Class5Pr1

advertisement

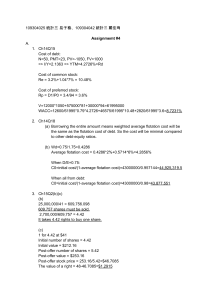

Chapter 11 Cost of Capital Costs in raising capital Firm can raise money by issuing different types of financial instruments such as … The costs involved in raising capital are different across the various types of instruments Because investors require different rates of return from different types of instruments Getting the required rate of return from the market Normally market information will provide the price of each type of instruments We need to derive the required rate of return from the market price of the instrument How to derive the rate of return from market price Use the formulae such as Bond price = AxPVIFA(n,i)+FxPVIF(n,i) i or Kd is the required rate of return of the bond Price of preferred share = D/Kp Price of common stock assuming constant dividend growth = D1/Ke-g Another way to determine Ke of common stock Ke = required rate of return for individual stock Ke = riskfree rate + risk premium Hence, risk premium of individual stock = Ke - riskfree rate Similarly risk premium of the market = market rate of return - riskfree rate According to the Capital Asset Pricing Model, the risk premium of individual stock is determined by the market risk premium CAPM cont’ There are two reasons – market risk cannot be reduced by diversification and individual stock price moves according to the market. When the market (return) rises, most of the stock prices (return) will rise - some rise more while other less. It all depends on the value of beta. Ke - Rf = [Rm - Rf] Or Ke = Rf + [Rm - Rf] Rf=risk free rate, T-Bill rate is a good approximation, = Share’s systematic risk, [Rm - Rf] = Market risk premium Internal Source of Capital Retained earnings constitute to one-third of the equity financing Based on opportunity cost consideration, the cost of retained earnings is equivalent to the rate of return on the firm’s common stock, Ke However, the cost of new common share is higher than the cost of retained earnings because of the additional issuing costs (flotation costs) Capital Structure It is too risky to have a single source of financing Normally capital structure would involve several different sources of financing Example, a mix of debt, preferred stock, equity financing and retained earnings How does a firm determine its overall cost of capital? F in an ce S o u rce D eb t M arket V alu e 1 000 000 R equ ired R ate 6% A m o un t of C o st 6 000 0 P referred shares C om m on shares T o tal 5 000 00 12% 6 000 0 5 000 00 20% 1 000 00 2 000 000 11% 2 200 00 Alternative way - WACC F in an ce S o u rce D eb t M arket V alu e 1M P referred 5 000 00 shares C o m m o n 5 000 00 shares T o tal 2M % o f R equ ired W eigh ted T o tal R ate A verage 50% 6% 3% 25% 12% 3% 25% 20% 5% 1 00 % 11% Calculating Cost of Capital WACC = Kd x MV of Debt/MV of Total Financing + Kp x MV of Preferreds/MV of Total Financing + Ke x MV of Commons/MV of Total Financing MV = Market Value Since the required rate is derived from the market price of each financial instrument, we have to use the market value (not the book value) to calculate the cost of each instrument Reasons for using MV of financial instrument The return required by investors is based on the market value of the investment The cost of capital will be used to assess future investments (future potential returns must be assessed against current costs, not historical costs) Hence historical book values are not relevant Other Costs Returns on investment earned by investors are only part of costs of each source of capital Additional costs to the firm involve allowances for costs of issuing securities (flotation costs) and taxes We have to adjust kb, kp , ke so that they reflect (a) tax considerations and (b) costs of issuing (flotation costs) After-tax Cost of Capital So far, we have not considered the impact of tax on cost of capital Since interest payments on bonds are tax deductible, the after-tax cost of Debt is Kd (1 - t) where t = Corp. tax rate Since dividend payments on preferred and common shares are not tax deductible, their after-tax costs will be the same as before Issuing Costs - Flotation Costs Flotation Costs include prospectus printing cost, underwriters fee, commissions to investment banks and selling groups, legal and accounting fees, etc Flotation Costs as a percentage of fund being raised Funds raised by Bonds: 2-4 % Funds raised by Preferreds: 3-6% Funds raised by Common shares: 4-9 % Flotation Costs Adjustment Let F = Flotation Cost per bond or share For preferred shares, P = D/Kp Actual amount received per unit = (P - F) Hence, (P - F) = D/Kp That is, Kp = D / (P - F) Flotation Costs Adjustment cont’ For corporate bond, the after-tax cost of debt is Kd (1 - t) The flotation cost adjusted cost of debt Knd = Kd (1 - t)/ 1 - F (approximate) For common stock, the cost adjusted rate Kne = Ke [P/(P - F)] where P = Price per share Optimal Capital Structure Since the cost of debt (especially after-tax cost) is lower than the cost of preferred/common share, why not have a single source of financing (i.e. debt financing only) A high D/E ratio implies the threat of bankruptcy Initially debt reduces the cost of capital but as more debt is used, the threat of bankruptcy will erase the benefits. (Figure 11-1) FIF T H 5 Foundations of Financial PPT 11-2 Management th CANADIAN ED ITIO N Figure 11-1 Cost of capital curve Cost of equity Cost of capital (percent) Weighted average cost of capital U-shaped Cost of debt Minimum point for cost of capital Block Hirt Short 0 McGraw-Hill R yerso n 40 Debt-equity mix (percent) 80 ©McGraw-Hill Ryerson Limited 2000 Usage of Cost of Capital Cost of Capital is the yardstick against which new projects are measured Projects must earn at least the cost of capital to be financially viable WACC is a technique to determine the cost of capital WACC is subject to certain limitations Limitations of WACC WACC is an appropriate discount rate only if the project risk is similar to the company’s risk The firm’s capital structure remains stable so that WACC is consistent with the project life Book values instead of WACC will be used when there are lack of market values Marginal Cost of Capital The marginal cost of debt ( the cost of the last amount of debt financing) will rise as more debt financing is used. (e.g. when D/E ratio exceeds a reasonable level) The marginal cost of equity also rises when the shift from retained earnings to external equity financing (i.e. new common stock issuance) is necessary (Figure 11-4) FIF T H 5 Foundations of Financial PPT 11-8 Management th CANADIAN ED ITIO N Figure 11-4 Marginal cost of capital and Baker Corporation investment alternatives Percent 12.0 - 10.0 - 8.0 - 16.0 14.0 A B 11.06% C 11.46% Kmc Marginal cost of capital 10.26% D E F 4.0 2.0 0.0 - G H 6.0 Block Hirt Short 10 15 19 McGraw-Hill R yerso n 39 50 70 Amount of capital ($ millions) 85 95 ©McGraw-Hill Ryerson Limited 2000