VUS 10 Great Depression - Suffolk Public Schools Blog

advertisement

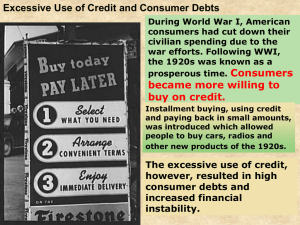

Great Depression Mrs. Saunders Great Depression The Great Depression was a period of severe economic hardship lasting from 1929 to World War II. Three of the most important causes were: – 1) Over-speculation in stocks using borrowed money that could not be repaid when the stock market crashed in 1929 and stock prices collapsed, – 2) the Federal Reserve’s failure to prevent widespread collapse of the nation’s banking system in the late 1920s and early 1930s, leading to severe contraction in the nation’s supply of money in circulation, – 3) High protective tariffs like the Hawley-Smoot Act (Tariff Act of 1930) that produced retaliatory tariffs in other countries, which strangled world trade. Great Depression Speculation is the act of buying something at a low price in the hope of reselling it later at a profit. One way people make money off stocks is through speculation. They buy them at one price. Then when the stock’s price goes up, they sell their stock at a profit. Between 1920 and 1929 prices on the New York Stock Exchange, the nation’s largest stock market, steadily increased. As a result, stock market speculators became very wealthy. Many of them realized if they borrowed money, then they could buy even more stock. After these investors sold their stock, they could repay their loans and still clear larger profits. This practice of buying stock on credit was called buying stock on margin. Margin buying led to overspeculation in the stock market. Great Depression The Federal Reserve System functions as the central bank of the United States. A Federal Reserve Bank is a banker’s bank. Only banks can have accounts at a Federal Reserve Bank. If a bank needs to borrow money, it may do so from the Federal Reserve Bank. However, a bank must pay interest on its loans from the Federal Reserve, just as individuals must pay interest if they borrow money from a bank. The Federal Reserve Board, appointed by the President of the United States, oversees the actions of the Federal Reserve Banks and sets the interest rate which banks must pay to borrow money from the Fed. The Federal Reserve’s power to set interest rates enables it to control the nation’s money supply. If the Federal Reserve Board believes the American economy is slowing down, it will cut interest rates and thereby encourage borrowing. On the other hand, if the Federal Reserve Board believes the economy is overheating and thereby causing inflation, then it will raise interest rates. (Inflation means prices increase, and the dollar buys less.) Great Depression When the stock market crashed in 1929, the Federal Reserve Board was unable to prevent it from triggering the Great Depression. During the twenties, many banks had invested their savings deposits in the stock market. They had also loaned money to speculators who were buying stock on credit. When the market crashed, these individuals could not cover their loans. As a result, the banks lost the money, which they had loaned for stock speculation. Although the Federal Reserve Board had recognized in the late twenties that speculation was out of control and had tried to adjust interest rates accordingly, it could not protect individual banks from their unsound loan policies. Great Depression Once banks began to fail, Americans began to lose confidence in the nation’s entire banking system. Thousands of Americans rushed to withdraw their savings from the banks, before they closed. This action placed even more pressure on the nation’s banks. As a result, during the first three years of the Great Depression, five thousand banks failed and nine million Americans lost their savings accounts. The Federal Reserve’s failure to prevent widespread collapse of the nation’s banking system in the late 1920s and early 1930s led to a severe contraction (reduction) in the nation’s supply of money in circulation. Great Depression High protective tariffs also helped cause the Great Depression. A protective tariff is a tax on imports that is so high that Americans cannot afford to buy foreign goods. After the 1929 stock market crash, Congress attempted to help American business by passing the Tariff Act of 1930, which was popularly called the Hawley-Smoot Tariff. Since the Hawley-Smoot Tariff was a protective tariff that set the highest tariff rates in American history, historians now believe it actually had the opposite effect from what Congress intended. Instead of helping business by encouraging Americans to buy American-made goods, the HawleySmoot Tariff encouraged foreign countries to retaliate by passing high tariffs of their own. This meant foreigners could not afford to buy American goods. In short, the erection of tariff barriers by all of the world’s major industrial powers strangled world trade. This decrease in world trade deepened the worldwide depression. Great Depression The Great Depression had a four-pronged effect on the United States. • First, unemployment skyrocketed and homelessness increased. By 1932 twelve million Americans were out of work, and the unemployment rate stood at twenty-five percent of the American work force. • Second, bank closings led to a near collapse of the nation’s financial system. • Third, business bankruptcies, increased unemployment, and bank closings led to political unrest. Labor unions especially became more militant, and some even questioned whether capitalism was the best economic system for the United States. • Fourth, as the Great Depression worsened banks foreclosed on thousands of farms. These farm foreclosures caused thousands of farm families to migrate (move away) from the lands of their birth. They traveled in search of jobs, which often did not exist. Great Depression Most Americans blamed President Herbert Hoover, a Republican, for the terrible conditions of the Great Depression. Consequently, in the presidential election of 1932 the Democrat candidate Franklin Delano Roosevelt (FDR) overwhelmingly defeated President Hoover’s bid for re-election. At his inauguration, Roosevelt tried to rally the American people by telling them, “This is pre-eminently the time to speak the truth, the whole truth, frankly and boldly. Nor need we shrink from honestly facing conditions in our country today. This great nation will endure as it has endured, will revive and will prosper. So first of all let me assert by firm belief that the only thing we have to fear is fear itself.” New Deal President Roosevelt offered a “New Deal” for the American people. The New Deal was FDR’s program to end the Great Depression. This program changed the role of the government to a more active participant in solving the nation’s problems. • The power of the federal government increased, and • Americans came to expect the federal government to take responsibility for bringing prosperity to the American economy. The New Deal followed a three-pronged strategy, often called the “three R’s.” These three R’s were relief, recovery and reform. This Clifford Berryman 1938 cartoon titled "Old Reliable" broadly caricatured FDR's shift to Keynesian economics: "This is one rabbit that never failed me!" remarks Roosevelt as he pulls "spending" out of his magician's hat. Keynes' influence would reach far beyond the Depression, providing the stimulus for much of the American economic growth during and after the Second World War. New Deal Relief programs tried to ease the suffering of the unemployed. Relief measures, like the Works Progress Administration (WPA), provided direct payments to people for immediate help. Many of these were public works programs. Public works are construction projects that benefit the whole society, like highways, bridges, schools, post offices, and parks. The federal government hired unemployed Americans who could not find jobs. New Deal Recovery programs aimed to bring about the recovery of business in all areas of the American economy. They were designed to bring the nation out of depression over time. For example, the Agricultural Adjustment Administration (AAA) tried to help farmers recover from the depression by limiting agricultural production and thereby raising livestock and crop prices. New Deal Reform programs attempted to bring about change for the better in American society. Some reform programs tried to help prevent future economic crises, by correcting unsound banking and investment practices. One program in this category was the Federal Deposit Insurance Corporation (FDIC), which protects the money of depositors in insured banks. New Deal Other reform programs tried to provide a degree of financial security for the most needy Americans. For example, the Social Security Act offered safeguards for workers, including unemployment insurance and retirement benefits. Americans came to believe that American society should use the federal government to provide care for those Americans, who through no fault of their own could not take care of themselves. Great Depression Although the Great Depression did not end until World War II, the New Deal provided hope for millions of Americans during one of the most difficult decades in American history. The New Deal also had lasting results. – It permanently changed the role of the American government in the economy. – The New Deal also fostered (encouraged) changes in people’s attitudes toward government’s responsibilities. – Organized labor acquired new rights, like the right to form a union, the right to strike, and minimum wage. – Finally, the New Deal set in place federal legislation that reshaped modern American capitalism.