Admore Gas, Mr. Ashar Saeed

advertisement

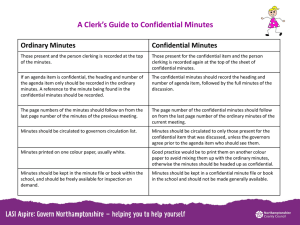

Dated: April 29, 2013 This presentation is only for discussion purposes and in no way be used for commercial dealing. The numbers used in this document are assumed/dummy numbers. Admore Gas (Private) Limited A licensed oil marketing company Case Study Investment Banking Team Shajar Capital Private & Confidential - For discussion purposes only 0 The OMC Admore retails refined petroleum products and lubricants across individual and commercial market segments operational since 2001 KPK 36 Outlets Value proposition Punjab 254 Outlets Storage facility of over 8500 MT 434 operational outlets Baluchistan 3 Outlets 200 pumps in development process Strong supply chain Sindh 89 Outlets Strong footprint in Punjab and AJK Private & Confidential - For discussion purposes only 1 Market Players vs. Admore Number of Pumps 4,000 One of the lowest Sale/Pump Ratio 3,760 3,000 2,000 851 1,000 530 434 362 Admore APL HASCOL 0.2% 8% 3% 238 0 Company Market Share PSO 65% Shell 12% Private & Confidential - For discussion purposes only Caltex 5% 2 Year 2012: At a glance Equity Capital Working Capital Financing Issues HSD and PMG Furnace Oil Refineries Industries Furnace Oil and Lubes HSD, PMG and Lubes Imports - Issues: Communication Management Debt Repayment Cash cycle Employees Private & Confidential - For discussion purposes only Retail Outlets - Resolution: Monitoring and Control Reactivate departments and function Debt restructuring Cash flow management Incentive based pay 3 Year 2012: Change of Management Shajar Group – Acquired major stake Financial Services Energy Healthcare Education Packaging Oil & Gas Shajar Capital Shajar Energy Dar ul Shifa Trust Liaqat Medical & Dental College ATCO Trading Admore Gas Invest One Consultancy Dar ul Sehat Hospital Trading Upstream Brokerage and Investment Advisory Trading Energy Private & Confidential - For discussion purposes only 4 Turnaround Process Turnaround Strategy General Initiatives • New management team • Fresh capital for cash flows support Re-composed Board • Nominated three directors on the board Business Development • Inducted ExManaging Director of PSO Supply Line • Restoration of supplies • Worked out restructuring with banks The restructuring process and turnaround may take 2-3 years. Communication Remedial Initiatives • Re-establishment of linkage through better monitoring and technology Private & Confidential - For discussion purposes only Management • Re-activated the sales, marketing and operations function Reduced Finance Cost • Restructuring of loans to revive relationships with Financial Institutions Cash Cycle • Effective cash flow management • Maintenance of Inventory 5 How to capitalize on this turnaround? UPSIDE POTENTIAL Private & Confidential - For discussion purposes only 6 Listing or Private Placement Sales FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 PMG 50,005,836 311,586,160 620,679,484 617,538,963 707,538,963 827,538,963 947,538,963 1,007,538,963 1,067,538,963 HSD 75,008,753 467,379,240 931,019,226 823,385,284 943,385,284 1,103,385,284 1,263,385,284 1,343,385,284 1,423,385,284 SKO - - - 102,923,161 117,923,161 137,923,161 157,923,161 167,923,161 177,923,161 HSFO - - - 411,692,642 471,692,642 551,692,642 631,692,642 671,692,642 711,692,642 Lubes & Allied - - - 102,923,161 117,923,161 137,923,161 157,923,161 167,923,161 177,923,161 125,014,589 778,965,400 1,551,698,710 2,058,463,210 2,358,463,210 2,758,463,210 3,158,463,210 3,358,463,210 3,558,463,210 Total Share Price FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 Revenue Multiple of 0.03 times 17 33 44 51 59 68 72 76 EBITDA Multiple of 1.3 times 11 27 33 47 57 64 71 74 Potential IPO Exit Year 3 Turnaround IPO Exit Year 5 IPO Exit Year 8 IPO Preparation Private & Confidential - For discussion purposes only 7 This presentation is only for discussion purposes and in no way be used for commercial dealing. The numbers used in this document are assumed/dummy numbers. THANKS Private & Confidential - For discussion purposes only 8