Review_Great Depression New Deal

advertisement

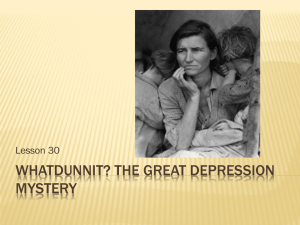

Excessive Use of Credit and Consumer Debts During World War I, American consumers had cut down their civilian spending due to the war efforts. Following WWI, the 1920s was known as a prosperous time. Consumers became more willing to buy on credit. Installment buying, using credit and paying back in small amounts, was introduced which allowed people to buy cars, radios and other new products of the 1920s. The excessive use of credit, however, resulted in high consumer debts and increased financial instability. 1 Unequal Distribution of Wealth High Tariffs and War Debts Overproduction in Industry and Agriculture 1928 Presidential Election Farm crisis Federal Reserve Monetary Policy Stock Market Crash and Financial Panic 2 Historians disagree as to the causes of the Great Depression. Most scholars would include: MONETARY POLICY HIGH TARIFFS AND WAR DEBTS STOCK MARKET CRASH AND FINANCIAL PANIC CAUSES OF THE GREAT DEPRESSION UNEQUAL DISTRIBUTION OF WEALTH INDUSTRY OVER PRODUCTION AGRICULTURE 3 UNEQUAL DISTRIBUTION OF WEALTH Although the nation's wealth grew by billions throughout the 1920s, it was not distributed evenly. The top 1% received a 75% increase in their disposable income while the other 99% saw an average 9% increase in their disposable income. 80% of Americans had no savings at all. Happy Feet song Disposable income is money remaining after the necessities of life have 4 been paid for. The chart shows that 99% of the population received a 9% increase in their income, while the top 1% saw their income rise by 75%. 1,230,000 Americans 80 70 60 50 TOP 1% BOTTOM 99% 40 30 121,770,000 Americans 20 10 0 1929 5 Chart showing wages of unskilled workers. Notice how little the wages changed during the supposed prosperity of the 1920’s. 700 600 500 400 300 200 100 0 1919 1920 1921 1922 1923 1924 1925 1926 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 1941 6 HIGH TARIFFS AND WAR DEBTS At the end of World War I, European nations owed over $10 billion ($115 billion in 2002 dollars) to their former ally, the United States. Their economies had been devastated by war and they had no way of paying the money back. The U.S. insisted their former allies pay the money. This forced the allies to demand Germany pay the reparations imposed on her as a result of the Treaty of Versailles. All of this later led to a financial crisis when Europe could not purchase goods from the U.S. This debt contributed to the Great Depression. In 1922, the U.S. passed the Fordney-McCumber Act, which instituted high tariffs on foreign-made industrial products. A tariff is a tax on imports. Other nations soon retaliated and world trade declined helping bring on the great depression. Later the Smoot-Hawley Tariff Act of 1930 raised U.S. tariffs on over 20,000 imported goods to record levels. It was intended to protect American industries from foreign competition; in reality, it caused other countries raised their tariffs on American exported products and further increased global 7 economic instability. OVERPRODUCTION IN INDUSTRY Factories were producing products, however wages for workers were not rising enough for them to buy them. Too few workers could afford to buy the factory output. The surplus products could not be sold overseas due to high tariffs and lack of money in Europe. 8 FARM OVERPRODUCTION Due to surpluses and overproduction, farm incomes dropped throughout the 1920’s. The price of farm land fell from $69 per acre in 1920 t0 $31 in 1930. Agriculture was in a depression which began in 1920, lasting until the outbreak of World War II in 1939. In 1929 the average annual income for an American family was $750, but for farm families it was only $273. The problems in the agricultural sector had a large impact since 30% of Americans still lived on farms. Surplus ears of corn 9 President Hoover’s belief in self-reliance would later affect his ideas about how to best solve the upcoming depression "I do not believe that the power and duty of the General Government ought to be extended to the relief of individual suffering. . . . The lesson should be constantly enforced that though the people support the Government the Government should not support the people." (1930) President and Mrs. Hoover 10 STOCK MARKET CRASH AND FINANCIAL PANIC The stock market was not sufficiently regulated in the 1920s. Millions of average Americans began speculating in the stock market in the 1920s. Speculating is buying risky stocks out of a desire to get rich quick, rather than investing in the long-term growth of the economy. This contributed to the outbreak of the Great Depression in 1929. 11 Major reasons for the stock market crash in October 1929 Stocks were overpriced due to speculation, meaning they were not worth their sale price Massive fraud and illegal activity occurred due to a lack of regulation and rules Margin buying, or buying using credit Federal reserve policy 12 FINANCIAL COLLAPSE • After the crash, many Americans panicked and withdrew their money from banks • Banks had invested in the Stock Market and lost money • In 1929- 600 banks fail • By 1933 – 11,000 of the 25,000 banks nationwide had collapsed Bank run 1929, Los Angeles Federal Reserve Monetary Policy The Federal Reserve System was created in 1913 to help stabilize the economy by establishing a central banking system for the U.S. A major goal is to deal with bank panics. Monetary policy manipulates the money supply to help strengthen the economy. At the beginning of the Great Depression, the Fed officials decided not to intervene in the banking crisis, and banks failed as depositors panicked and withdrew their funds. Many scholars argue their idleness worsened the situation. 14 • The U.S. was not the only country gripped by the Great Depression • Much of Europe suffered throughout the 1920s • In 1930, Congress passed the toughest tariff in U.S. history called the Smoot- HawleyTariff • It was meant to protect U.S. industry yet had the opposite effect • Other countries enacted their own tariffs and soon world trade fell 40% SMOOT-HAWLEY TARIFF THE DUST BOWL • A severe drought and over-use of farmland gripped the Great Plains in the early 1930s • Wind scattered the topsoil, exposing sand and grit • The resulting dust traveled hundreds of miles Kansas Farmer, 1933 Migration Routes from the Dust Bowl Regions Mexican Repatriation • The Mexican Repatriation refers to a mass migration that took place between 1929 and 1939, when as many as 500,000 people of Mexican descent were forced or pressured to leave the US. The event, carried out by American authorities, took place without due process. Some 35,000 were deported, amongst many hundreds of thousands of other immigrants who were deported during this period. The Immigration and Naturalization Service targeted Mexicans because of "the proximity of the Mexican border, the physical distinctiveness of mestizos, and easily identifiable barrios." • These actions were authorized by President Herbert Hoover and targeted areas with large Hispanic populations, mostly in California, Texas, Colorado, Illinois, and Michigan. This federal policy was intended to reduce the size of the agricultural labor force during the Great Depression. It made the Great Depression the only era in history during which more people left than entered the United States. • • THE NEW DEAL The student understands changes over time in the role of government. THe student is expected to: - evaluate the impact of New Deal legislation on the historical roles of state and federal government. AMERICA GETS BACK TO WORK FDR LAUNCHES NEW DEAL • FDR promised a “new deal” for the American people. • New Deal was a series of programs designed to fight the effects of the Great Depression. • New Deal programs particularly targeted at helping the unemployed people. ROOSEVELT’S FIRESIDE CHATS • FDR communicated to Americans via radio • His frequent “Fireside Chats” kept Americans abreast of the government’s efforts during the Depression and restored confidence to citizens during this trying time. AMERICANS GAIN CONFIDENCE IN BANKS • Next, FDR passed the Glass-Steagall Act which established the Federal Deposit Insurance Corporation • The FDIC insured account holders up to $5,000 and set strict standards for banks to follow (today = $250,000) LEGACIES OF THE NEW DEAL • FDIC – banking insurance critical to sound economy • Deficit spending has became a normal feature of government • Social Security is a key legacy of the New Deal in that the Feds have assumed a greater responsibility for the social welfare of citizens since 1935 • The federal government took an active role in protecting and promoting Americans' individual economic well-being. THE IMPACT OF THE NEW DEAL • Federal authority was drastically expanded. • American people developed new attitudes about the role and function of government.