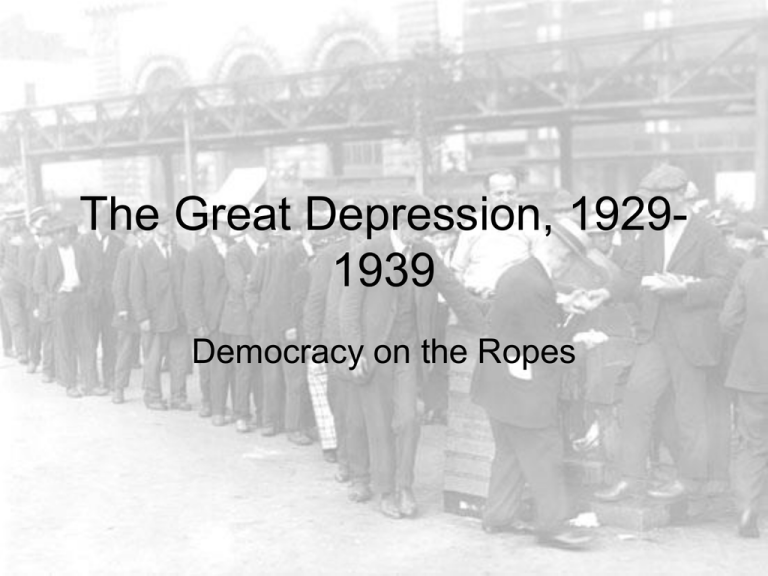

The Great Depression, 1929-1939

advertisement

The Great Depression, 19291939 Democracy on the Ropes Economic Cycles post-WWI • 1919-22— unemployment and inflation • 1923—hyperinflation in Germany (4.2 trillion DM = $ 1!!) & Ruhr invasion • 1924-29—temporary recovery and growth • 1929-late 30s— depression Structural Economic Problems • Strong inflationary pressures (rationing, depreciated currencies, borrowing) • Low commodities prices (world glut) • Indemnities/Reparations—disrupts investment, creates circular flow of capital • Disrupted markets—due to WWI, Asia, North and Latin America gain relative to Europe • Economic nationalism—tariffs and protectionism (Smoot-Hawley Tariff, 1930) The Hinge • Reparations cause fluctuations in currency values • Gold standard returns after war (British pound overvalued) • Currency values affect trade and cause drain of gold on treasuries • French v. British financial policies • Depression causes currencies to abandon gold standard Role of United States • Unwillingness to act as financial leader • 1924—Dawes Plan (U.S. begins to supply 2/3 of German capital) • 1929—Young Plan • Tariff and trade policies • Easy money policy and stock market bubble (purchasing on margin) • Stock market crash of 1929 (shuts off capital flow) Elements of Great Depression • Massive unemployment and the downward spiral (33-40% in U.S./Germany) • Investment dries up • Bank and financial failures (Credit-Anstalt, 1931) • Protectionism and tariffs—world trade plummets Muddled Responses • Classical economics—deflationary policies and budget cuts (cf. J.M. Keynes, 1936) • Reparations finally canceled in 1931 • British pound collapses in 1931—off gold standard (U.S. in 1934) • Weak response of the democracies • Rise of extremist movements, especially in Central and Eastern Europe