Lesson 30 of Focus: Understanding Economics in History

advertisement

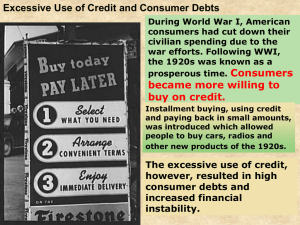

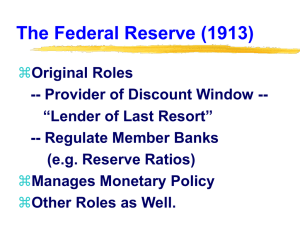

Lesson 30 WHATDUNNIT? THE GREAT DEPRESSION MYSTERY HISTORY TEKS: (16) Economics. The student understands significant economic developments between World War I and World War II. The student is expected to: (A) analyze causes of economic growth and prosperity in the 1920s, including Warren Harding's Return to Normalcy, reduced taxes, and increased production efficiencies; (B) identify the causes of the Great Depression, including the impact of tariffs on world trade, stock market speculation, bank failures, and the monetary policy of the Federal Reserve System; (C) analyze the effects of the Great Depression on the U.S. economy and society such as widespread unemployment and deportation and repatriation of people of European and Mexican heritage and others; (D) compare the New Deal policies and its opponents' approaches to resolving the economic effects of the Great Depression; and (E) describe how various New Deal agencies and programs, including the Federal Deposit Insurance Corporation, the Securities and Exchange Commission, and the Social Security Administration, continue to affect the lives of U.S. citizens. WHATDUNNIT? In the 1920s, jobs were plentiful, the economy was growing, and the standard of living was rising. Between 1920 and 1929 homeownership doubled. Most home-owning families enjoyed amenities such as electric lights and flush toilets. 60% of all households had cars, up from 26% due to Ford’s assembly line. The airline age began as Charles Lindbergh made his historic transAtlantic flight in 1927. More teenagers were attending high school. Radio became a household staple. NBC started broadcasting in 1926 and CBS in 1928. WHATDUNNIT? By 1933… One fourth of the labor forces was unemployed. Families were losing their homes and many were going hungry. Adolescents who should be in school were riding around the country in freight cars, looking for jobs. Whatdunnit? What happened? • The United states possessed the same productive resources in the 1930s as it had in the 1920s. • Great factories and productive machinery were still present. • Workers had the same skills and were willing to work just as hard. • How could life have become so miserable for so many in such a short period of time? 1920S Prosperity of the 1920s was based largely on purchases of homes and cars which could now be bought in installments. Business created jobs by building new plants and government built roads and infrastructure for housing. The stock market “roared” in the Roaring 20s. Toward the end of the decade, sales declined and the market crashed. 1929-1933 Normally, people start buying again as automobiles wear out and incomes improve. Politicians kept promising that “prosperity was just around the corner.” Business activity continued to decline and unemployment stood at 28% in March, 1933. END OF THE 1920S: DEMONSTRATION OF DOWNWARD SPIRAL (ACTIVITY ON PAGE 361) Machinery workers stand. Car sales people stand. Auto workers stand. Steel workers stand. Construction workers stand. Furniture sellers stand. Furniture workers stand. Clothing sellers stand. Restaurant workers stand. Grocery workers stand. A multiplier effect comes into play when workers who lose jobs spend less and cause others to lose jobs. Visual 30.1: What is a Business Cycle? LOOKING AT THE RECENT BUSINESS CYCLE: EXPANSION BEGINS AGAIN (FINISH ACTIVITY) Machinery workers sit. Car sales people sit. Auto workers sit. Steel workers sit. Construction workers sit. Furniture sellers sit. Furniture workers sit. Clothing sellers sit. Restaurant and grocery workers sit. Grocery workers sit. VISUAL 30.2 NUMBER OF U.S. BANKS CLOSING TEMPORARILY OR PERMANENTLY, 1920-1933 Year Number of Bank Closings 1920 168 1921 505 1922 367 1923 646 1924 775 1925 618 1926 976 1927 669 1928 499 1929 659 1930 1352 1931 2294 1932 1456 1933 4004 A rise in bank failures led to a significant reduction in the amount of money available to buy good and services. The Federal Reserve, founded in 1913, hesitated to loan to banks considered “unsound.” They allowed them to fail. Remember that pre-FDIC, when the bank failed, depositors lost funds. Current perspective: 140 banks failed in 2009, 157 in 2010 and 11 so far this year. VISUAL 30.3 MONEY IN CIRCULATION Money in Circulation* The FED raised interest rates, contracting the money supply. 1929 $26.2 1930 $25.1 1931 $23.5 With less money circulating, fewer goods and services were bought and more people became unemployed. Year 1932 $20.2 1933 $19.2 When interest rates increased, the bonds held by the banks lost value. *Currency plus bank deposits, in billions of dollars. ACTIVITY 30.3 WHAT WOULD YOU HAVE DONE? 1. The world financial system that emerged after World War I was based upon the gold standard. The United States and Great Britain guaranteed that they would exchange their currencies for gold at a fixed rate ($20.67) for an ounce of gold. ADDITIONAL INFO ON THE GOLD STANDARD: (This information in on page 324 of the Focus: Understanding Economics in United States History book, Lesson #27 – Free Silver or a Cross of Gold:) The money supply of a nation on the gold standard is limited by the amount of gold available. Advantage of gold standard: A gold standard tends to prevent inflation. Disadvantages of gold standard: Money supply may not be able to grow as the economy grows because of limitations on the amount of gold available. Banks must be prepared to pay out gold in exchange for checks written against the accounts of their customers. HISTORY TEKS: (15) Economics. The student understands domestic and foreign issues related to U.S. economic growth from the 1870s to 1920. The student is expected to: (A) describe how the economic impact of the Transcontinental Railroad and the Homestead Act contributed to the close of the frontier in the late 19th century; (B) describe the changing relationship between the federal government and private business, including the costs and benefits of laissez-faire, anti-trust acts, the Interstate Commerce Act, and the Pure Food and Drug Act; (C) explain how foreign policies affected economic issues such as the Chinese Exclusion Act of 1882, the Open Door Policy, Dollar Diplomacy, and immigration quotas; (D) describe the economic effects of international military conflicts, including the Spanish-American War and World War I, on the United States; and (E) describe the emergence of monetary policy in the United States, including the Federal Reserve Act of 1913 and the shifting trend from a gold standard to fiat money. ACTIVITY 30.3 WHAT WOULD YOU HAVE DONE? 1. The world financial system that emerged after World War I was based upon the gold standard. The United States and Great Britain guaranteed that they would exchange their currencies for gold at a fixed rate ($20.67) for an ounce of gold. Other major countries agreed to exchange their currencies for gold, dollars or pounds. In 1927, several countries, most notably Germany and Austria, experienced serious bank runs. To stabilize their currencies, they exchanged their dollars and pounds for gold. The United States experienced a serious loss of gold. To encourage foreign investors to buy American investments, the Federal Reserve Banks raised interest rates. If you were an American business owner planning to build a new factory or buy new equipment, what would you have done after interest rates were increased? ACTIVITY 30.3 WHAT WOULD YOU HAVE DONE? 2. The Federal Reserve lowered interest rates after a time, but in 1930 and 1931, when the American economy had already taken a downturn, more bank runs occurred in many countries, and again gold flowed out of the United States. To keep gold in the United States, the Federal Reserve Banks again raised interest rates. What was the result? One of the New Deal reforms was taking the U.S. off the gold standard. ACTIVITY 30.3 WHAT WOULD YOU HAVE DONE? 3. Now imagine that you are an American citizen with a bank account. You read the newspapers. You see that banks are collapsing in other countries and that the rate of bank failures in the United States has risen. What might you do? Activity 28.1 in Lesson 28 (p. 333) is a play which allows students to understand how runs on banks happen. Lesson 28 is Money Panics and the Establishment of the Federal Reserve System ACTIVITY 30.3 WHAT WOULD YOU HAVE DONE? 4. In 1932 Congress creates the Reconstruction Finance Corporation (RFC), which lends money to businesses that are in trouble, including banks. The law requires that the names of banks receiving loans from the RFC must be published. You read in the newspaper that the bank in which your money is deposited is receiving help from the RFC. What are you likely to do? The FDIC was created to insure deposits as one of the New Deal reforms. WHATDUNNIT: THE GREAT DEPRESSION MYSTERY What or who was to blame? The Federal Reserve for not really being the lender of last resort to the banks? The fact that the world was on a Gold Standard? A banking system with no “FDIC equivalent”? A President who raised taxes in the middle of the problems to “balance the budget”? A Congress who passed the Smoot-Hawley Tariff Act in 1930 and nearly killed trade? MAKING THE HISTORICAL CONNECTIONS: Each part of the country also has a unique history related to the 1920s and 1930s. Teaching state history or local history helps students make the historical connections to the Great Depression. Here is an example from the Texas Panhandle. RELATING THE 20’S & 30’S TO THE TEXAS PANHANDLE: In the 1920’s, automobiles became commonly owned by families, and there was a clamor for better roads. One of those roads has a heritage special to the Panhandle of Texas – Route 66. The goal was to “link the main streets of America.” Construction began in 1926 on the 2,344 mile route. At that time, only 800 miles was paved. THE BORGER OIL BOOM January 11, 1926 - The Dixon Creek Oil Company hits a gusher in Hutchison County, kicking off an oil boom. Panhandle oil fields produced: 1925 – 1 million barrels of oil 1926 – 26 million barrels of oil 1926 – within 90 days, the Borger area grew by 35,000 people CONSEQUENCES OF THE OIL BOOM Law and order were almost non-existent in Borger In 1927 and again in 1929, Gov. Moody sent the Texas Rangers to “clean up” Borger. The town of Panhandle was the nearest rail head, and before a spur line was build to Borger in late 1926, Panhandle shipped more freight that any town on the Santa Fe except Chicago. Other oil towns—Pampa, Lefors, McLean, White Deer, Canadian, Miami—grew. The railroads grew—by 1930 10% of Amarillo depended on the Santa Fe railroad for their livelihood. Population of the Texas Panhandle: 1920 – 115,000 1930 – 240,000 AS THE GREAT DEPRESSION BEGAN… Oil & gas and the railroads were not the only drivers of the Panhandle economy. Traditionally cattle country, by the end of WWI, wheat and cotton became important cash crops. On October 24, 1929, the stock market crashed, but rains had been plentiful, crops were good, and the oil & gas industry acted as a buffer for the Texas Panhandle economy. THE DELAYED REACTION… By the fall of 1930, prices of farm and ranch products dropped alarmingly. Rains were still good and bumper harvests through 1931 produced a glut of wheat, but prices continued to fall. Then in the summer of 1931, the rains stopped. There were no wheat crops in 1932, 1933, 1934. THE DUST BOWL THE DUST BOWL Dalhart reported black dusters in 1934. March 3, 1935, was the first black duster in Amarillo. April 14, 1935, was the “granddaddy of them all.” Poor agricultural practices and years of sustained drought caused the Dust Bowl, which lasted about a decade. THE DUST BOWL The birds were the first sign. The wind had picked up from the north…riding the wind were hundreds, and then thousands, of birds headed south as if it were fall, not spring. On the horizon to the northeast, a thick strip of darkness appeared as if a storm were approaching. But there were no flashes of lightning or thunder. Silently, the darkness loomed higher and closer. Great, billowing clouds of dirt suddenly bore down on the city. Soon, the city was plunged into darkness as the dust storm swept through at more than 50 miles an hour. . . . Historic Amarillo by Mike Cox ROUTE 66: “THE MOTHER ROAD” These iconic pictures reflect the struggles of the families who left the Dust Bowl behind, heading west to find new hope in California. Between 1935 and 1940, the number of farms in the Panhandle declined by nearly 25%. ROUTE 66: “THE MOTHER ROAD” “And then the dispossessed were drawn west . . . car-loads, caravans, homeless and hungry; twenty thousand and fifty thousand and a hundred thousand and two hundred thousand. . . .The kids are hungry. We got no place to live. Like ants scurrying for work, for food, and most of all for land. John Steinbeck, The Grapes of Wrath In his 1939 novel, The Grapes of Wrath, and the movie made in 1940, John Steinbeck immortalized Route 66. TEACHING ABOUT THE GREAT DEPRESSION Lesson 30 is essentially about the causes of the Great Depression. Lesson 31, on page 363, entitled “Did the New Deal Help or Harm the Recovery?” gets into the specifics of governmental efforts to recover from the Great Depression. TEACHING ABOUT THE GREAT DEPRESSION The St. Louis Federal Reserve Bank has a 6 lesson teaching curriculum on the Great Depression which can easily be downloaded from their website at stlouisfed.org .