1

Introducing our new

HDHP/HSA option

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

2

Today’s Presentation

• What is an HDHP/HSA program?

• Why is the company offering an

HDHP/HSA program?

• How do HDHP/HSA programs work?

• How does my HSA work?

• How do I get the most from my HDHP/HSA

program?

• How do I enroll in my HDHP/HSA program?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

3

What is an HDHP/HSA?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

4

Your HDHP/HSA Program

• A qualified High Deductible Health Plan (HDHP)

combined with a Health Savings Account (HSA)

• Created as part of the Medicare Modernization Act

of 2003

• Part of the fast-growing Consumer-Directed

Healthcare (CDH) trend

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

5

Why is the company offering

an HDHP/HSA program?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

6

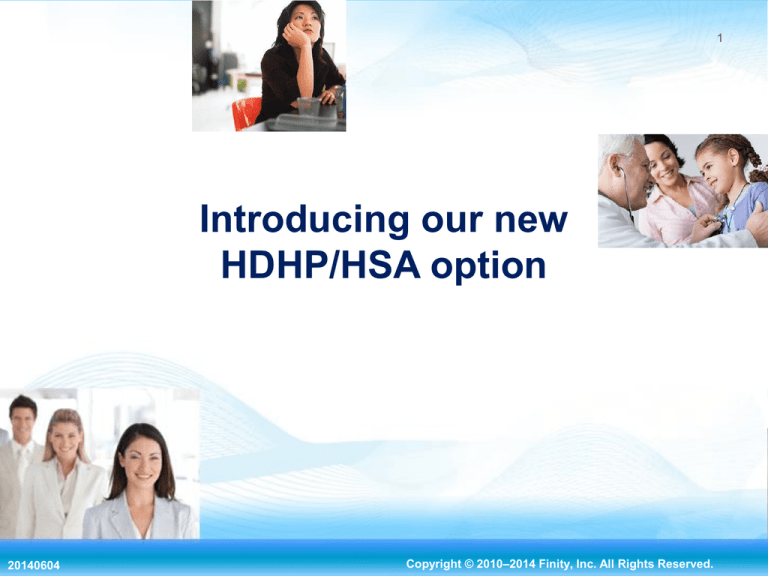

Rising Cost of Health Insurance

HDHPs May Have Lower Premium Costs

Sample difference in premium costs in 2013.

Individual

Family

$18,000

$16,623

$16,000

$14,000

$14,155

$12,000

Estimated average annual premium of

$5,006 for HDHP individual coverage

and $14,155 for HDHP family

coverage. vs. $6,025 for non-HDHP

individual coverage and $16,623 for

non-HDHP family coverage.

$10,000

$8,000

$6,000

$6,025

$5,006

$4,000

Source: Kaiser/HRET Survey of EmployerSponsored Health Benefits, 2013.

Chart compiled by Finity Communications.

$2,000

$0

HDHP

20140604

Non-HDHP

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

7

Creating a Sustainable Healthcare Program

• Consumer-Directed Healthcare programs may be

more sustainable

• CDH programs are designed to:

• Provide lower premiums

• Emphasize the importance of preventive care

• Motivate healthy lifestyles

• Encourage health consumerism

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

8

How do HDHP/HSA

programs work?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

9

HDHP + HSA + Wellness Program

HDHP/HSA

Program

Healthy

Lifestyle

20140604

Health

Consumerism

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

10

How Your HDHP/HSA Works

HSA

20140604

HDHP

Wellness

HSA Funded by

Employee &/or

Employer

HDHP Premiums

Paid by Employee

&/or Employer

Certain

Preventive Care

Covered Before

the Deductible

Eligible Expenses

Paid Out of HSA

Before

Deductible

Covered

Expenses Paid by

HDHP Benefits

After Deductible

Wellness

Program Offers

Resources, Tools,

and Information

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

11

HDHP/HSA Programs Provide Choice

• HSA dollars can be used to pay for any IRSqualified medical expense

• Medical expenses must be primarily for the

alleviation or prevention of a physical or

mental illness

• Your HDHP provides details about which

medical expenses will count toward your

deductible

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

12

How does my HDHP work?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

13

High Deductible Health Plan (HDHP)

• A health plan offered by your employer

• HDHPs typically have higher deductibles and

lower premiums than traditional health

insurance plans

• You pay for most healthcare costs until the

deductible is reached

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

14

Your High Deductible Health Plan

(HDHP)

• Minimum annual deductible

Coverage Type

2014

2015

Self-Only

$1,250

$1,300

Family

$2,500

$2,600

• Maximum annual out-of-pocket

Coverage Type

20140604

2014

2015

Self-Only

$6,350

$6,450

Family

$12,700

$12,900

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

15

Your High Deductible Health Plan

(HDHP)

• After the deductible, the HDHP begins to pay

for covered benefits

• Certain basic preventive care is covered

before the deductible is reached

• Other features of your HDHP

• Finding out more about your HDHP

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

16

How does my HSA work?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

17

Your Health Savings Account (HSA)

• You must be enrolled in an HDHP to be

eligible for a Health Savings Account

• An HSA is a tax-advantaged account that can

be used to pay for IRS-qualified medical

expenses

• No “use it or lose it” provisions

• Your money is always yours

• You can use funds for current or future medical

expenses

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

18

HSA Benefits

•

•

•

•

•

20140604

More employee control

Choice of healthcare services

Tax advantages

Money rolls over each year

Portability if you leave the company

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

19

HSAs Put You in Control

• Higher deductible generally means

lower premium costs than traditional

health insurance plans

• You can put money into your HSA to pay for

medical expenses before your deductible is

reached

• Money you don’t use is yours and rolls over

each year

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

20

HSA Federal Tax Advantages

Pre-Tax

Contributions

Tax-Free

Growth

Tax-Free

Withdrawals

State taxes may vary.

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

21

Your HSA Balance Rolls Over

• There are no “use it or lose it” provisions with

an HSA

• Your HSA dollars roll over year after year

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

22

HSAs Are Portable

• Your HSA goes with you if you change jobs

• Money is immediately 100% yours

• You can use money in your HSA to pay for COBRA

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

23

How does the wellness

program work?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

24

Wellness Resources

• Health Risk Assessment

• Interactive wellness tools and

health trackers

• In-depth education and information

• Health management resources

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

25

How do I make the most

of my HDHP/HSA program?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

26

Making the Most of Your HDHP/HSA

Program

• Maximize the preventive care benefits

• Use your HSA only for IRS-qualified

medical expenses

• Become a conscious health consumer

• Comparison-shop for high-value healthcare

services

• Make healthy lifestyle choices

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

27

Contribute the Maximum to Your HSA

Self-Only

Family

Catch-Up

Contribution

(55 and Up)

2014

$3,300

$6,550

$1,000

2015

$3,350

$6,650

$1,000

Maximum Contribution

• If you have HSA funds at the end of the year,

you can use them for future medical expenses

• You can contribute up to the maximum even if

it exceeds your HDHP deductible

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

28

Become a Health Consumer

• Look for the best price on quality

healthcare

• Compare name-brand and generic

prices

• Adopt and maintain a healthy lifestyle

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

29

HDHP/HSA Program Tips

• Use your HSA for medical expenses

– Non-qualified expenses will be subject to current tax

and potential penalties

• Keeping records is important

– For IRS purposes, keep receipts for at least three

years after using HSA funds to pay for a medical

expense

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

30

How do I enroll in my

HDHP/HSA program?

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

31

4 Simple Steps to Enroll in Your

HDHP/HSA

• Step One

– Begin by enrolling in your HDHP

• Step Two

– Decide on your HSA contributions

• Step Three

– Enroll in your HSA

• Step Four

– Start saving for your future!

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.

32

You can join your

HDHP/HSA program today!

20140604

Copyright © 2010–2014 Finity, Inc. All Rights Reserved.