Employee Benefits - Saint Louis University

advertisement

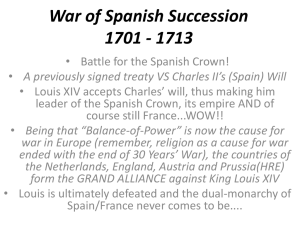

Employee Benefits SAINT LOUIS UNIVERSITY 2012 Annual Enrollment S a i n t L o u i s U n i v e r s i t y Benefits Overview—Coverages Offered Medical/Pharmacy Voluntary Dental Flexible Spending Accounts Employee Term Life and Accidental Death & Dismemberment (AD&D) Voluntary Term Life Voluntary AD&D Long Term Disability Business Travel Accident Please hold all questions until the conclusion of this presentation. We will take time to address questions at the end. S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 1 Medical/Pharmacy Benefits Annual Enrollment 2012 Highlights Effective January 1, 2012 The Vitality™ Wellness Program Save $30 per month on premium and earn rewards! Health screenings are needed to participate in the Vitality program Medical changes Primary Plan eliminated New qualified High Deductible Health Plan (HDHP) New optional Health Savings Account (HSA) for the HDHP Express Scripts Walgreens update New copays for Plus Plan New 4th tier copay for Plus Plan for self injectables “Preventive” medications under HDHP covered at 100% John Hancock – Long Term Care Exiting marketplace for new apps Will service existing policyholders Applications up until 12/31/11 No dental plan design changes S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 3 2012 Medical Plan Options Plus Plan SLUCare In-Network HSA Plan Out-of-Network Deductible SLUCare In-Network Out-of-Network Non-Embedded: (One member can satisfy entire family deductible) Individual $0 $250 $750 $1,500 $1,500 $3,000 Family $0 $500 $1,500 $3,000 $3,000 $6,000 Coinsurance 0% 10% 40% 0% 10% 40% Out-of-Pocket Maximum (includes deductibles) Non-Embedded: (One member can satisfy entire family OOP Max) Individual $0 $1,250 $4,750 $1,500 $3,000 $6,000 Family $0 $2,500 $9,500 $3,000 $6,000 $12,000 10% after ded. 40% after ded. 0% after ded. 10% after ded. 40% after ded. 100% 100% 100% 100% 100% 10% after ded. 40% after ded. 10% after ded. 40% after ded. $100 copay $100 copay 10% after ded. 40% after ded. $50 copay $50 copay 10% after ded. 40% after ded. Physician Office Visits Primary Care $10 copay Specialist Care $20 copay Preventive Care 100% Inpatient Hospital Emergency Room Urgent Care Center S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 4 2012 Pharmacy Plan Options Plus Plan HSA Plan Express Scripts Express Scripts Express Scripts Express Scripts Retail Mail Order Retail Mail Order (34-day supply) (90-day supply) (34-day supply) (90-day supply) Tier 1 $8 $16 Medical Deductible and Coinsurance Tier 2 $30 $60 Medical Deductible and Coinsurance Tier 3 $50 $100 Medical Deductible and Coinsurance Tier 4 20% to $150 Preventive Medications Priced according to the tier in which they fall Medical Deductible and Coinsurance Covered at 100%, no copay or deductible NEW! Under the proposed HSA plan, certain preventive, or “maintenance,” medications would be covered at 100%... NO copay or deductible would need to be satisfied by you or your family! For a list of these drugs go to www.slu.edu S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 5 What is an HSA? Health Savings Accounts (HSAs) are designed to help you save and pay for your health care S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 6 Putting Money INTO an HSA #1 Important Lesson: Rules when you can put money IN; no rules to pull money OUT #2 Important Lesson: Need $0.00 in your healthcare FSA before opening an HSA S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 7 HSA Eligibility You are eligible to open and contribute to an HSA if you: Are covered by an eligible high deductible health plan Are not covered by any other health plan that is not a high deductible plan Are not enrolled in Medicare, Medicaid, or TRICARE Have not received VA benefits within the past 3 months Are not claimed as a dependent on someone else’s tax return Are not covered by a healthcare FSA S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 8 Putting Money INTO an HSA How Much, and When? $3,100 for an individual; SLU will contribute $250 $6,250 for a family; SLU will contribute $500 You must aggregate the employer and employee contributions: SLU’s Seed Money ($250 or $500) + Your contribution = $3,100 or $6,250 55+ can fund an additional $1,000/year “catch-up” contribution Employee and spouse get one bite at the maximum contribution apple each year…they may allocate the maximum between their HSAs S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 9 Putting Money INTO an HSA Must be considered an “Eligible Individual” Employee has single coverage under HDHP, but is also covered under spouse’s non-HDHP plan Employee has single coverage under HDHP, but spouse has a traditional FSA Employee has family coverage under HDHP, spouse has employee-only non-HDHP coverage Employee has single coverage under HDHP, spouse has employee + children coverage under non-HDHP S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 10 HSA Qualified Medical Expenses Medical plan deductibles and coinsurance Medical, dental and vision care and services Use HSA dollars to pay for medical expenses for your spouse or dependents Any money you take out of your HSA for qualified medical expenses is income-tax free S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 11 Taking Money OUT of an HSA Issues in Distributions Reimbursement of expenses for employee, opposite-sex spouse and Tax Code “dependents” are tax free…if the expense was incurred on or after the date the HSA was established “Medical expenses” include: SAVE YOUR RECEIPTS!!! Section 213 expenses (OTC Rx with prescriptions) COBRA premiums Medicare premiums Qualified long-term care premiums Retiree health insurance after age 65, but not Medigap/Supplement plans Other withdrawals are taxable Income tax, plus… Subject to 20% excise tax if withdrawn prior to age 65 Withdrawal by HSA account holder, who is not yet 65, to pay Medicare premiums for spouse, who is at least age 65, are taxable and subject to excise tax S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 12 How an HSA Helps You Save 1 2 3 Steve S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx 4 Steve puts his money into his HSA pretax Any money Steve withdraws from his HSA to pay for qualified medical expenses is withdrawn income tax-free. Steve may earn interest on his account, and it is not taxable. The amount not spent during this year carries over for use in future years. Saint Louis University 13 How You Can Make the Most of Your Coverage Health Care Consumerism Make informed choices Look for ways to lower health care costs Own your health care decisions Understand your medical coverage Maintain a healthy lifestyle Use your preventive care coverage to catch health issues early S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 14 Paying for Non-Qualified Expenses Any funds used for purposes other than to pay for qualified medical expenses are: The tax penalty does not apply to account holders age 65 and older, those who become disabled or enroll in Medicare. Taxable as income 20% tax penalty S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 15 Making Deposits Payroll Deduction Arrange a regular automatic payroll deduction. Mail a Check Mail a deposit at any time to deposit additional dollars into your account. e-Contribute Arrange a regular electronic transfer from an account at another financial institution. S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 16 Access Your HSA Funds Use your UnitedHealthcare Health Savings Account Debit MasterCard® Sign up for automatic bill pay and online banking Use HSA checks Pay with personal funds and reimburse yourself from your HSA S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 17 Managing Your HSA with myuhc.com Treatment cost estimator Check statements Check interest rates Pay bills to health care providers Download forms Update personal information Arrange for deposits Manage investment activities Learn about HDHPs and HSAs HSA calculators Investments are not FDIC insured, are not guaranteed by OptumHealth Bank and may lose value. S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 18 2012 Cost Sharing Plus Plan Monthly Payroll Deductions Single Employee and Spouse Employee and Child(ren) Family Monthly Payroll Deductions Single Employee and Spouse Employee and Child(ren) Family With Wellness Incentive $94.34 $313.79 $283.90 $448.26 HSA Qualified Plan Without Wellness Incentive $124.34 $343.79 $313.90 $478.26 With Wellness Incentive Without Wellness Incentive $29.81 $178.28 $161.30 $254.68 $59.81 $208.28 $191.30 $284.68 If you enroll in the HSA Qualified Plan for 2012, SLU will contribute funds to help you build your balance: $250 for Single Enrollees $500 for Enrollees with Family Members Wellness Incentive increased from $20 to $30 for 2012 S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 19 2012 Cost Sharing – Biweekly Rates Plus Plan Biweekly Payroll Deductions Single Employee and Spouse Employee and Child(ren) Family Biweekly Payroll Deductions Single Employee and Spouse Employee and Child(ren) Family With Wellness Incentive $43.54 $144.83 $131.03 $206.89 HSA Qualified Plan Without Wellness Incentive $57.39 $158.67 $144.88 $220.74 With Wellness Incentive Without Wellness Incentive $13.76 $82.28 $74.45 $117.54 $27.60 $96.13 $88.29 $131.39 Wellness Incentive increased from $9.23 to $13.85 per biweekly payperiod for 2012 S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 20 2012 Cost Sharing Annual Contribution Difference vs. 2011 Plus Plan Plus Plan Annual Difference in Payroll Deductions With Wellness Incentive Single Employee and Spouse Employee and Child(ren) Family $304.44 $181.92 $164.52 $259.80 HSA Qualified Plan Annual Difference in Payroll Deductions With Wellness Incentive Single Employee and Spouse Employee and Child(ren) Family ($469.92) ($1,444.20) ($1,306.68) ($2,063.16) If you enroll in the HSA Qualified Plan for 2012, SLU will contribute funds to help you build your balance: $250 for Single Enrollees $500 for Enrollees with Family Members S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 21 Dependent Eligibility Audit • SLU has a responsibility to: Administer the plan as stated in the plan document Administer the plan consistently for all employees Monitor the costs of the plan • SLU will complete a Dependent Eligibility Audit in early 2012 Employees will be asked to provide verification for enrolled dependents Ineligible dependent will be removed from the plan Claims paid for ineligible dependents may be recovered and the expenses would become the responsibility of the employee S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 22 Eligible Dependents Definition of an Eligible Dependent: Legal spouse or dependent child under 26 years of age of the employee or the employee's spouse. The term child includes any of the following: Natural child Stepchild Legally adopted child Child placed for adoption Child for whom legal guardianship has been awarded S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 23 Vitality Annual Enrollment 2012 Vitality Check Where do I go? SLU provides the opportunity on campus by calling 977-3500 or you can visit your physician in November What’s in it for me? To get the $30 monthly reduction in your medical premiums, you must get a Vitality Check and complete the health risk assessment (HRA) in November S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 25 Other Activities Review and activate your personal health goals Update or confirm your email contact information Complete an online Course to learn about a health topic Complete a Vitality Check™ biometric screening with a Vitality partner Schedule a preventive screening Schedule a Healthy Habit Donate blood Complete a Fitness Assessment with a Vitality partner Track your workouts using a Vitality-approved fitness device Sign up at a Partner Health Club Sign up for an Athletic Event Complete online health tool calculators Get CPR or first aid certified Please note: This list does not cover the program in its entirety. Please refer to the web site for complete program activities, rules and details. S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 26 Voluntary Dental Benefits Annual Enrollment 2012 Voluntary Dental Benefits Coverage will continue through Delta Dental Choose among three dental plan options Benefits will remain the same for 2012 Contributions increasing 3.2% S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 28 Voluntary Dental Plan—Delta Dental Flex Option Basic Plus Basic In-Network Out-of-Network In-Network Only In-Network Only Individual $50 $50 $25 $25 Family $150 $50 $75 $75 $1,000 $1,000 $1,000 $750 0% no deductible 0% no deductible 10% after deductible 30% after deductible 30% after deductible 30% after deductible 40% after deductible 60% after deductible 65% after deductible Not covered $1,000 $1,000 $1,000 Not covered 50% For adults and children 60% For adults and children 50% For children only Not covered Deductible Calendar Year Maximum Per person Preventive Care 0% no deductible 0% no deductible Basic Restorative Care Major Restorative Services Orthodontia Lifetime maximum (per person) Orthodontia S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 29 Dental Payroll Deductions Flex Basic Plus Basic Single $32.00 $20.89 $14.91 Two-person $62.64 $39.46 $28.98 Family $107.24 $67.45 $51.84 Single $14.77 $9.64 $6.88 Two-person $28.91 $18.21 $13.38 Family $49.50 $31.13 $23.93 Monthly Bi-Weekly S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 30 Flexible Spending Accounts Annual Enrollment 2012 Flexible Spending and Dependent Care Accounts Administration will remain with ConnectYourCare You must make a new election for the 2012 Plan Year; current elections cannot be carried forward Can be used at authorized vendors (medical facilities, hospitals, pharmacies, etc.) Debit card allows direct payment at time of service Cards are good for three years – don’t throw yours away! Remember if you are electing the HSA plan option, the IRS requires your current healthcare balance to be $0.00 before opening the HSA S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 32 Flexible Spending and Dependent Care Accounts Annual maximum for the health care FSA will remain at $5,000 Annual maximum for the Dependent Care Account Contribution will remain at $5,000 ($2,500 if married and filing separate returns) For the health care FSA, your total election amount less previous reimbursements is available at the time of transaction For the Dependent Care FSA, only the cash balance in your account is available at the time of transaction You cannot roll over unused balances from one year to the next; carefully estimate your expenses for the next plan year S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 33 Eligible Traditional Medical FSA Expenses Copays, co-insurance and deductibles for medical, prescription and dental plans Eye exams, contacts and eyeglasses Laser eye surgeries Hearing aids Over-the-counter medical supplies (but not medications) Bandages, splints, contact lens solution, etc. Insulin Some expenses not covered by your health care plan S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 34 Advantages of FSAs—Tax Savings Example Without FSA Pretax Savings Annual Base Pay With FSA Pretax Savings $25,000 $25,000 Health Care Account Expenses -$0 -$1,000 Dependent Care Account Expenses -$0 -$2,000 Annual Taxable Income $25,000 $22,000 Estimated Federal Income Taxes -$3,750 -$3,300 After-tax Cost of Expenses -$3,000 -$0 Annual Net Pay $18,250 $18,700 Tax Savings $450 Assumes individual filer w/federal income tax rate of 15%; example does not include state, city, or other taxes S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 35 Annual Enrollment 2012 S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Elections Are Binding For The Plan Year Unless There Is A Life Status Change Marriage Birth/adoption Divorce Death Change in employment status Change in dependent status Life status change allows you to make benefit election changes and adjust your FSA elections Benefits department must be notified within 31 days of life change S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 37 Final Words Enrollment season is November 1st through 30th All employees must enroll or make changes through Banner Self-Service Update beneficiary information if necessary All materials to benefits office no later than Wednesday, November 30, 2011 S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 38 Contact Information Please email questions or comments to: benefits@slu.edu or wellness@slu.edu Your feedback is important!!! S:\EB\Clients\STLUN08\EE Comm\2012\2012 Enrollment Presentation.pptx Saint Louis University 39