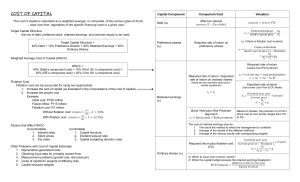

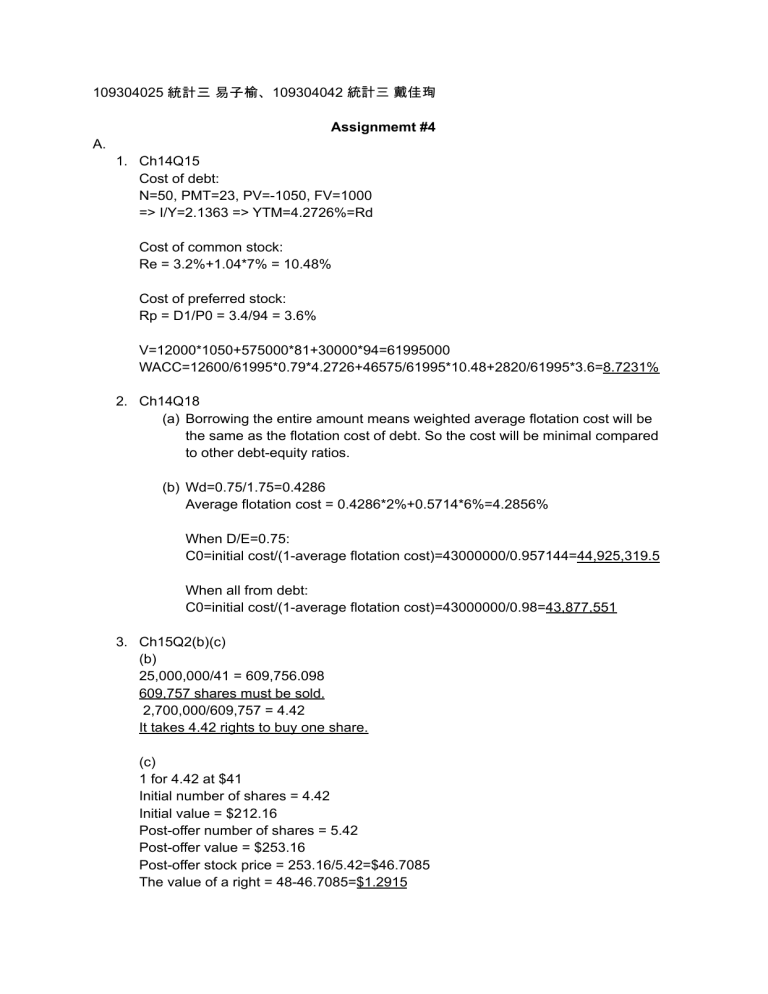

109304025 統計三 易子榆、109304042 統計三 戴佳珣 Assignmemt #4 A. 1. Ch14Q15 Cost of debt: N=50, PMT=23, PV=-1050, FV=1000 => I/Y=2.1363 => YTM=4.2726%=Rd Cost of common stock: Re = 3.2%+1.04*7% = 10.48% Cost of preferred stock: Rp = D1/P0 = 3.4/94 = 3.6% V=12000*1050+575000*81+30000*94=61995000 WACC=12600/61995*0.79*4.2726+46575/61995*10.48+2820/61995*3.6=8.7231% 2. Ch14Q18 (a) Borrowing the entire amount means weighted average flotation cost will be the same as the flotation cost of debt. So the cost will be minimal compared to other debt-equity ratios. (b) Wd=0.75/1.75=0.4286 Average flotation cost = 0.4286*2%+0.5714*6%=4.2856% When D/E=0.75: C0=initial cost/(1-average flotation cost)=43000000/0.957144=44,925,319.5 When all from debt: C0=initial cost/(1-average flotation cost)=43000000/0.98=43,877,551 3. Ch15Q2(b)(c) (b) 25,000,000/41 = 609,756.098 609,757 shares must be sold. 2,700,000/609,757 = 4.42 It takes 4.42 rights to buy one share. (c) 1 for 4.42 at $41 Initial number of shares = 4.42 Initial value = $212.16 Post-offer number of shares = 5.42 Post-offer value = $253.16 Post-offer stock price = 253.16/5.42=$46.7085 The value of a right = 48-46.7085=$1.2915 4. Ch15Q3 Number of share for rights offering = 17,500,000/41 = 426,829 Assume the number of shares before the offering is x. 54.3*(x+426,829) = 56x + 17,500,000 23,176,814.7 - 17,500,000 = 1.7x x = 5,676,814.7/1.7 = 3,339,303 There are 3,339.303 shares before the offering. 5. Ch16Q13 (a) because the company has no debt, cost of equity = WACC = 9.2% (b) debt = 25% D/E = 0.25/0.75 = 1/3 r_e = 9.2%+(9.2%-5.9%)*1/3*(1-21%) = 0.10069 =10.1% (c) debt = 50% D/E = 0.5/0.5 = 1 r_e = 9.2%+(9.2%-5.9%)*1*(1-21%) = 0.11807 = 11.8% (d) In (b), WACC =5.9%*0.25*(1-21%)+10.1%*0.75 = 0.0117+0.0758= 8.75% In (c),WACC=5.9%*0.5*(1-21%)+11.8%*0.5 = 0.0233+0.059=8.23% 6. Ch16Q16 V_L = V_U + PV of tax shield = EBIT(1-T_c)/R_U + T_c*D = 57,000*79%+21%*134,000 = 465,324.4660 In this scenario, value of the firm is greater as the ratio of D/E increase. So company should change its debt-equity ratio, to debt 100%, equity 0% and maximize the value of the firm. B. (a) cost of debt N = 23*2 = 46, PV = -1,000*104.75% = -1,047.5, PMT = 85/2 = 42.5 ->I/Y = 4.0218 ->YTM = r_d = 8.0435% (b) required return on the preferred stock r_p = D1/P0 = 2.5/32.25 = 0.0775 = 7.75% (c) required return on common equity(CAPM) r_e = r_f + b(r_m-r_f) = 1.9%+1.35*6% = 0.1 = 10% (d) required return on common equity r_e = D1/P0 + g = 1.2(1+12.5%)/43.5 + 7% = 1.35/43.5 + 7% = 0.3010 + 7% = 0.1010 = 10.1% (e) weighted average cost of capital WACC = 0.15*8.0435%*(1-40%) + 0.35*7.75% + 0.5*10% = 0.0072+0.0271+0.05 = 0.0843 = 8.43%