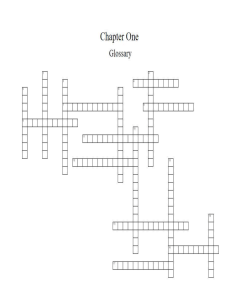

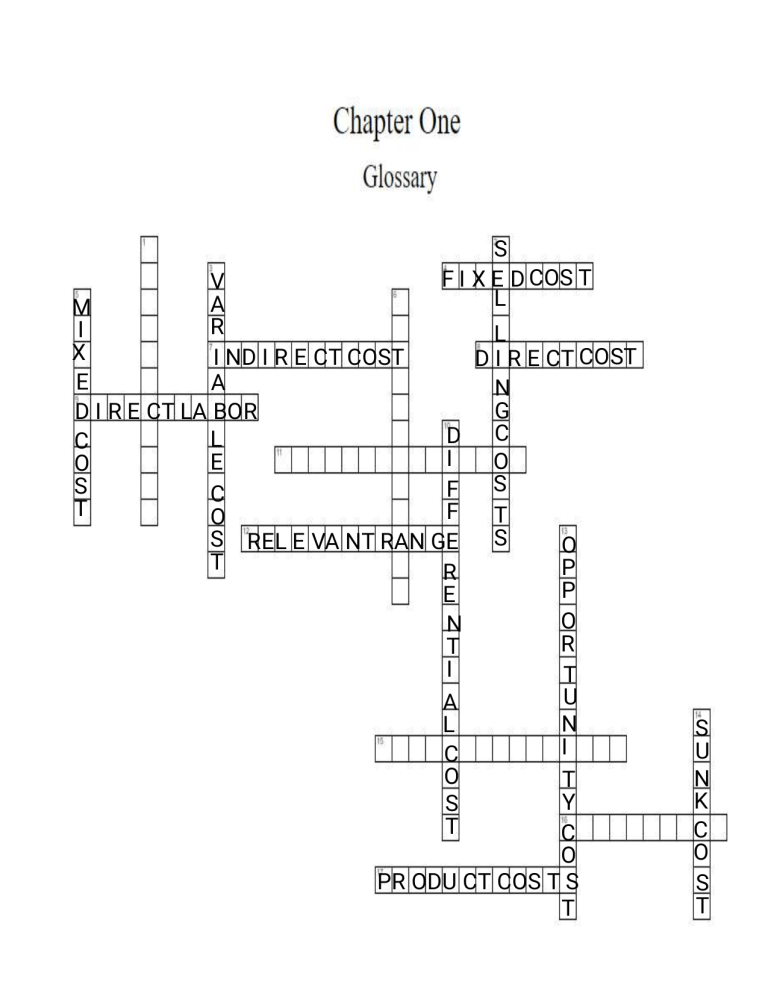

S F I X E D COS T L V A M R I L X I ND I R E CT COST D I R E CT COST E A N G D I R E CT LA BOR D C L C I O E O S S F C T F T O S S REL E VA NT RAN GE O T P R P E O N R T I T U A N L I C O T Y S T C O PR ODU CT COS T S T S U N K C O S T ACROSS 4 A cost that remains constant, in total, regardless of changes in the level of activity within the relevant range. 7 A cost that cannot be easily and conveniently traced to a specified cost object. 8 A cost that can be easily and conveniently traced to a specified cost object. 9 Factory labor costs that can be easily traced to individual units of product Manufacturing 11 All manufacturing costs except direct materials and direct labor. overhead 12 The range of activity within which assumptions about variable and fixed cost behavior are valid. 15 Materials that become an integral part of a finished product and whose costs can be conveniently traced to it. 16 Anything for which cost data are desired. 17 All costs that are involved in acquiring or making a product. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead DOWN 1 Costs that are taken directly to the income statement as expenses in the period in which they are incurred 2 All costs that are incurred to secure customer orders 3 A cost that varies, in total, in direct proportion to changes in the level of activity. 5 A cost that contains both variable and fixed cost elements. 6 A measure of whatever causes the incurrence of a variable cost. 10 A future cost that differs between any two alternatives 13 The potential benefit that is given up when one alternative is selected over another. 14 A cost that has already been incurred and that cannot be changed by any decision made now or future.