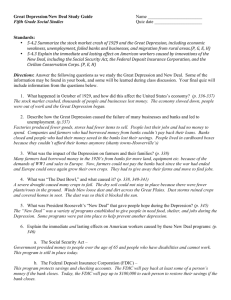

Economic Troubles on the Horizon

advertisement

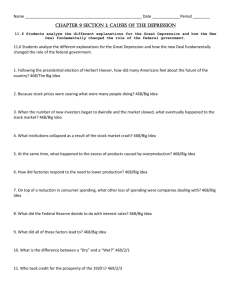

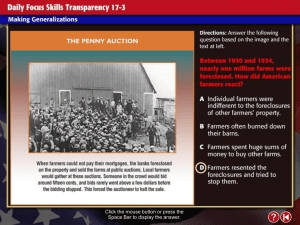

The Great Depression What would happen if you spent more money that you actually had? What happens when many people and businesses are in that situation? 1. What jobs are recession proof? What things might you do is you cannot get a job with an established company? What social services are available today compared to the unemployed people of 1929? Summarize the critical problems threatening the American economy in the late 1920’s. Describe the causes of the stock market crash and the Great Depression. Explain how the Great Depression affected the economy in the United States and throughout the world. Industries in Trouble Basic industries such as railroads, textiles and steel barely made a profit in the late 1920’s There was less demand for mining and lumbering after World War I Farmers Need a Lift During the war demand for crops such as wheat and corn were high Farmers took out loans for more equipment and land After WWI, the demand for such crops declined and farmers were left with debt—farmers could not pay loans and many of their farms went into foreclosure _______________________ Federal price supports for key products such as wheat, corn, cotton and tobacco The government would buy surplus crops at a guaranteed prices and sell them on the world market President Coolidge vetoed the bill twice What would a free market economist say about the Congress’s bill for federal price supports? Living on Credit Credit—the arrangement in which consumers agreed to buy now and pay later for purchases When people had trouble paying off debt, they cut back on spending Uneven distribution of income During the 1920’s rich got richer and the poor got poorer More than 70% of the nation’s families earned less than $2,500 per year (considered a decent standard of living) Many people could not afford the goods that manufactures made Election of 1928 ______________( R) vs. ______________(D) Hoover wins following the years of prosperity in the 1920’s Dreams of riches in the Stock Market ____________________ The most widely used barometer of the stock market’s health Made of the 30 largest firms traded on the stock market What is speculation? What does it mean to buy on margin? Speculation —people bought stocks and bonds in hope to make a quick profit Buying on margin —paying a small percentage of a stocks price as a down payment and borrowing the rest The unrestrained buying and selling fueled the market’s upward spiral What can speculation and buying on margin be compared to today? Contrast the Great Depression with today’s recession. Use the text book and internet to complete a Venn diagram. What is a recession? Two consecutive quarters of negative growth in the GDP. ________________ October 29, 1929 the bottom fell out of the market and people lost confidence Shareholders rushed to sell their stocks People who bought on margin were left with debt and many lost their life savings The Great Depression Period from 1929-1940 which the economy plummeted and unemployment skyrocketed Banks and Business Failures Many people withdrew money from banks—only to find out that the banks had invested it in the stock market 600 banks closed in 1929 Unemployment went from 3% in 1929 to 25% in 1933 Worldwide shock waves Depression was not limited the United States Europeans were still trying to recover from WWI Germany was forced to pay war reparations—the Great Depression compounded the problems by limiting America’s ability to import European goods as well as making it difficult to sell American farm products and manufactured goods aboard _________________________ Highest protective tariff in history Designed to protect American farmers and industry, it had the opposite effect Europeans retaliated with their own tariff and worldwide trade had failed more than 40 % Causes of the Great Depression: ______________________________________ ________________________________________ _________________________________ ____________________________________ Can a recession or a depression be prevented? If you were president, what policies would you put in place to ensure economic growth?