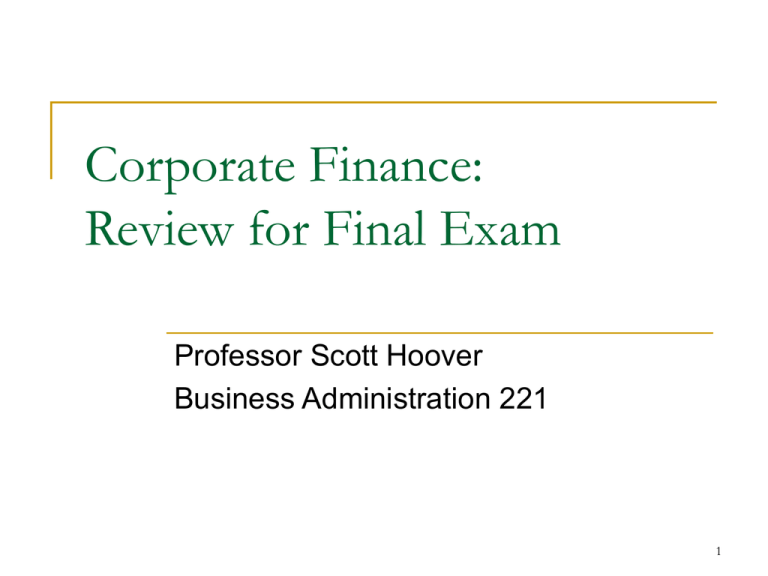

Corporate Finance MGMT 221

advertisement

Corporate Finance: Review for Final Exam Professor Scott Hoover Business Administration 221 1 Introduction Time Value of Money Basic Intuition: Indifference Present Value vs. Future Value Financial Statements (review) Financial Statement Analysis What questions are important in assessing the health of a firm? The DuPont Relationship Ratios Difficulties with Financial Statement Analysis 2 Financial Forecasting The Cash Budget Importance The Typical Methodology (Percent-of-Sales Forecasting) What is a cash budget? Basic methodology Growth Management What is the optimal growth rate for a company? The Sustainable Growth Rate 3 Financing How much debt should a firm have? A Second Look at ROE…. Benefits of Debt Drawbacks of Debt The relationship between interest rates on debt and ROIC FRICTO Analysis Difficulties in determining the optimal level of debt Financial Securities Bonds Derivatives Stock 4 Capital Budgeting How are projects created? Relevant Cash Flows Capital Expenditures Salvage Cash Flows Operating Cash Flows Changes in Net Working Capital Opportunity Costs Externalities 5 The Weighted Average Cost of Capital (WACC) Cost of Equity Cost of Debt Cost of Preferred Stock Project Evaluation Techniques NPV IRR mutually exclusive projects 6 EXAM STRUCTURE Topic # of Problems Points General 4 40 Stocks 1 10 Capital Budgeting 3 50 # of Problems Points Problem Solving 4 60 Short Answer/Essay 4 40 Type 7