate e.g. Brick buildings (acquired after 1987): d = 4% Electrical equipment & aircraft: d = 25% Revenue Canada’s ‘50% rule’: CCA for the first year = d [installed cost / 2] Jacoby, Stangeland and Wajeeh, 2000 8 CCA - The U-Air Case Initial Facts: U-Air is considering the addition of 4 new planes to its fleet, at a cost of $10 M each. (ready to fly), for a new line to the Bahamas Expected life of an airplane is 30 years U-Air is expected to sell the airplanes for $3,691,406.25 each in 4 years Calculate the expected CCA schedule for this purchase for the next 4 years Year Beginning UCC CCA Ending UCC CCA Tax Shield (TcCCA) 1 2 3 4 . . . . . . . . . . . . 9 Investing in Net Working Capital (NWC) An investment in NWC, represents an increase in the NWC allocated to the project: purchasing of raw materials and inventory keeping cash reserves for unexpected expenses an increase in accounts receivable a decrease in accounts payable and taxes payable NWC - The U-Air Case: U-Air managers predict the following requirement for NWC generated by the Bahamas project: Year 0 1 2 3 4 NWC 1,600 K 2,400 3,000 2,200 0 Changes in NWC +1,600 K + 800 + 600 - 800 - 2,200 Cash Flow from NWC - 1,600 K - 800 - 600 + 800 +2,200 10 Calculating Net Working Capital (NWC) Inventory Cash Accounts Receivable Accounts Payable Taxes Payable Year 0 $600,000 $1,000,000 $1,300,000 $1,100,000 $200,000 Year 1 $850,000 $1,550,000 $1,900,000 $1,600,000 $300,000 Year 2 $1,050,000 $1,950,000 $2,300,000 $2,000,000 $300,000 Jacoby, Stangeland and Wajeeh, 2000 Year 3 Year 4 $800,000 $0 $1,400,000 $0 $1,650,000 $0 $1,450,000 $0 $200,000 $0 11 Capital Budgeting: The U-Air Case Facts Costs of test marketing (already spent) $2,000 K Current (time-0) market value of 4 airplanes $40,000 K Number of round-trip tickets per year during 4-year life of the project: (16,000, 24,000, 30,000, 22,000) Ticket price $2 K Operating costs per ticket $1 K Number of round-trip tickets per year (during next 4 years) lost in sales of U-Air’s other Caribbean lines: (100, 200, 400, 300) with the same ticket price and variable cost Cash flows from investment in NWC: (-$1,600 K, -800, -600, +800, +2,200) U-Air already owns a terminal which can be used for the Bahamas project. Renting a similar terminal would cost U-Air $10,000 K per year U-Air will sell the airplanes after 4 years for $3,691.40625 K each r =10%, and Tc = 40%. Jacoby, Stangeland and Wajeeh, 2000 12 The Worksheet for Cash Flows of U-Air’s Bahamas Project ($ thousands) (All cash flows occur at the end of the year.) I. Income Year 0 Year 1 Year 2 CF from Ticket Sales Ticket Sales Revenues Sales - Side effects Year 3 Year 4 32,000 48,000 60,000 44,000 (200) (400) (800) (600) 31,800 47,600 59,200 43,400 Operating costs Fixed costs (Opportunity cost) Variable costs V. costs - Side effects EBDT EBDT(1- Tc)* 0 10,000 16,000 (100) (25,900) 5,900 3,540 10,000 24,000 10,000 30,000 (200) 10,000 22,000 (400) (300) (33,800) (39,600) (31,700) 13,800 19,600 11,700 8,280 11,760 7,020 * Calculated with Tc = 40%. Jacoby, Stangeland and Wajeeh, 2000 13 Case – Part 1 - Q1 & Q2 The Worksheet for Cash Flows of U-Air’s Bahamas Project (Cont’d) ($ thousands) (All cash flows occur at the end of the year.) Airplanes Change in NWC Total investment cash flow (ICF) II. Investments Year 0 Year 1 Year 2 Year 3 Year 4 (40,000) 14,765.625 (1,600) (800) (600) 800 2,200 (41,600) (800) (600) 800 16,965.625 Calculating the NPV of the Project (@ r = 10%) PV of EBDT(1- Tc) PV of ICF PV of CCA Tax-Shield 23,691.37 (30,634.34) 8,027.63 NPV of the Bahamas Project 1,084.66 Jacoby, Stangeland and Wajeeh, 2000 14 The PV of CCA Tax Shield If U-Air never sells the airplanes, then the CCA tax shield will be a growing perpetuity with a negative growth rate, and the twist of Revenue Canada’s ‘50% rule’ Since U-Air will sell the airplanes in 4 years (for $3,691,406.25 each), to calculate the PV of CCA tax shield, we use the growing perpetuity formula, adjusted for Revenue Canada’s ‘50% rule’ and the sale of the airplanes. In this course, we deal with the simplest case where there are no capital gains and the asset pool is not terminated after the sale (“The total value of U-Air’s class-9 asset pool is not expected to be below a level of $350 million over the next four years.”) The PV of CCA tax shield is given by: PVCCATax Shield C d Tc 1 0.5r S d Tc 1 rd 1 r rd 1 r n 40,000 0.25 0.4 1.05 14,765.625 0.25 0.4 1 0.1 0.25 1 .1 0.1 0.25 1.14 $8,027 .63K Where: S = Min[sale value of assets, original price of assets] = Min[$14,765,625.25, $40,000,000]= $14,765,625.25 C = the original price of the assets = $40,000K d = 25% for Electrical equipmentJacoby, & aircraft. Stangeland and Wajeeh, 2000 n = the time when assets are sold = 4 years 15 Total Project Cash Flow Approach ($ thousands) (All cash flows occur at the end of the year.) EBDT(1- Tc) Year 0 0 Total investment cash flow (ICF) (41,600) (800) (600) 800 16,965.625 Total Project CF (Excluding CCA Tax-Shield) (41,600) 2,740 7,680 12,560 23,985.625 5,000 2,000 8,750 3,500 (41,600) 4,740 11,180 CCA Tax-Shield s: Annual CCA Annual Tax-Shield (TcCCA) Total Project Cash Flow: Year 1 3,540 Year 2 8,280 Year 3 11,760 Year 4 7,020 6,562.5 4,921.875 2,625 1,968.75 15,185 25,954.375 Calculating the NPV of the Project (@ r = 10%) NPV of the Bahamas Project: 1,084.66 16 Case – Part 1 – Q3 The Worksheet for REAL Cash Flows of U-Air’s Bahamas Project Nominal CF’s ($ thousands) (All cash flows occur at the end of the year.) Year 0 Year 1 EBDT(1- Tc) Investment CF (ICF) 0 3,540 (41,600) (800) Year 2 Year 3 Year 4 8,280 11,760 7,020 (600) 800 16,965.625 We have an annual inflation rate of: p = 4% We convert nominal CFs to real CFs, with: Ct,r = Ct,n / (1+p)t Real CF’s Year 0 Year 1 Year 2 EBDT(1- Tc) 0 3,403.85 7,655.33 Investment CF (ICF) (41,600.00) (769.23) (554.73) Jacoby, Stangeland and Wajeeh, 2000 Year 3 Year 4 10,454.60 6,000.73 711.20 14,502.29 17 The Worksheet for REAL Cash Flows of U-Air’s Bahamas Project (Cont’d) We calculate the NPV of the REAL CFs of the Project with the real rate: Fisher Relation: rr = [(1+ rn)/(1+p)] - 1= [(1.10)/(1.04)] - 1= 5.769231% The NPV of the Project: PV of EBDT(1- Tc) PV of ICF 23,691.37 (30,634.34) PV of CCA Tax-Shield* 8,027.63 NPV of the Bahamas Project 1,084.66 Same as calculated with the nominal CF * CCA Tax-Shield is a stream of nominal CF => calculate NPV with the nominal rate Jacoby, Stangeland and Wajeeh, 2000 18