Using Financial Statement Models for Valuation MGT 4850 Spring 2008

advertisement

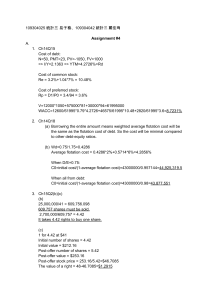

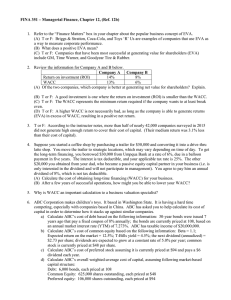

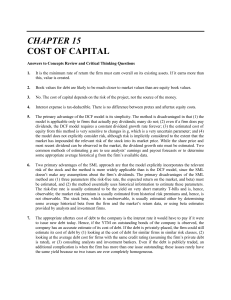

Using Financial Statement Models for Valuation MGT 4850 Spring 2008 University of Lethbridge Corporate Valuation • Building Pro forma model • Calculating the relevant free cash flows • Calculating the cost of capital for the free cash flows • Determining the terminal value of the firm • Properly discounting the free cash flows • Sensitivity analysis Farmers Bagels Inc. • Balance sheets and Income Statements for 1995 and 1996 (p.90) • Ratio analysis (p. 91) • Sales predictions (2001)→ terminal value Model Assumptions • Drop the distinction between product sales and other income • Cost of goods sold -40% • Selling, general and administrative expenses (-1%/y) • Income tax rate 41.5% • Cash cushion-declining proportion of sales • Accounts receivable – 22% of sales Model Assumptions II • Inventory 5% of sales • Property and equipment at cost 70% in ‘96 to 40% in 2001. • Straight line deprec. at 10% of prop. Cost • Accounts payable and accrued expenses +1%/y till 20% • Income tax payable 25% • Other curr. liabilities 1% of sales • No dividends, no new equity (debt is the plug). MODEL INCOME STATEMENT Balance Sheet Negative Debt • If total value of minimum cash balance plus all other assets is greater than current liabilities the company needs debt. • [Cash ratio]*Sales+Acc. Rec. + Inventory + Prepaid exp. + Net property and equipm. – Curr. Liab. – Com. Stock – Ret. Earn. < 0 then debt is set at 0 p.94 pro forma model Deriving the FCF (p.90) • Positive profit, negative cashflows Projected FCF • 1999 first positive cash flow (p.97) Proposition one Agency costs As WACC • WACC= E/(E+D)*re + D/(E+D)* rD(1-Tc ) • CAPM based averages for the industry Industry Average WACC 20.43% and terminal value Sensitivity Analysis • Value as a function of WACC (row) and terminal growth rate (column) Sensitivity Analysis • Share price is calculated as a unction of two variables Terminal Value Proxies