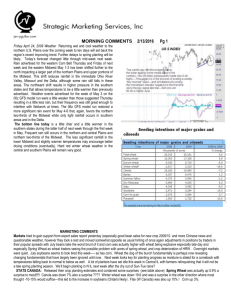

US Wheat Omaha - US Wheat Associates

advertisement

mike@themoneyfarm.com 2014-15 Market Perspective or What do we do now Ollie?? Last December Every Headline Was Bearish! • New farm crisis? Iowa farmers expected to lose money over next four years –Des Moines Register • Iowa corn and soybean growers can expect to see a $1.4 billion hit to farm income this year alone • Record Wheat Harvest Curbs Costs for Domino’s Pizza: Commodities – Bloomberg • Canola futures in Winnipeg declined sharply by Can-$15 during the past two trading days, despite the strength in soybeans – Oil World • Canadian 13/14 canola ending stocks to set record level • Minn-Dak CEO says growers will likely lose money in 2014 – Fargo Forum One Bullish Headline! The rising standard of living and the shift to more consumer-oriented economies in the emerging markets result in a reversal of the decline in agricultural commodity prices. Corn goes to $5.25 a bushel, wheat to $7.50 and soybeans to $16.00. Byron R. Wien, Vice Chairman, Blackstone Advisory Partners Things to Consider • World consumption of grains and oilseeds increasing annually regardless of prices, economies, world turmoil • World inventories will increase in 2013-14 but will still be historically small – except oilseeds • There will again be price volatility • It is now about weather & yields Total World Grains Will get smaller again on April 9th Record world corn consumption despite high prices Expected to continue to increase Prohibited GMO variety?? Possible 2014/15 Corn Outlook U.S. Corn Supply/Demand (million bushels) USDA May My 2014/15 Guess Planted Acres 91.7 90.2 Harvested Acres 84.3 83 Yield 165.3* 162 Production 13,935 13,446 1,146 1,146 Supply 15,111 14,622 Total Demand 13,385 13,400 1,726 1,222 Carry In Ending Supplies December Corn Futures Tightest ever w/ record imports! Record large world supplies! World consumes what it produces! China’s import growth continues unabated despite talk of slowing economy, poor crush margins, etc., etc. Total World Soybeans Possible 2014/15 Soybean Outlook U.S. Corn Supply/Demand (million bushels) USDA May My 2014/15 Guess Planted Acres 81.5 83 Harvested Acres 80.5 82 Yield 45.2* 44 Production 3,635 3,608 Carry In 130 130 Imports 15 (90) 15 Supply 3,780 3,753 Total Demand 3,450 3,450 330 303 Ending Supplies November Soybeans Mpls December Wheat Stats Canada Impact Chicago December Wheat Kansas City December Wheat Possible 2014/15 Wheat Outlook U.S. Wheat Supply/Demand (million bushels) USDA May My 2014/15 Planted Acres 55.8 55 Harvested Acres 45.9 45 Yield 42.7 43 1,963 1,935 Carry In 583 583 Imports 160 160? 2,706 2,678 2,166 (-285) 2,200 558 478 Production Supply Total Demand Ending Supplies U.S. Wheat Issues • Hard red winter wheat - very tight and maybe quality issues (light test weight, high protein, sprout?) • Soft red winter wheat – good crop but no demand? • Hard red spring wheat – Canada’s 2013 hangover? World Wheat Issues • EU has been and will be aggressive soft wheat seller drawing stocks down • Russia/Ukraine will sell first tonnage “cheap”, balance will depend on crop size • Southern Hemisphere wheat crop ?? El Nino?? • World demand still growing, but competing with cheaper corn for feed consumption Why Has Demand Been So Strong? “Middle Class” Outside the U.S. Expected to Double by 2022 – To Nearly 1 Billion Households Foreign households w/real PPP incomes greater than $20,000 a year Millions of Households 1000 800 600 400 Developing countries 200 0 Source: Global Insight’s Global Consumer Markets data as analyzed by OGA Developed countries (ex US) Developing Countries With Fastest Growing Middle Class 24% of households in these countries are middle class. By 2022, this could increase to 51% Households with real PPP incomes greater than $20,000 (millions) China 122 India 56 Russia 18 Brazil 13 Mexico 6 Indonesia 2011 4 Turkey Proj. gains by 2021 4 Thailand 3 Egypt 3 South Korea 2 0 25 50 75 100 Source: Global Insight’s Global Consumer Markets data as analyzed by OGA 125 150 175 200 Meat Consumption Growth Focused in Developing Nations Meat increase in developing countries is 36% vs. 7% in developed Change in Meat Consumption (2011 vs. 2001) 43% 7% -1% 12% 40% 6% 30% 19% 78% 61% 39% Data Source: USDA - PS&D 48% Things to Consider • U.S. old crop soybean supplies will stay very tight • Corn supplies not as burdensome as many had predicted – strong demand at lower prices • U.S. Wheat is very tight but Canada still has to find a home for 2013 crop • Big World Crops in 2014 Keeps Markets Bearish • The world is still a production problem away from sharply higher prices (John Deere CEO) The next bearish hurdles? • USDA June 30 Reports – Acreage revisions – How much less corn and more soybeans? • Quarterly stocks – The magical 300 to 400 million bushels of corn? – Soybean supplies? – Wheat feed usage? • Weather & yields? mike@themoneyfarm.com