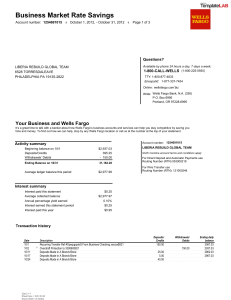

SM Wells Fargo Opportunity Checking February 16, 2020 2021 ■ Page 1 of 4 Questions? Available by phone 24 hours a day, 7 days a week: MARY E MALDONADO JOSE VALDEZ 1130 BUSH 926 WW6TH ST ST APT V LEMOORE CA 93230-3475 93245-3475 HANFORD CA Telecommunications Relay Services calls accepted 1-800-TO-WELLS (1-800-869-3557) TTY: 1-800-877-4833 En español: 1-877-727-2932 Online: wellsfargo.com Write: Wells Fargo Bank, N.A. (114) P.O. Box 6995 Portland, OR 97228-6995 You and Wells Fargo Account options Thank you for being a loyal Wells Fargo customer. We value your trust in our company and look forward to continuing to serve you with your financial needs. A check mark in the box indicates you have these convenient services with your account(s). Go to wellsfargo.com or call the number above if you have questions or if you would like to add new services. ✓ Direct Deposit Online Bill Pay ✓ Auto Transfer/Payment Online Statements ✓ Overdraft Protection Mobile Banking ✓ Debit Card My Spending Report ✓ Overdraft Service Account number: 1421103407 3269631465 Statement period activity summary Beginning balance on 1/20 Online Banking -$159.06 Deposits/Additions $92,789.06 160.00 39,782.67 Withdrawals/Subtractions -52,780.56 - 0.50 Ending balance on 2/16 $0.44 $79,791.17 MARY E MALDONADO JOSE VALDEZ California account terms and conditions apply For Direct Deposit use Routing Number (RTN): (RTN): 122000247 121042882 Routing Number Overdraft Protection This account is not currently covered by Overdraft Protection. If you would like more information regarding Overdraft Protection and eligibility requirements please call the number listed on your statement or visit your Wells Fargo branch. (114) Sheet Seq = 0009786 February 16, 2020 2021 ■ Page 2 of 4 Transaction history Date 2/3 2/8 Check Number Description ATM Cash Deposit on 02/03 301 West D St Lemoore CA 0008232 ATM ID 0101A Card 2289 Recurring Payment authorized on 02/06 Backgroundcheckers 855-517-0851 FL S301037528253514 S301037528253514Card Card2289 2289HFD 855-517-0851 FL Deposits/ Additions 160.00 39,782.67 Withdrawals/ Subtractions Ending daily balance balance 0.94 39,78.62 0.50 52,780.50 Ending balance on 2/16 0.44 0.44 79,791.17 $160.00 39,782.67 $ Totals $0.50 $52,780.56 The Ending Daily Balance does not reflect any pending withdrawals or holds on deposited funds that may have been outstanding on your account when your transactions posted. If you had insufficient available funds when a transaction posted, fees may have been assessed. Monthly service fee summary For a complete list of fees and detailed account information, see the disclosures applicable to your account or talk to a banker. Go to wellsfargo.com/feefaq for a link to these documents, and answers to common monthly service fee questions. Fee 01/20/2021 -- 02/16/2020 02/16/2021 Fee period period 01/20/2020 Standard monthly service fee $10.00 You paid $0.00 Minimum required This fee period The bank has waived the fee for this fee period. How to avoid the monthly service fee Have any ONE of the following account requirements · Minimum daily balance · Total amount of qualifying direct deposits $500.00 $10,000.00 $500.00 $50,000.00 JL/JL IMPORTANT ACCOUNT INFORMATION Effective onor orafter afterApril April1,1,2020, 2021, Wells Fargo no longer temporary including WellsInstant Fargo Issue Instant Issue Debit Effective on Wells Fargo will will no longer issueissue temporary debit debit cards,cards, including Wells Fargo Debit Cards, Wells Fargo Business Instant Issue Debit Cards, and EasyPay Instant Cards. If you need a replacement card, you may request one ® by signing on to Wells Fargo Online or calling the number on your statement. Once requested, replacement cards arrive by mail in 5 to 7 calendar days. You may add your Wells Fargo Debit Card or EasyPay Card to a Wells Fargo-supported digital wallet on your mobile device so you can make secure, convenient purchases in stores, online, and in apps, and access Wells Fargo ATMs while you wait for your replacement card. For more details on digital wallets, please visit wellsfargo.com/mobile/payments. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. Some ATMs within secure locations may require a physical card for entry. Effective onor orafter afterApril April1,1,2020, 2021, ATM Access Code feature willlonger no longer be available to access your accounts Wells Fargo ATMs. Effective on thethe ATM Access Code feature will no be available to access your accounts at Wells at Fargo ATMs. You may continue to access Wells Fargo ATMs using your Wells Fargo Debit, ATM or EasyPay Card, or with a Wells Fargo-supported digital wallet on your mobile device. For more information about adding your card to a digital wallet, please visit wellsfargo.com/mobile/payments. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. Some ATMs within secure locations may require a physical card for entry. Note: After the ATM Access Code feature for accessing Wells Fargo accounts is discontinued, the "Use an Access Code" button may continue to be displayed on Wells Fargo ATMs to support other services. -$159.06 $0.00 3 3 February 16, 2020 2021 ■ Page 3 of 4 To provide you with additional flexibility to access accounts, we have increased the daily ATM withdrawal limit on your Wells Fargo Debit, ATM, or EasyPay Card(s) to $1,010. Any card that already has a daily ATM withdrawal limit of $1,010 or more remains the same. To view your card limits any time, sign on at wellsfargo.com/cardcontrol and click on Open Card Details. Sheet Seq = 0009787 Sheet 00002 of 00002 February 16, 20210 ■ Page 4 of 4 Worksheet to balance your account General statement policies for Wells Fargo Bank Follow the steps below to reconcile your statement balance with your account register balance. Be sure that your register shows any interest paid into your account and any service charges, automatic payments or ATM transactions withdrawn from your account during this statement period. $ A Enter the ending balance on this statement. ■ To dispute or report inaccuracies in information we have furnished to a Consumer Reporting Agency about your accounts. You have the right to dispute the accuracy of information that Wells Fargo Bank, N.A. has furnished to a consumer reporting agency by writing to us at Overdraft Collection and Recovery, P.O. Box 5058, Portland, OR 97208-5058. Please describe the specific information that is inaccurate or in dispute and the basis for the dispute along with supporting documentation. If you believe the information furnished is the result of identity theft, please provide us with an identity theft report. ■ In case of errors or questions about your electronic transfers, telephone us at the number printed on the front of this statement or write us at Wells Fargo Bank, P.O. Box 6995, Portland, OR 97228-6995 as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer on the statement or receipt. We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared. B List outstanding deposits and other credits to your account that do not appear on this statement. Enter the total in the column to the right. Description Amount Total $ + $ C Add A and B to calculate the subtotal. = $ We will investigate your complaint and will correct any error promptly. If we take more than 10 business days to do this, we will credit your account for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. D List outstanding checks, withdrawals, and other debits to your account that do not appear on this statement. Enter the total in the column to the right. Number/Description Total 1. Tell us your name and account number (if any). 2. Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. 3. Tell us the dollar amount of the suspected error. Amount $ E Subtract D from C to calculate the adjusted ending balance. This amount should be the same as the current balance shown in your register. - $ = $ ©2010 Wells Fargo Bank, N.A. All rights reserved . NMLSR ID 399801