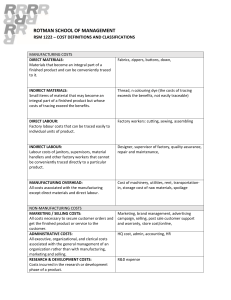

COST CLASSIFICATION COST Outflow of ECONOMIC RESOURCES for making and selling a product CLASSIFICATION Arrangement of things into logical group Group of doctors Groups of boys Groups of girls etc. COST CLASSIFICATION THROUGH FUNCTION Function : Any activity performed in business Finance cost Research cost distribution cost Production cost Cost Selling cost Administration cost SELLING COST Cost of selling product Cost of making new customer and retaining existing customer. Examples Bad debt Advertisement Sales man salary Cost of printing price list and Sales commission catalogue discount Cost of printing slogan on After sales services delivery van Market research before Shop cost (depreciation , Rent) launching a product. ADMINISTRATION COST Office related cost Examples Office guard salary Office electricity bill Telephone bill Phone operator salary Office furniture’s depreciation Office building depreciation Office building Rent Office building insurance Office building repairs and maintenance Auditor /lawyer/accountant salary Distribution cost Cost of distributing product Example Driver salary Fuel cost of delivery vehicles Road tax Delivery vehicle cost * Repairs * Maintenance * Insurance * Depreciation etc. Finance cost Cost of arranging finances Example Interest Store cost (where F/G is stored) * Repairs * Maintenance * Insurance * Depreciation etc. Secondary packaging Research cost Cost which is incurred prior to the production Scientist salary Laboratory cost etc. Production cost Cost of producing a product Elements of production cost * Materials cost * Labour cost * expenses MATERIAL COST DIRECT MATERIALS INDIRECT MATERIALS Tangible Major part of product Economically feasible Directly identifiable/ traceable Tangible Not major part of product Not economically feasible Not directly identifiable/ traceable Example Wood for table Metal for chairs leg Flour for cake Fabric for shirts Leather for shoes Brick for building Primary packaging Example Staple pins for book Gum for shoes Nails for chairs Buttons for shirt Salt for cake Baking powder for cake Lubricant used In factory LABOUR TEST DIRECT LABOUR INDIRECT LABOUR Labour who’s wages are directly identifiable Labour who actually manufacture product or perform services Labour who’s wages are not directly identifiable Labour who do not manufacture product or perform services but provide help / assistance in production. Example Doctor for hospital Teacher for school Carpenter Brick layer in construction company Auditor for audit firm Lawyer for law firm Accountant for accounting firm Machine operator Chef in hotel Example Nurse for hospital Supervisor salary Factory cleaning staff Factory guard Teacher assistant Store keeper Factory manager Expenses Direct expenses Indirect expenses Cost which is not direct material not direct labour but still incurred specifically incurred for production. Cost which is not indirect material not indirect labour and not incurred specifically for production. But these expenses are related to production. Intangible Example Example Royalty payable Designing cost Cost of special tool Rent Insurance Repair & maintenance Heat and light Electricity Power cost Depreciation Factory P&M Store (where raw material is stored) COST CLASSIFICATION THROUGH BEHAVIOUR Fixed cost Cost which do not change with the change in activity level. Cost which remain constant. Example Rent Depreciation straight line basis Insurance Supervisor salary Activity level Total cost £ Cost per unit Exam focus VARIABLE COST Cost which DIRECTLY CHANGES with the change in activity level example * Direct cost * Sales commission based on sales volume * Fuel cost Exam focus Activity level Total cost £ Cost per unit SEMI VARIABLE COST Cost which is partly fixed and partly variable Cost which has element of both fixed and variable cost Example Exam focus TELEPHONE BILL Activity level Total cost £ Cost per unit STEP FIXED COST Cost which is fixed with in a certain level of activity. If activity exceeds that limit cost will increase and becomes fixed up to another level of activity. Example Rent Supervisor salary Activity level Total cost £ Cost per unit 1) Production cost Direct material Direct labour Direct expense Indirect material Indirect labour Indirect expense 1) 2) 1) 1) 1) Selling cost Distribution cost Administration cost Finance cost Research cost Prime cost Total Production cost Production overheads Total cost Non-production CONVERSION COST These are the costs of converting purchased raw materials into finished or semifinished products, i.e. production cost excluding direct material cost Conversion cost = Direct Labour + Direct Expenses + Production Overheads Conversion cost = Total Production Cost – Direct Material Cost Cost object : any thing for which a separate measurement of cost is required. Cost centre : a production or service location, function, activity or item of equipment where cost is accumulated. Cost unit : a unit of product which has cost attached to it.