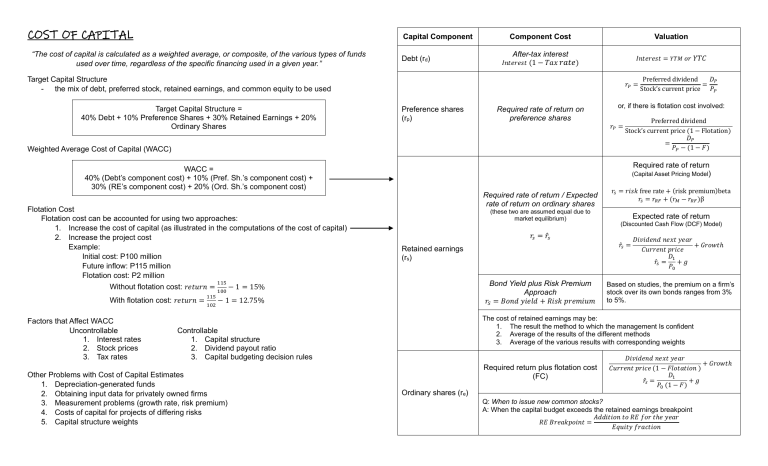

COST OF CAPITAL Capital Component “The cost of capital is calculated as a weighted average, or composite, of the various types of funds used over time, regardless of the specific financing used in a given year.” Debt (rd) Component Cost Valuation After-tax interest 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 = 𝑌𝑇𝑀 𝑜𝑟 𝑌𝑇𝐶 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 (1 − 𝑇𝑎𝑥 𝑟𝑎𝑡𝑒) Target Capital Structure - the mix of debt, preferred stock, retained earnings, and common equity to be used Target Capital Structure = 40% Debt + 10% Preference Shares + 30% Retained Earnings + 20% Ordinary Shares 𝑟𝑃 = Preference shares (rp) Required rate of return on preference shares (Capital Asset Pricing Model) Required rate of return / Expected rate of return on ordinary shares (these two are assumed equal due to market equilibrium) Factors that Affect WACC Uncontrollable 1. Interest rates 2. Stock prices 3. Tax rates 115 102 Expected rate of return (Discounted Cash Flow (DCF) Model) 𝑟̂𝑠 = Retained earnings (rs) Bond Yield plus Risk Premium Approach 𝑟𝑆 = 𝐵𝑜𝑛𝑑 𝑦𝑖𝑒𝑙𝑑 + 𝑅𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 − 1 = 12.75% 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑛𝑒𝑥𝑡 𝑦𝑒𝑎𝑟 + 𝐺𝑟𝑜𝑤𝑡ℎ 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑝𝑟𝑖𝑐𝑒 𝐷1 𝑟̂𝑠 = +𝑔 𝑃0 Based on studies, the premium on a firm’s stock over its own bonds ranges from 3% to 5%. The cost of retained earnings may be: 1. The result the method to which the management Is confident 2. Average of the results of the different methods 3. Average of the various results with corresponding weights Controllable 1. Capital structure 2. Dividend payout ratio 3. Capital budgeting decision rules Other Problems with Cost of Capital Estimates 1. Depreciation-generated funds 2. Obtaining input data for privately owned firms 3. Measurement problems (growth rate, risk premium) 4. Costs of capital for projects of differing risks 5. Capital structure weights 𝑟𝑠 = 𝑟𝑖𝑠𝑘 free rate + (risk premium)beta 𝑟𝑠 = 𝑟𝑅𝐹 + (𝑟𝑀 − 𝑟𝑅𝐹 )β 𝑟𝑠 = 𝑟̂𝑠 100 With flotation cost: 𝑟𝑒𝑡𝑢𝑟𝑛 = Preferred dividend Stock’s current price (1 − Flotation) 𝐷𝑃 = 𝑃𝑃 − (1 − 𝐹) Required rate of return WACC = 40% (Debt’s component cost) + 10% (Pref. Sh.’s component cost) + 30% (RE’s component cost) + 20% (Ord. Sh.’s component cost) Flotation Cost Flotation cost can be accounted for using two approaches: 1. Increase the cost of capital (as illustrated in the computations of the cost of capital) 2. Increase the project cost Example: Initial cost: P100 million Future inflow: P115 million Flotation cost: P2 million 115 Without flotation cost: 𝑟𝑒𝑡𝑢𝑟𝑛 = − 1 = 15% or, if there is flotation cost involved: 𝑟𝑃 = Weighted Average Cost of Capital (WACC) Preferred dividend 𝐷𝑃 = Stock’s current price 𝑃𝑃 Required return plus flotation cost (FC) Ordinary shares (re) 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑛𝑒𝑥𝑡 𝑦𝑒𝑎𝑟 + 𝐺𝑟𝑜𝑤𝑡ℎ 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑝𝑟𝑖𝑐𝑒 (1 − 𝐹𝑙𝑜𝑡𝑎𝑡𝑖𝑜𝑛 ) 𝐷1 𝑟̂𝑠 = +𝑔 𝑃0 (1 − 𝐹) Q: When to issue new common stocks? A: When the capital budget exceeds the retained earnings breakpoint 𝐴𝑑𝑑𝑖𝑡𝑖𝑜𝑛 𝑡𝑜 𝑅𝐸 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑦𝑒𝑎𝑟 𝑅𝐸 𝐵𝑟𝑒𝑎𝑘𝑝𝑜𝑖𝑛𝑡 = 𝐸𝑞𝑢𝑖𝑡𝑦 𝑓𝑟𝑎𝑐𝑡𝑖𝑜𝑛