Commodity Outlook Gasoline Strategies

advertisement

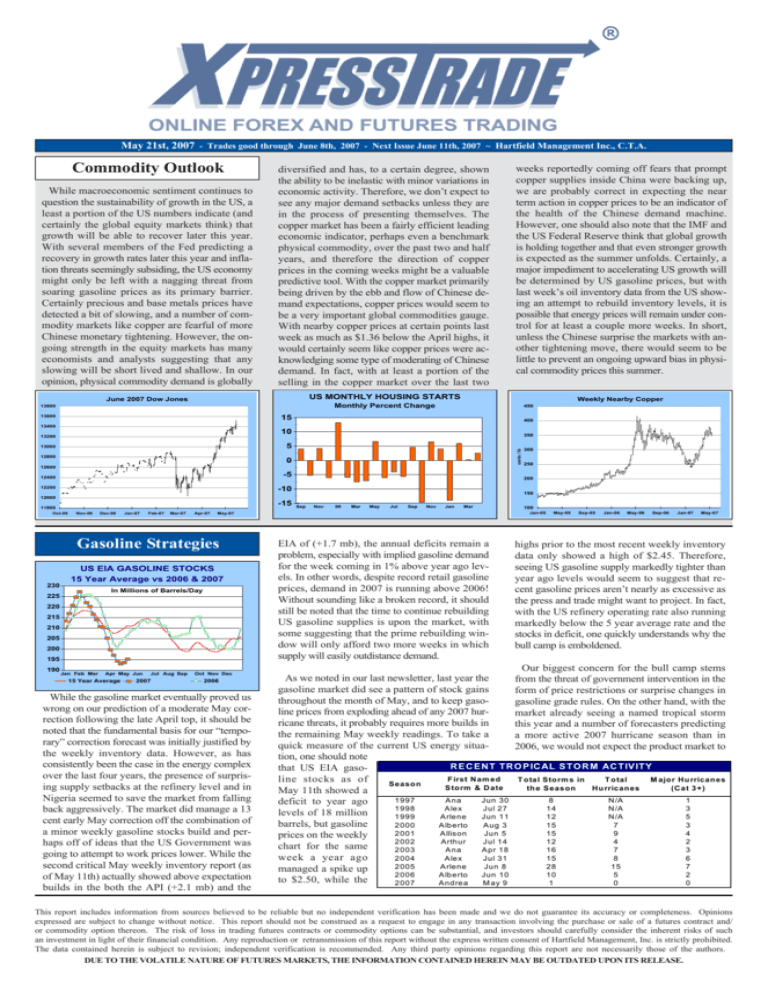

May 21st, 2007 - Trades good through June 8th, 2007 - Next Issue June 11th, 2007 ~ Hartfield Management Inc., C.T.A. Commodity Outlook While macroeconomic sentiment continues to question the sustainability of growth in the US, a least a portion of the US numbers indicate (and certainly the global equity markets think) that growth will be able to recover later this year. With several members of the Fed predicting a recovery in growth rates later this year and inflation threats seemingly subsiding, the US economy might only be left with a nagging threat from soaring gasoline prices as its primary barrier. Certainly precious and base metals prices have detected a bit of slowing, and a number of commodity markets like copper are fearful of more Chinese monetary tightening. However, the ongoing strength in the equity markets has many economists and analysts suggesting that any slowing will be short lived and shallow. In our opinion, physical commodity demand is globally diversified and has, to a certain degree, shown the ability to be inelastic with minor variations in economic activity. Therefore, we don’t expect to see any major demand setbacks unless they are in the process of presenting themselves. The copper market has been a fairly efficient leading economic indicator, perhaps even a benchmark physical commodity, over the past two and half years, and therefore the direction of copper prices in the coming weeks might be a valuable predictive tool. With the copper market primarily being driven by the ebb and flow of Chinese demand expectations, copper prices would seem to be a very important global commodities gauge. With nearby copper prices at certain points last week as much as $1.36 below the April highs, it would certainly seem like copper prices were acknowledging some type of moderating of Chinese demand. In fact, with at least a portion of the selling in the copper market over the last two June 2007 Dow Jones US MONTHLY HOUSING STARTS weeks reportedly coming off fears that prompt copper supplies inside China were backing up, we are probably correct in expecting the near term action in copper prices to be an indicator of the health of the Chinese demand machine. However, one should also note that the IMF and the US Federal Reserve think that global growth is holding together and that even stronger growth is expected as the summer unfolds. Certainly, a major impediment to accelerating US growth will be determined by US gasoline prices, but with last week’s oil inventory data from the US showing an attempt to rebuild inventory levels, it is possible that energy prices will remain under control for at least a couple more weeks. In short, unless the Chinese surprise the markets with another tightening move, there would seem to be little to prevent an ongoing upward bias in physical commodity prices this summer. Weekly Nearby Copper Monthly Percent Change 13800 13600 450 15 400 10 350 13400 13200 12800 cents / lb 5 13000 0 12600 -5 12400 12200 300 250 200 -10 150 12000 -15 11800 Oct-06 Nov-06 Dec-06 Jan-07 Feb-07 Mar-07 Apr-07 Gasoline Strategies US EIA GASOLINE STOCKS 15 Year Average vs 2006 & 2007 230 In Millions of Barrels/Day 225 220 215 210 205 200 195 190 Jan Feb Mar Apr May Jun 15 Year Average Jul Aug Sep 2007 Sep Nov 06 Mar May Jul Sep Nov Jan Mar Oct Nov Dec 2006 While the gasoline market eventually proved us wrong on our prediction of a moderate May correction following the late April top, it should be noted that the fundamental basis for our “temporary” correction forecast was initially justified by the weekly inventory data. However, as has consistently been the case in the energy complex over the last four years, the presence of surprising supply setbacks at the refinery level and in Nigeria seemed to save the market from falling back aggressively. The market did manage a 13 cent early May correction off the combination of a minor weekly gasoline stocks build and perhaps off of ideas that the US Government was going to attempt to work prices lower. While the second critical May weekly inventory report (as of May 11th) actually showed above expectation builds in the both the API (+2.1 mb) and the 100 Jan-05 May-07 EIA of (+1.7 mb), the annual deficits remain a problem, especially with implied gasoline demand for the week coming in 1% above year ago levels. In other words, despite record retail gasoline prices, demand in 2007 is running above 2006! Without sounding like a broken record, it should still be noted that the time to continue rebuilding US gasoline supplies is upon the market, with some suggesting that the prime rebuilding window will only afford two more weeks in which supply will easily outdistance demand. May-05 Sep-05 Jan-06 May-06 Sep-06 Jan-07 May-07 highs prior to the most recent weekly inventory data only showed a high of $2.45. Therefore, seeing US gasoline supply markedly tighter than year ago levels would seem to suggest that recent gasoline prices aren’t nearly as excessive as the press and trade might want to project. In fact, with the US refinery operating rate also running markedly below the 5 year average rate and the stocks in deficit, one quickly understands why the bull camp is emboldened. Our biggest concern for the bull camp stems As we noted in our last newsletter, last year the from the threat of government intervention in the gasoline market did see a pattern of stock gains form of price restrictions or surprise changes in throughout the month of May, and to keep gasogasoline grade rules. On the other hand, with the line prices from exploding ahead of any 2007 hurmarket already seeing a named tropical storm ricane threats, it probably requires more builds in this year and a number of forecasters predicting the remaining May weekly readings. To take a a more active 2007 hurricane season than in quick measure of the current US energy situa2006, we would not expect the product market to tion, one should note R E C E N T TR O P IC AL S T O R M AC T IV ITY that US EIA gasoF irst N am ed line stocks as of T o ta l Sto rm s in T o tal M ajo r H u rrican es Se aso n S to rm & D ate th e S eas on H u rrican es (C a t 3 +) May 11th showed a 1 997 A na Jun 30 8 N /A 1 deficit to year ago 1 998 A le x Jul 27 14 N /A 3 levels of 18 million 1 999 A rlene Jun 11 12 N /A 5 barrels, but gasoline 2 000 A lb erto A ug 3 15 7 3 2 001 A llison Jun 5 15 9 4 prices on the weekly 2 002 Arth ur Jul 14 12 4 2 chart for the same 2 003 A na A pr 18 16 7 3 week a year ago 2 004 A le x Jul 31 15 8 6 2 005 A rlene Jun 8 28 15 7 managed a spike up 2 006 A lb erto Jun 10 10 5 2 to $2.50, while the 2 007 And re a M ay 9 1 0 0 This report includes information from sources believed to be reliable but no independent verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/ or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the express written consent of Hartfield Management, Inc. is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. DUE TO THE VOLATILE NATURE OF FUTURES MARKETS, THE INFORMATION CONTAINED HEREIN MAY BE OUTDATED UPON ITS RELEASE. With the possibility of gasoline stocks levels rebuilding staring the market in the face over the next few weeks, the June and July RBOB options might be the best way to trade what could become an extremely volatile market. In the end, we think the bull camp will prevail, provided a pattern of gasoline stock rebuilding doesn’t occur. US EIA REFINERY OPERATING RATE 5 Year Average vs 2007 96 In Percent 94 92 90 88 86 84 Jan Feb Mar Apr May Jun Jul 15 Year Average Aug Sep Oct Nov Dec 2007 Suggested Trading Strategies: 1) Buy July RBOB futures at $2.23 and then sell a June RBOB $2.38 call for 300 points and buy a June RBOB $2.23 put for 380 points. 2) Buy an August RBOB $2.30/$2.41 bull call spread for 300 points with an objective of 800 points. Risk the combination to a net loss of 200 points. Corn Strategies The first look at the 2007/2008 season sparked a sharp rally in corn last week, as the USDA demand numbers were stronger than expected and the trend yield forecast was a bit lower than expected. As a result, there is no room for any weather scare or abnormality that could cause average yield to deviate from the USDA projection, which assumes normal weather. In addition, world stocks are expected to tighten again for the coming year, despite the highest planted area in corn since 1944, a shift to higher production in South America and an expectation for record corn production of 146 million tonnes in China. Even with the huge planted area, normal yield will not allow much of an increase in stocks. In fact, the 7.6% stocks/usage ratio for 2007/08 posted in the report last Friday ranks as the second tightest in history. The market experienced an “outside day up” the day the report was released and took on the appearance of a resumption of the longer term uptrend. The USDA pegged US ending stocks at 947 million bushels for 2007/08, which was below the pre-report average trade estimate near 1.023 billion bushels. Total usage for 2007/08 was pegged at 12.465 billion bushels versus 11.575 billion for 2006/07. Corn used to produce ethanol is expected to jump to 3.4 billion bushels for the coming season, which would represent 27% of the total crop and significantly exceed the US corn export forecast USDA SUPPLY/DEMAND US CORN Planted Area (M Acres) Harvested Area (Acres) Yield (Bu/Acre) Beginning Stocks (M Bu) Production Imports Supply, Total Feed & Residual Food, Seed & Industry Ethanol for Fuel Domestic Total Total Exports Use, Total Ending Stocks Stocks/Use Ratio Higher Yield 90.5 82.9 155.0 02-03 78.9 69.3 129.3 03-04 78.6 70.9 142.2 04-05 80.9 73.6 160.4 1,718 9,915 7 11,639 1,899 9,503 10 11,412 1,596 8,967 14 10,578 1,087 10,089 14 11,190 958 11,807 11 12,776 2,114 11,114 9 13,237 1,967 10,535 10 12,512 937 12,460 15 13,412 937 12,021 15 12,973 937 12,460 15 13,412 937 12,850 15 13,802 5,842 1,957 5,864 2,046 7,799 1,941 9,740 1,899 7,911 1,905 9,815 1,596 5,563 2,340 996 7,903 1,588 9,491 1,087 5,795 2,537 1,168 8,332 1,900 10,232 958 6,158 2,686 1,323 8,844 1,818 10,662 2,114 6,141 2,981 1,603 9,122 2,147 11,270 1,967 5,850 3,525 2,150 9,375 2,200 11,575 937 5,700 4,790 3,400 10,490 1,975 12,465 947 5,700 4,790 3,400 10,490 1,975 12,465 508 5,700 4,790 3,400 10,490 1,975 12,465 947 5,700 4,790 3,400 10,490 1,975 12,465 1,337 19.5% 16.3% 11.5% 9.4% 19.8% 17.5% 8.1% 7.6% 4.1% 7.6% 10.7% While the weather looks to turn dry in the Midwest and the intended acres look to get planted, the focus of attention seems to be quickly shifting to the abnormally dry forecast for the Midwest for the next week or so, along with warmer and drier than normal weather experienced this spring in the southeastern US, as there are concerns that these dry conditions could spread into the eastern Corn Belt. If US average yield comes in near 145 bu/acre, which would be down just 3.5% from the current trendline yield used in the USDA forecast last week, ending stocks could drop to near 508 million bushels in 2007/08 from 937 million in 2006/ 07. This would leave a stocks/usage ratio of just 4.1%, a record low. On the other hand, a yield of 155 bushels/acre brought on by good weather could bring ending stocks to 1.34 billion bushels U.S. CORN YIELD ACTUAL VS. TRENDLINE 180 160.4 150.3 140 120 100 81 83 85 87 89 91 93 95 97 99 01 03 05 07 CROP YEAR BEGINNING Actual Yield 2007-08 Crop Outlook Lower USDA Yield Yield 90.5 90.5 82.9 82.9 145.0 150.3 01-02 75.8 68.8 138.2 Talk of a developing La Nina pattern which might cause warmer and drier than normal conditions for the Midwest along with dryness concerns in China may have helped spark some of the buying support last week. In addition, it is the time of the year when traders begin to look at “what if” yield scenarios for the coming season in order to determine the need or lack of need for a weather premium. While beginning stocks are relatively tight, the sharp jump in planted area should cause the market to remain hyper-sensitive to crop developments. 80 May USDA 07-08 90.5 82.9 150.3 00-01 79.6 72.4 136.9 On top of the second tightest domestic situation in history, the market also faces extreme tightness in the world outlook, with world corn ending stocks pegged at just 90.25 million tonnes for 2007/08, the lowest since 1983/84, and a stocks/ usage of just 11.7%, which is the lowest on record going back to 1960. The forecasts above assume normal weather, but the expanding drought in the North China Plain is a concern. In Henan province, China’s “breadbasket,” rainfall since March has been down 70% on the average for the last two years. This has traders already questioning the record crop forecast. China’s ending stocks are pegged at just 25.9 million tonnes, which will mark the 8th year in a row of tightening stocks from 124 million in 1999. 160 May USDA 06-07 78.3 70.6 149.1 May USDA 05-06 81.8 75.1 148.0 of 1.975 billion bushels. This is up from 2.15 billion bushels in 2006/07, 1.6 billion last year and 1.3 billion two years ago. The USDA numbers were much tighter than trade expectations, and it will not take much in the way of a weather scare to attract new buying and the building of a weather premium. BUSHELS/ACRE top in early May the way it did last year. In looking at the enclosed table one might not be able to glean a distinct correlation between an early named tropical storm and more activity in that year but one might be able to conclude that with the exception of 2006, the propensity for a greater number of storms seen in recent years. (Some additional hurricane analysis is contained on page 3 of this newsletter, and those expected to be involved with the energy markets in the months ahead had better be aware of the importance of Gulf of Mexico weather, as the perception of a supply threat will be almost as important as an actual disruption early.) TRENDLINE YIELD and the stocks/usage ratio closer to 10.7%. This would still be down from 17.5% for 2005/06 and 19.8% for 2004/05. University studies indicate that corn planted after May 20th could yield 3 bushels fewer per acre than corn planted earlier in the spring. As of Sunday, May 13th, Iowa producers had planted just 70% of the crop as compared with 92% last year. Total US corn planting progress as of May 13th stood at 78% completed compared to 53% the previous week and 83% last year. The 10 year average planting progress for this time of year is 73%. A solid demand trend for exports, domestic feed usage and monthly ethanol usage suggests that traders will accept the solid demand numbers in the USDA forecast as credible. Funds were noted buyers of approximately 14,000 contracts on Friday, May 11th, the day the USDA report was released. Prior to that, trendfollowing fund traders had lowered their net long position from a peak of 312,921 contracts in February to 139,602 as of May 8th. A turn higher in open interest, if it occurs, will be seen as a positive technical development. The market looks vulnerable to increased fund buying and increased small trader short covering if resistance levels are violated. It will take nearly perfect weather to see a major increase in stocks for the coming season, and the recent break back to near a 50% retracement of the September to February rally could be a sign that the liquidation sell-off is nearly complete. Suggested Trading Strategies: 1) Buy December corn at 369 with an objective of 457 3/ 4. Risk the trade to 354 1/2. 2) Buy the September 380/480 bull call spread for around 21 cents with an objective of 63. Risk 8 cents from entry. Soy Complex November soybeans rallied at least 40 cents in the four trading sessions following the USDA May 11th Supply/Demand report which gave traders a first look at the new crop season. The USDA pegged ending stocks for 2007/08 at 320 million bushels, which was below the average trade estimate of 366 million bushels and down from 610 million for 2006/07. With this projection, US soybean ending stocks will have been cut almost in half from last year, and the stocks to usage ratio will fall to 10.5% from over 20%. With such a sharp reduction coming on the assumption of normal growing weather this season, the trade is already getting concerned that the market will face an extremely tight ending stocks situation for the 2008/2009 season unless planted acreage increases or demand is displaced to South America from the US. As a result, the trade perceives the need for higher soybean values in order to entice South American producers to produce more for the coming season. This has helped provide a solid base of support to the market. Suggested Trading Strategies: 1) Buy November Soybeans at 797 1/2 with an objective of 877. Risk to a close under 786. 2) Buy December soybean oil at 35.05 with an objective of 36.88. Risk to 34.49. 3) Buy December soybean meal at 214.80 with an objective of 232.90. Risk to 211.40. SOYBEAN OIL USED FOR BIODIESEL Million Pounds 250 2003 through 2005 = Average Monthly Soybean Oil Use 200 220.0 186.2 169.0 146.0 150 141.5 167.8 157.8 157.2 153.2 147.5 137.5 104.4106.6 100 55.4 50 41.2 IN METRIC TONS 2700 2600 2500 2400 2300 Gold Strategies 64.8 TOTAL WORLD GOLD MINE PRODUCTION 2200 9.9 11.4 0 03 04 05 JanFebMarAprMayJun Jul AugSepOctNovDec 07 FebMar News that the USDA left export projections for the new crop season at over 1 billion bushels despite the sharp rise in the South American harvest just completed was also seen as a positive development. Brazil and Argentina crop estimates were left unchanged from last month at 58.8 and 45.5 million tonnes respectively. This pushed the combined production to 104.3 million tonnes or up 7% from last year. China’s imports were reduced by 1 million tonnes to 30 million, as total usage was revised down to 46.85 million tonnes. In the report, world ending stocks for 2006/07 were pegged at 61.89 million tonnes versus 61.02 million reported last month and 53.84 million tonnes for 2005/06. Recent egg data suggests increasing poultry production into the summer, which is seen as a supportive force for the meal market. Wholesale prices for chicken breast jumped to average $1.85 per pound last week from $1.70 the previous week and $1.13 one year ago. The May 9th Hatchery report showed that poultry producers set 218 million eggs in incubators during the week ending May 5, 2007. This was up 3 percent from the eggs set the corresponding week a year earlier. Soybean oil prices rallied to new contract highs on Friday after the USDA report and again on Monday, Tuesday and Wednesday of last week, as US ending stocks are expected to drop 2.179 billion pounds for 2007/08 from 2.954 billion in 2006/07. The USDA began reporting domestic use for methyl ester (bio-diesel) in the supply/ demand report, with the 2007/08 figure coming in at 3.8 billion pounds, up from 2.55 billion in 2006/ 07 and 1.557 billion in 2005/06. (See enclosed chart for an update of the recent monthly usage numbers.) A surge in palm oil to a new 9-year high added to the bullish tone. Palm prices were buoyed by an 11.65% reduction in palm oil stocks for the month of April, the lowest in 3 years. Palm oil output rose 4.11% in April, which was lower than expected, while exports grew 5.9%. Higher palm oil prices relative to soybean oil prices could support a bounce in soybean oil demand despite the recent run-up in prices. Total US soybean usage is forecast at 3.039 billion bushels for 2007/08 versus 3.032 billion for 2006/07, and US exports are estimated at 1.080 billion bushels for 2007/08 versus 1.080 billion for 2006/07. The US crush was pegged at a new record high 1.79 billion bushels for the 2007/08 season, so the anticipated drop in soybean oil ending stocks is a significant concern. The surge higher in palm, a jump in energy prices and a declining ending stock outlook should be seen as supportive factors for soybean oil. Statistics Canada pegged canola stocks at 4.277 million tonnes, which is down 16.4% from last year. The market seems to have already absorbed the bearish upfront supply situation, and the USDA reports were supportive enough to suggest the need for a weather premium. Unquestionably, the main hallmark of the 2006 and 2007 bull market run in the gold market has been the perpetual weakness in the US Dollar. However, the sustainability of bullish conditions in gold would seem to be dependent upon a long list of classic fundamental themes. Perhaps more importantly, the bullish setup in the precious metals market also seems to be built on very sustainable, longer term historical shifts in financial market practices. In addition to a continued tightening of supply and demand conditions over the coming 12 months, gold and silver are also experiencing a return to prominence as an asset class. In fact, after seeing gold summarily declared a “non performing asset” by the world’s central bank community as recently as mid-2001, the re- Foreign Reserves Estimated Share Held in Gold US 76% Gold Germany, France, Italy 63% Gold Spain, Austria 45.5% Gold Japan 1.8% Gold China 1.2% Gold surgence of these assets could be considered is a tectonic shift. While gold and silver have already regained a certain share of the global investment allocation, with the Dollar seemingly set to fall as other global economic powerhouses emerge and the idea that true global diversification is set to present itself over the coming years, it would seem as though the duration of the gold and silver bull market could be quite extensive. In the end, the factors that appear to be poised to drive gold and silver even higher over the next 2-3 years are: a sinking Dollar, financial investment diversification, classic commodity supply/demand tightness, flight to quality buying, geopolitical uncertainty buying and, perhaps the most dominating of all factors, true global commodity price inflation. In short, the near term looks to be driven by the Dollar, the intermediate term by global diversification and in the long term by classic and perhaps historic inflation arising from the commodity sector. With the World Gold Council and the South African government both expecting gold production to continue to decline through the end 2100 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 of 2007 and the majority of gold producers continuing to lift gold hedges, it would certainly seem like supply will remain supportive of the bull case. While the “de-hedging” of gold positions by major producers is expected to slow down later in 2007, the consolidation of the gold mining sector has perhaps given the producers more of a say in what gold prices should be. In other words, seeing the producers hold back on hedging would seem to imply that they want even higher prices before they begin to sell forward. Therefore, until the majority of the hedges are unwound and the miners express an interest in locking in gold prices, we suspect that prices will continue to rise. Certainly the economic slowing detected in the US from February through May served to prompt the late February and early March decline in gold prices, and it might also have had a hand in the April and May slide in prices. However, with a series of new investment vehicles like ETF’s still catching hold, gold futures contracts being launched in a number of foreign countries, gold de-hedging expected to continue, gold production expected to decline further and perhaps even more labor and wage disputes ahead, we suspect that the mid January through mid May consolidation zone will end up giving the gold market a clear-cut fundamental value to work up and away from. Certainly, June gold prices could see a return to levels below the $650/ounce level, but as long as the global economy manages to regather some of its momentum in the second half of the year and the fundamental track in gold is left largely unchanged, we suspect that gold will end the year on an upbeat note, possibly revisiting the 2006 highs of $732 on the weekly charts. Suggested Trading Strategies: 1) Buy December gold at $690/buy a December gold $655 put for 13.00 and then sell a December gold $740 call for 12.00. Use an objective of $735 on the long futures and risk the combination to a loss of $1,200. 2) Sell 1 February 2008 gold $700 gold call and buy 3 February 2008 gold 770 calls for a net cost of $400. Use an objective of $720 basis the futures and risk a net loss of $1,000 on the combination. Hurricane Forming Conditions Warm waters are necessary to fuel the heat engine of the tropical cyclone. Water temperature of at least 26.5 °C (80°F) needed down to a depth of at least 50 m (150 feet). Release of latent heat through rapid temperature cooling with increased height provides energy for the tropical storm. Relatively moist layers near the mid-troposphere (5 km or 3 mi). Presence of low amounts of wind shear (High wind shear conditions prevent formation of the feedback loop). Formation within a minimum distance of at least 500 km (300 miles) or 5 degrees from the equator. Near equator formation allows the Coriolis force to deflect winds blowing towards the low pressure center, causing a circulation. A pre-existing near surface system of disturbed weather necessary, with sizable spin and low level inflow. Increased chances when sea-surface temperatures are much higher than long-term averages (current condition). Increased chances when El Niño rapidly dissipates prior to the active portion of the hurricane season (current condition). Colorado State University Forecast of at Least One Major Hurricane Landfall in the 2007 Season Entire U.S. Coastline: 74% (average for last century is 52%) U.S. East Coast Including Peninsula Florida: 50% (average for last century is 31%) Gulf Coast from the Florida Panhandle Westward to Brownsville, TX: 49% (average for last century is 30%) Above-average major hurricane landfall risk in the Caribbean Tropical Storm Activity Source Colorado State University National Oceanic and Atmospheric Administration Record high activity Record low activity Colorado State University Prediction for 2007 Colorado State University Prediction for 2007 Actual activity as of 16-May-07 Date/Type Historical Average Historical Average Historical Extreme Historical Extreme 8-Dec-06 3-Apr-07 Named storms 9.6 11 28 4 14 17 1 Hurricanes 5.9 6.2 15 2 7 9 0 Major hurricanes 2.3 2.7 8 0 3 5 0