market - Planet Retail

advertisement

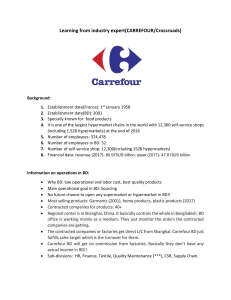

GLOBAL TRENDS & FORECASTS, 2013 Retail Horizons - Looking forward to 2020 ROBERT GREGORY Global Research Director December 2012 1 A Service MATTHEW STYCH Research Director Contents 1. Retail in 2012 2. 10 Trends for 2020 i. Flexibility ii. Internationalisation of Emerging Market Retailers iii. Mycommerce iv. Market Polarisation v. Direct to Consumer vi. Nostalgia vii. Hyperlocal Marketing viii. Community Retailing ix. Digital Engagement x. Logistics as a Differentiator 3. Retail in 2020: Implications 2 1. Retail in 2012 1. Retail in 2012 Shoppers are increasingly demanding more from retailers, who are having to face some uncomfortable questions. Where does my food come from? I want that NOW I want my voice to be heard I trust customer reviews I want convenience I want value Should I exit international markets to focus on core home market? Is big-box dead? CONSUMER Uncertainty over economy Ageing population Increasingly fastpaced lifestyles 4 Does online need offline? Am I safe from Amazon? MARKET Single households Tech-savvy Rising fuel prices Saturation Urbanisation Weak nonfood sales Legislation Rise of e-commerce 1. Retail in 2012 Three events which impacted global retail in 2012: 1. Carrefour halts roll-out of Carrefour planet concept in Europe beyond 2012. Carrefour planet was seen as the retailer’s attempts to reinvent the hypermarket format, which has been losing share in Western Europe. However, new CEO George Plassat has halted the roll-out of planet beyond 2012 given that converted stores had not performed as well as expected. Carrefour planet was too costly to roll out on a wide scale and also caused confusion among shoppers about price positioning. Failure of Carrefour planet, the retailer’s first major (and costly) attempt to revitalise the hypermarket, has sparked genuine concerns over the viability of the format. The need to invest back in the core French market has ultimately led to Carrefour exiting non-core markets such as in South-East Asia. 2012 also saw other retailers, such as Best Buy and Tesco, launch new strategies based on big-box slowdown. 5