SOFTS COMMENTS Jack Scoville

MORNING GRAINS COMMENTS

Price Futures Group, CBOT

Chicago, IL

(312) 264-4322 jscoville@pricegroup.com

Jack Scoville

Thursday, April 16, 2020

JSL, SA de CV

San Salvador, El Salvador

(503) 2260-7806 jslsadecv@comcast.net

JSL, SA

San José, Costa Rica

(506) 2282-7024 jslsa@comcast.net

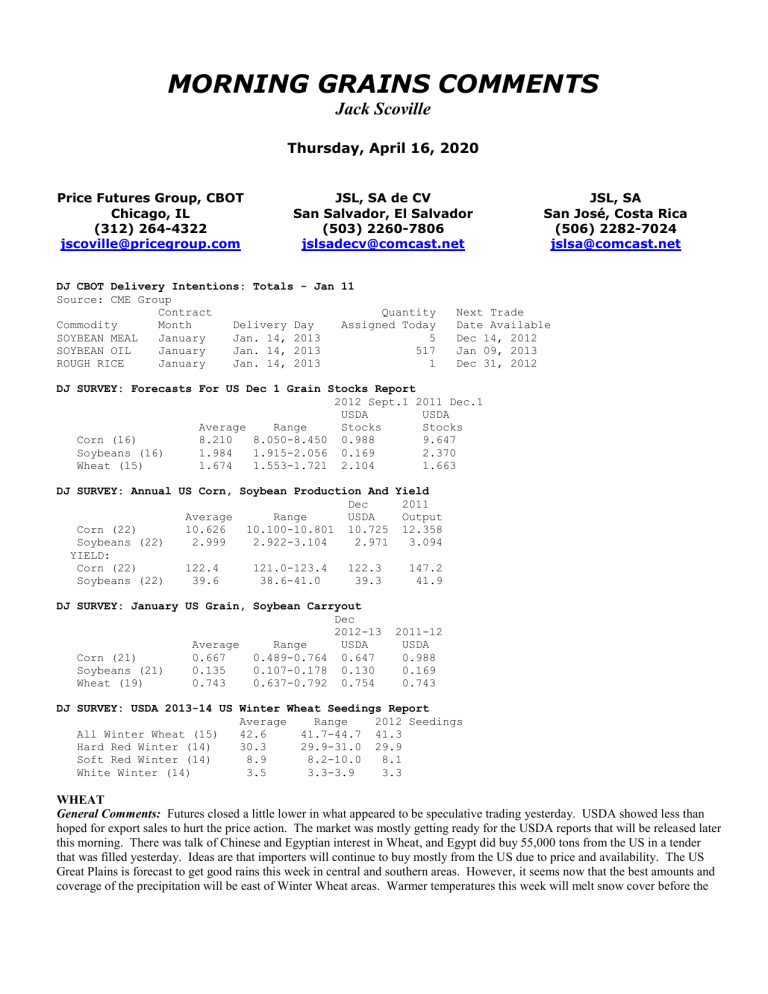

DJ CBOT Delivery Intentions: Totals - Jan 11

Source: CME Group

Contract Quantity Next Trade

Commodity Month Delivery Day Assigned Today Date Available

SOYBEAN MEAL January Jan. 14, 2013 5 Dec 14, 2012

SOYBEAN OIL January Jan. 14, 2013 517 Jan 09, 2013

ROUGH RICE January Jan. 14, 2013 1 Dec 31, 2012

DJ SURVEY: Forecasts For US Dec 1 Grain Stocks Report

2012 Sept.1 2011 Dec.1

USDA USDA

Average Range Stocks Stocks

Corn (16) 8.210 8.050-8.450 0.988 9.647

Soybeans (16) 1.984 1.915-2.056 0.169 2.370

Wheat (15) 1.674 1.553-1.721 2.104 1.663

DJ SURVEY: Annual US Corn, Soybean Production And Yield

Dec 2011

Average Range USDA Output

Corn (22) 10.626 10.100-10.801 10.725 12.358

Soybeans (22) 2.999 2.922-3.104 2.971 3.094

YIELD:

Corn (22) 122.4 121.0-123.4 122.3 147.2

Soybeans (22) 39.6 38.6-41.0 39.3 41.9

DJ SURVEY: January US Grain, Soybean Carryout

Dec

2012-13 2011-12

Average Range USDA USDA

Corn (21) 0.667 0.489-0.764 0.647 0.988

Soybeans (21) 0.135 0.107-0.178 0.130 0.169

Wheat (19) 0.743 0.637-0.792 0.754 0.743

DJ SURVEY: USDA 2013-14 US Winter Wheat Seedings Report

Average Range 2012 Seedings

All Winter Wheat (15) 42.6 41.7-44.7 41.3

Hard Red Winter (14) 30.3 29.9-31.0 29.9

Soft Red Winter (14) 8.9 8.2-10.0 8.1

White Winter (14) 3.5 3.3-3.9 3.3

WHEAT

General Comments: Futures closed a little lower in what appeared to be speculative trading yesterday. USDA showed less than hoped for export sales to hurt the price action. The market was mostly getting ready for the USDA reports that will be released later this morning. There was talk of Chinese and Egyptian interest in Wheat, and Egypt did buy 55,000 tons from the US in a tender that was filled yesterday. Ideas are that importers will continue to buy mostly from the US due to price and availability. The US

Great Plains is forecast to get good rains this week in central and southern areas. However, it seems now that the best amounts and coverage of the precipitation will be east of Winter Wheat areas. Warmer temperatures this week will melt snow cover before the

return of cold air next week. The cash markets in the US and around the world are firm. World prices keep moving higher, so US

Wheat is now competitive or is well below the competition. Conditions for Winter Wheat crops in the US remain an issue as weather in the Great Plains remains very dry.

Overnight News: The southern Great Plains should get some precipitation today, then will be dry. Temperatures should trend to below normal. Northern areas could see dry weather or light precipitation, mostly over the weekend. Temperatures should average below to much below normal after today. The Canadian Prairies should see mostly dry conditions or light precipitation.

Temperatures will average below normal.

Chart Analysis: Trends in Chicago are mixed to down with objectives of 730, 697, and 641 March. Support is at 744, 740, and 737

March, with resistance at 761, 768, and 780 March. Trends in Kansas City are mixed to down with objectives of 791, 766, and 710

March. Support is at 796, 783, and 770 March, with resistance at 807, 817, and 834 March. Trends in Minneapolis are mixed.

Support is at 835, 830, and 816 March, and resistance is at 853, 861, and 871 March.

RICE

General Comments: Prices closed lower yesterday in reaction to a disappointing week of export sales and in preparation for the

USDA reports today. The reports will be released at 11:00 AM Chicago time. Nothing has really changed on the charts or in the news for Rice at this time. Charts show that trends are mixed for the short term. Ideas are that the market is getting oversold after the big down moves of the last few sessions. Domestic cash markets are called slow, but with a steady to firm tone. The export sales report once again showed good demand, but less than what has been seen in recent weeks. The export pace has been strong for several weeks now, and more strong business is expected in the short term. The market is still finding little selling interest from producers, and cash prices continue to firm. Very little Rice is left in producer hands in Texas,

Overnight News: Rain from west to east today. Dry again over the weekend. Temperatures will average above normal today and tomorrow, then below normal.

Chart Analysis: Trends are mixed. Support is at 1510, 1504, and 1490 March, with resistance at 1526, 1534, and 1540 March.

CORN AND OATS

General Comments: Corn and Oats were a little higher one more time as traders start to get ready for the USDA reports that will be released later this morning. Most expect USDA to trim production estimates due to abandonment of the crops in some areas.

Demand ideas have fueled debate as some expect USDA to show robust demand potential while others note that exports so far have been poor. Demand on the export side remains very weak, but US prices are becoming more and more competitive and export demand could increase in the near future. Export demand was poor once again in the weekly reports released yesterday. Domestic demand reports have been soft for feed due to reduced animal populations, but domestic demand for ethanol production has held strong and is on pace to meet USDA targets and other industrial demand should be good. Basis levels have been very strong as farmers are not offering much. Wire reports indicated that interior US basis levels are at record highs for this time of year. Most areas were firm again yesterday. The weather is improved in of South America. Current weather forecasts feature showers and rains in northern sections of Brazil. Southern Brazil should get some rains. Dry weather is forecast in Argentina.

Overnight News:

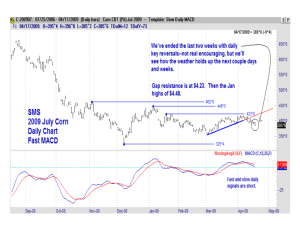

Chart Analysis: Trends in Corn are mixed. Support is at 690, 678, and 665 March, and resistance is at 701, 707, and 715 March.

Trends in Oats are mixed. Support is at 331, 329, and 327 March, and resistance is at 340, 342, and 351 March.

SOYBEANS AND PRODUCTS

General Comments: Soybeans and products closed mixed as traders get ready for the USDA reports that will be released later this morning. Soybeans and Soybean Meal closed a little lower while Soybean Oil closed a little higher. The price action was disappointing given that the export sales report compared favorably to trade expectations and as there were good sales announced by

USDA in the daily reporting system. Most seem to anticipate that the reports will be more bullish than bearish as USDA should show strong demand even if production is increased a little bit. Reports of very good growing conditions in southern Brazil continue. It is dry in Argentina, and this is beneficial. Forecasts for the week call for showers and rains in northern sections of

Brazil, and crop development should remain mostly very good. However, the northeast would like more rain. Southern Brazil should get some very beneficial precipitation this week. Drier weather is expected to return in most of Argentina this week. The overall Soybeans demand continues and there is still the threat that the US will sell all it has before too much longer, so the down side for prices could be limited. Basis levels remain strong.

Overnight News: China bought 120,000 tons of US Soybeans yesterday

C hart Analysis: Trends in Soybeans are mixed. Support is at 1373, 1356, and 1351 March, and resistance is at 1398, 1413, and

1426 March. Trends in Soybean Meal are mixed. Support is at 393.00, 381.00, and 378.00 March, and resistance is at 413.00,

419.00, and 423.00 March. Trends in Soybean Oil are mixed. Support is at 4940, 4925, and 4890 March, with resistance at 5020,

5075, and 5135 March.

CANOLA AND PALM OIL

General Comments: Canola was little changed as traders spent most of the session getting ready for the USDA reports that will be released later this morning. Elevators were good sellers of futures, and some selling was seen on the stronger Canadian Dollar.

Commercials were reported to be the best buyers, but were reported to be less active than in previous sessions. They had increased basis levels paid to farmers and it seemed to work as farmers started to sell a little bit. Exporters were mostly quiet as their demand is filled for now. Chart patterns are mixed or down. Ideas are that demand must be rationed this year and that prices will hold generally strong. Ideas are that prices for Canola should hold better than those in the Soy Complex. Palm Oil was lower again on bad demand. Exports reported from private sources were bad, although bad data had been expected. MPOB monthly data was at least as bearish as had been expected. Some selling came from ideas of less demand from China due to quality changes that started this month. News of big supplies keeps sellers around. However, Palm Oil production could continue to trend lower for seasonal reasons and start to offer some support to prices soon.

Overnight News:

Chart Analysis: Trends in Canola are mixed. Support is at 578.00, 571.00, and 569.00 March, with resistance at 586.00, 594.00, and 600.00 January. Trends in Palm Oil are mixed to down with objectives of 2360 March. Support is at 2355, 2340, and 2300

March, with resistance at 2435, 2470, and 2525 March.

DAIRY

General Comments: Dairy markets were lower on follow through selling. The market ignored good demand at the auction and focused on the charts. Chart patterns show that trends are down. Futures have rejected moves lower in the last couple of weeks, but the bears finally got the job done. Whey futures are still trying to breakout to the up side of the recent trading range, but yesterday were pushed back into the trading range on the weakness in the other dairy markets. US and EU prices continue to show premiums to other origins. Demand still seems to be good, especially for Cheese. The CME auction also showed good demand for Cheese.

Overnight News:

Chart Analysis: Trends in Milk are down with objectives of 1745 February. Support is at 1755, 1740, and 1725 February, and resistance is at 1785, 1810, and 1820 February. Trends in Cheese are down with objectives of 172.00 and 165.50 February.

Support is at 173.00, 170.00, and 167.00 February, with resistance at 175.00, 176.50, and 177.00 February. Trends in Butter are mixed to down with no objectives. Support is at 152.50, 151.50, and 150.00 February, and resistance is at 156.00, 157.50, and

158.00 February. Trends in Whey are mixed. Support is at 5700, 5600, and 5500 February, with resistance at 5900, 6000, and 6100

February.

Daily Cash Nonfat Dry Milk Trading on Thursday, January 10, 2013

(Carload Unit = 42,000-45,000 lbs)

------------------------------------------------------------------

NONFAT DRY MILK : CLOSE : CHANGE

------------------------------------------------------------------

EXTRA GRADE : $1.5600 : N.C.

GRADE A : $1.5350 : -.0125

------------------------------------------------------------------

SALES: NONE

LAST BID UNFILLED: 1 CAR GRADE A @ $1.5100

LAST OFFER UNCOVERED: 1 CAR GRADE A @ $1.5350

Close represents US $ per pound. Change is price change from previous close.

Information disseminated by USDA, Dairy Market News - Madison, WI

1204C (608) 278-4200

Daily Cash Cheese Trading on Thursday, January 10, 2013

(Carload Unit = 40,000-44,000 lbs.)

------------------------------------------------------------------

CHEESE : CLOSE : CHANGE

------------------------------------------------------------------

BARRELS : $1.6850 : -.0050

40# BLOCKS : $1.7200 : N.C.

------------------------------------------------------------------

SALES: 6 CARS BARRELS:

4 @ $1.6575, 1 @ $1.6800, 1 @ $1.6775

LAST BID UNFILLED: 1 CAR BARRELS @ $1.6850

LAST OFFER UNCOVERED: 1 CAR BARRELS @ $1.6900

Close represents US $ per pound. Change is price change from previous close.

Information disseminated by USDA, Dairy Market News - Madison, WI

1204C (608) 278-4200

Daily Cash Butter Trading on Thursday, January 10, 2013

(Carload Unit = 40,000-42,000 lbs)

------------------------------------------------------------------

BUTTER : CLOSE : CHANGE

------------------------------------------------------------------

GRADE AA : $1.4475 : -.0025

------------------------------------------------------------------

SALES: 1 CAR GRADE AA @ $1.4475

LAST BID UNFILLED: NONE

LAST OFFER UNCOVERED: NONE

Close represents US $ per pound. Change is price change from previous close.

Information disseminated by USDA, Dairy Market News - Madison, WI

1203C (608) 278-4200

Midwest Weather Forecast: Chances for rain through the weekend. Temperatures should average above to much above normal through Saturday, then near normal by Monday.

FOB Gulf of Mexico of Mexico Basis Levels:

FOB Gulf Basis Levels-Cents per Bushel

January

February

Corn

59 March

63 March

HRW

125 March

March 59 March

All basis levels are positive unless noted as negative

SRW

72 March

75 March

74 March

Soybeans

105 March

92 March

70 March

Soybean

Meal

58 March

Soybean Oil

120 March

141 W. Jackson Blvd. Suite 1340A, Chicago, IL 60604 | (800) 769-7021 | (312) 264-4364 (Direct) | www.pricegroup.com

Past performance is not indicative of future results. Investing in futures can involve substantial risk & is not for everyone. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or futures.

The Price Futures Group, its officers, directors, employees, and brokers may in the normal course of business have positions, which may or may not agree with the opinions expressed in this report. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Reproduction and/or distribution of any portion of this report are strictly prohibited without the written permission of the author.

To SUBSCRIBE to Morning Grains please click here.

To Unsubscribe from Morning Grains please click here.

Click Here to View the Morning Grains Archives