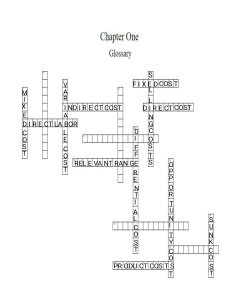

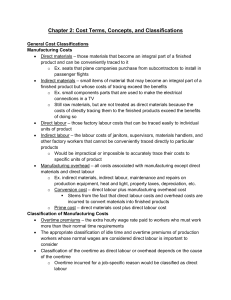

ROTMAN SCHOOL OF MANAGEMENT RSM 1222 – COST DEFINITIONS AND CLASSIFICATIONS MANUFACTURING COSTS DIRECT MATERIALS: Materials that become an integral part of a finished product and can be conveniently traced to it. Fabrics, zippers, buttons, down, INDIRECT MATERIALS: Small items of material that may become an integral part of a finished product but whose costs of tracing exceed the benefits. Thread, n colouring dye (the costs of tracing exceeds the benefits, not easily traceable) DIRECT LABOUR: Factory labour costs that can be traced easily to individual units of product. Factory workers: cutting, sewing, assembling INDIRECT LABOUR: Labour costs of janitors, supervisors, material handlers and other factory workers that cannot be conveniently traced directly to a particular product. Designer, supervisor of factory, quality assurance, repair and maintenance, MANUFACTURING OVERHEAD: All costs associated with the manufacturing except direct materials and direct labour. Cost of machinery, utilities, rent, transportationin, storage cost of raw materials, spoilage NON-MANUFACTURING COSTS MARKETING / SELLING COSTS: All costs necessary to secure customer orders and get the finished product or service to the customer. ADMINISTRATIVE COSTS: All executive, organizational, and clerical costs associated with the general management of an organization rather than with manufacturing, marketing and selling. RESEARCH & DEVELOPMENT COSTS: Costs incurred in the research or development phase of a product. Marketing, brand management, advertising campaign, selling, post sale customer support and warranty, store cost/online, HQ cost, admin, accounting, HR R&D expense PERIOD VS. PRODUCT COSTS PRODUCT COSTS: Include all costs involved in purchase or manufacture of goods. PERIOD COSTS: All costs that are expensed on the income statement in the period in which they are incurred or accrued. Selling (marketing) and administrative expenses are period costs. All manufacturing cost All non-manufacturing cost VARIABLE vs. FIXED COSTS VARIABLE COST: A cost that varies in total, in direct proportion to changes in the level of activity. Direct material and direct labour (Variable overhead cost) FIXED COSTS: A cost that remains constant in total, regardless of changes in the level of activity within the relevant range. Rent of the building, supervisor, repair and maintenance, insurance, depreciation of equipment, administrative cost MIXED COSTS: A cost that has a component that is fixed and a component that is variable. Utilities, Mixed Costs: a cost with fixed AND variable components