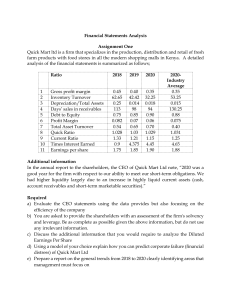

Answer indications: Cash flow statements and financial ratios Financial Accounting for Decision Makers, chapter 6 6.1. See page 567 of AM. 6.3. See page 568 of AM. 6.5. Cash generated from operations: 397 Net cash from operating activities: 200 Cash flows from investing activities: -650 Cash flows from financing activities: 600. 6.7. See page 570 of AM. 6.8. See page 571 of AM. Financial Accounting for Decision Makers, chapter 8 8.1. See page 573 and 574 of AM. 8.4. Return on capital employed Operating profit margin Gross profit margin 2020 0.03 0.02 0.40 Average inventories turnover period Average settlement period for trade receivables Sales revenue to capital employed 2021 0.03 0.02 0.42 2020 60.8 76.0 1.3 2021 73.0 91.3 1.3 8.6. a) Return on capital employed Operating profit margin Gross profit margin Current ratio Acid test ratio Average settlement period for trade receivables Average settlement for trade payables Average inventories turnover period 2020 0.31 0.20 0.42 1.28 0.53 31.55 32.20 79.44 2021 0.20 0.14 0.38 1.66 0.67 47.45 36.98 114.85 b) Liquidity: improvement, but too low for manufacturer. Could make suppliers concern. Efficiency: Credit period increases. If this was a policy result, that was not very successful, because sales increase was too low. Otherwise it would be a sign of poor credit control. Inventory turnover period has increased. Seems that some products do not sell very good. Gross profit margin and operating profit margin are lower. So there is a lower return on capital employed. 8.7. See page 575 of AM.