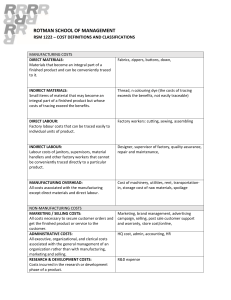

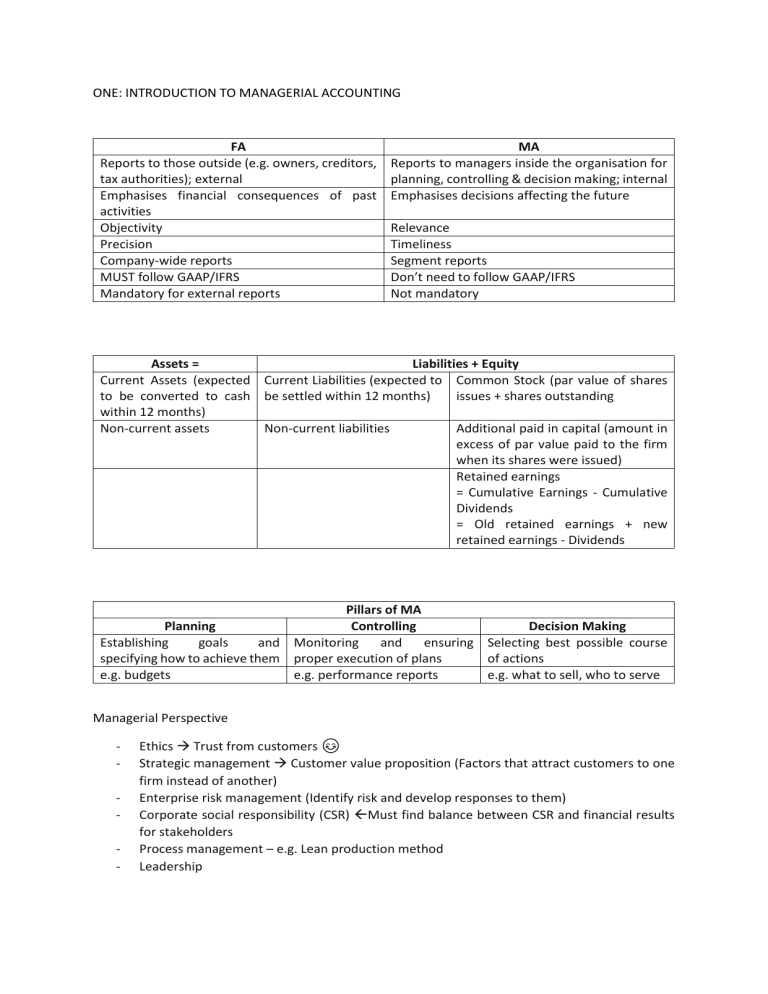

ONE: INTRODUCTION TO MANAGERIAL ACCOUNTING FA Reports to those outside (e.g. owners, creditors, tax authorities); external Emphasises financial consequences of past activities Objectivity Precision Company-wide reports MUST follow GAAP/IFRS Mandatory for external reports MA Reports to managers inside the organisation for planning, controlling & decision making; internal Emphasises decisions affecting the future Relevance Timeliness Segment reports Don’t need to follow GAAP/IFRS Not mandatory Assets = Liabilities + Equity Current Assets (expected Current Liabilities (expected to Common Stock (par value of shares to be converted to cash be settled within 12 months) issues + shares outstanding within 12 months) Non-current assets Non-current liabilities Additional paid in capital (amount in excess of par value paid to the firm when its shares were issued) Retained earnings = Cumulative Earnings - Cumulative Dividends = Old retained earnings + new retained earnings - Dividends Pillars of MA Planning Controlling Decision Making Establishing goals and Monitoring and ensuring Selecting best possible course specifying how to achieve them proper execution of plans of actions e.g. budgets e.g. performance reports e.g. what to sell, who to serve Managerial Perspective - Ethics Trust from customers 😊 Strategic management Customer value proposition (Factors that attract customers to one firm instead of another) Enterprise risk management (Identify risk and develop responses to them) Corporate social responsibility (CSR) Must find balance between CSR and financial results for stakeholders Process management – e.g. Lean production method Leadership Cost object - Anything that is desired that costs data - E.g. products, customers, jobs Costs - - DIRECT o Easily traced to a specified cost object o E.g. sales manager’s salary INDIRECT o Cannot be easily traced to a specified cost object o E.g. factory manager’s salary WHY? It is incurred as a consequence of running the entire factory, it is not incurred to produce any one product o Common cost Cost incurred to support a number of cost objects but cannot be traced to them individually - Rule of thumb: Cost MUST be caused by cost object - PARTICULAR COST o May be direct or indirect, depends on cost object o E.g. manager’s salary Direct cost of manufacturing division Indirect cost of manufacturing basketball shorts Underlined: cost object COSTS: MANUFACTURING, NON-MANUFACTURING Manufacturing Costs - Direct materials - Direct labour - Manufacturing overhead (Indirect) Direct Materials - Materials that become an integral part of the finished product, of which their costs can be easily and conveniently traced to the product - Raw materials o Can be direct or indirect materials o Any materials that are used in the final product o Not just natural resources o Finished products of firm A can be raw materials of firm B - Examples of DIRECT materials: Car seat, tyres, - Examples of INDIRECT materials: Glue, solder o INDIRECT materials are treated as part of MANUFACTURING OVERHEAD Direct Labour - Consists of labour costs that can be easily traced to individual units of a product - “touch” labour - E.g. assembly line workers - INDIRECT labour o Cannot be traced to an individual product o Inconvenient to trace to individual product o Treated as part of MANUFACTURING OVERHEAD o E.g. labour costs of janitors, supervisors, security guards Manufacturing Overhead - INDIRECT COST - Includes ALL manufacturing costs, except direct materials/labour o E.g. indirect materials, indirect labour, maintenance/repairs, insurance, depreciation Non-manufacturing Costs - Selling costs - Administrative costs - General costs Selling costs - Include all costs that are incurred to secure customer orders and get the product to the customer - E.g. advertising, shipping, sales travels, sales commissions Administrative costs - Include all costs associated with the general management of an organisation, rather than manufacturing/selling - E.g. executive compensation, general accounting, secretarial work, PR COSTS: PRODUCT, PERIOD Product Costs (Manufacturing costs) - Can be capitalised - All costs involved in acquiring/manufacturing a product - E.g. direct materials, direct labour, manufacturing overhead - Initially allocated to inventory, before product is sold o Once product is sold, they are expensed Matched against sales revenue: e.g. Cr Rev, Dr Exp Period Costs (Non-manufacturing costs) - Usually cannot be capitalised o Goes to P&L - All costs that are not product costs - E.g. selling & admin costs - Expensed on income statements in the period they are incurred/used, not when cash exchanges hands. Not carried forward. Manufacturing Costs Direct materials Direct labour Prime Cost Manufacturing overhead Conversion Cost -Cost to convert materials into final product Cost behaviour - Refers to how a cost reacts to changes in the level of activity Variable costs - Variable cost change PROPORTIONATELY with the change in level of activity o Variable costs are variable to the activity base Aka cost driver Measure of whatever causes the incurrence of a variable cost E.g. Direct labour hours, machine hours, units produced/sold - E.g. Direct materials, direct labour, supplies, power, sales commission, shipping - Changes with activity level, but CONSTANT when expressed on a PER UNIT BASIS o E.g. will always be $10/unit Fixed Costs - Remains constant in TOTAL regardless of changes in the level of activity - CHANGES when expressed on a PER UNIT BASIS - E.g. straight line depreciation, insurance, rent - How fixed is a fixed cost? o Depends on relevant range Range of activity within which the assumption that cost behaviour is strictly linear is reasonably valid o Outside the range, fixed cost may no longer be strictly fixed Relevant range applies to variable costs as well Cost behaviour patterns (e.g. employee wages) are often called step-variable costing Mixed Costs - Contains both fixed and variable cost elements - Aka “semi variable costs” - y = mx + c DIFFERENTIAL COSTS vs OPPORTUNITY COSTS vs SUNK COSTS -Always relevant costs -Potential benefit given up -Already incurred, cannot be -Future revenue that differs when one project is chosen changed by any decision between 2 alternatives over the other. (Differential revenue) -Not found -Can be fixed/variable records -Irrelevant in decision making; in accounting ignore -Costs that must be explicitly considered in every decision Income Statement - Tells you revenue and expenses over a period of time - 2 formats - o Traditional o Contribution COGS 1. Cost per unit x No. of units sold 2. Beginning inventory + Purchases – Ending Inventory Traditional Format - Does not distinguish between fixed and variable costs o Managers need cost data organised by cost behaviour to aid in planning, controlling and decision making o Hence, the traditional format is not good for internal reporting Revenue Less: COGS Gross Profit/Loss Less: Operating Expenses (e.g. Selling & Admin costs) Net Income/Loss Contribution Format Revenue Less: Variable Costs (e.g. COGS, Variable Selling, Variable Admin) Contribution Margin Less: Fixed Costs (e.g. Fixed Selling, Fixed Admin) Net Operating Income/Loss Quality of Conformance When a product - Meets/exceeds its design specifications - Is free of defects that mar its appearance/degrade its performance High quality of conformance *Note: Luxury car and entry level car will have the same quality of conformance is they are both defect free Preventing/detecting/dealing with defects require QUALITY COSTS/cost of quality - All the costs incurred to prevent defects or resulted from defects in products Quality Costs - **Prevention costs o Arise from activities whose purpose is to reduce the number of defects o By design/training/supervision/reporting/feedback Quality circles: Small groups of employees who meet on a regular basis to discuss ways to improve quality o Statistical process control activities: Technique used to detect if a process is in or out of control (out of control results in defects) - **Appraisal costs o Aka Inspection costs o Incurred to identify defective products before they are sent to customers (aka QC) **Incurred to keep defective products from falling into the hands of customers - Internal + External Failure costs o Incurred when a product fails to conform to its design specifications o Internal Failure Costs: Identify defects before they are shipped out o Includes: cost of scrap/spoilage, rework labour & overhead etc External Failure Costs: When a defected product has already been sent to the customer Includes: Warranty repairs and replacements, product recalls, liability arising from defective product Distribution of Quality Costs - Low appraisal/prevention costs High number of defects High failure costs - Firms should focus efforts on prevention and appraisal to reduce defects and therefore reduce failure costs - As a company’s quality programme becomes more refined and robust, prevention activities become more effective than appraisal activities o Appraisal activities only find defects, but prevention activities PREVENT defects, which is better! Quality Cost Report - Details prevention costs, appraisal costs, cost of failure (both int and ext) ISO-9000 Requirements: 1. Quality control system is used 2. Said system is fully operational 3. Intended level of quality is achieved on a sustained and consistent basis