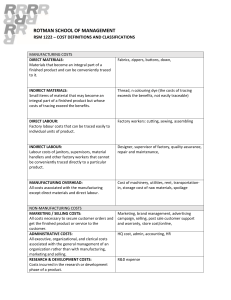

Chapter 2: Cost Terms, Concepts, and Classifications General Cost Classifications Manufacturing Costs • Direct materials – those materials that become an integral part of a finished product and can be conveniently traced to it o Ex. seats that plane companies purchase from subcontractors to install in passenger flights • Indirect materials – small items of material that may become an integral part of a finished product but whose costs of tracing exceed the benefits o Ex. small components parts that are used to make the electrical connections in a TV o Still raw materials, but are not treated as direct materials because the costs of directly tracing them to the finished products exceed the benefits of doing so • Direct labour – those factory labour costs that can be traced easily to individual units of product • Indirect labour – the labour costs of janitors, supervisors, materials handlers, and other factory workers that cannot be conveniently traced directly to particular products o Would be impractical or impossible to accurately trace their costs to specific units of product • Manufacturing overhead – all costs associated with manufacturing except direct materials and direct labour o Ex. indirect materials, indirect labour, maintenance and repairs on production equipment, heat and light, property taxes, depreciation, etc. o Conversion cost – direct labour plus manufacturing overhead cost § Stems from the fact that direct labour costs and overhead costs are incurred to convert materials into finished products o Prime cost – direct materials cost plus direct labour cost Classification of Manufacturing Costs • Overtime premiums – the extra hourly wage rate paid to workers who must work more than their normal time requirements • The appropriate classification of idle time and overtime premiums of production workers whose normal wages are considered direct labour is important to consider • Classification of the overtime as direct labour or overhead depends on the cause of the overtime o Overtime incurred for a job-specific reason would be classified as direct labour o Overtime costs resulting from general conditions would be classified as overhead to be allocated to all products produced during that period Non-Manufacturing Costs • Marketing or selling costs – all costs necessary to secure customer orders and get the finished product or service to the customer o Ex. ordering-getting costs such as those for advertising, sales travel, and sales salaries o Ex. order-filling costs include packing, shipping, etc. • Administrative costs – all executive, organizational, and clerical costs associated with the general management of an organization rather than with manufacturing, marketing, or selling o Ex. executive compensation, costs of administrative support functions such as accounting, human resources Product Costs vs. Period Costs Product Costs • Product costs – all costs that are involved in the purchase or manufacture of goods o For manufactured goods, these costs consist of direct materials, direct labour, and manufacturing overhead (also called inventoriable costs) o Product costs “attach” to units of product as the goods are purchased or manufactured, and they remain attached as the goods go into inventory awaiting sale o When the goods are sold, the costs are released from inventory as expenses (typically called cost of goods sold) and matched against revenue for that period Period Costs • Period costs – all costs that are expensed on the income statement in the period in which they are incurred or accrued o Ex. selling (marketing) and administrative expenses Cost Classifications on Financial Statements The Balance Sheet • Key difference between the balance sheet or a manufacturing company and a merchandising company: o Merchandising company = only one class of inventory – goods purchased from suppliers, that have been sold to customers o Manufacturing company = three classes of inventories § Raw (direct) materials inventory – materials used to make a product that have not yet been placed into production § Work in process inventory – inventory consisting of units of product that are only partially complete and will require further work before they are ready for sale to a customer § Finished goods inventory – inventory consisting of units of product that have been completed but have not yet been sold to customers The Income Statement • The only apparent difference is in the labels of some of the entries that go into the computation of the cost of goods sold figure • The concepts from the above equation are applied to determine the cogs for merchandising companies: • The cogs for a manufacturing company are determined as follows: • To determine the cost of goods sold in a manufacturing company, we need to know the cost of goods manufactured and the beginning and ending balances in the finished goods inventory account Costs of goods manufactured – costs that include the direct materials, direct labour, and manufacturing overhead used for the products finished during the period • Schedule of Cost of Goods Manufactured • Schedule of cost of goods manufactured – a schedule showing the direct materials, direct labour, and manufacturing overhead costs incurred for a period and assigned to work in process and completed goods • The direct materials cost is not the cost of materials purchased during the period; it is the cost of materials used during the period • The purchases of raw materials are added to the beginning inventory of raw materials to determine the cost of raw materials available for use • The ending raw materials inventory is deducted from this amount to arrive at the cost of raw materials used in production • Total manufacturing costs – costs that represent the direct materials, direct labour, and manufacturing overhead used to perform the production work for finished or unfinished products for the period (sum of the three cost elements) Product Costs – Continued An Example of Cost Flows Cost Classifications for Predicting Cost Behaviour Variable Cost • Variable cost – a cost that varies, in total, in direct proportion to changes in the level of activity (constant per unit) o Ex. direct materials = cost may vary in direct proportion to the number of units that are produced Fixed Cost • Fixed cost – a cost that remains constant, in total, regardless of changes in the level of activity within the relevant range o If a fixed cost is expressed on a per unit basis, it varies inversely with the level of activity o Ex. insurance, property taxes, administrative salaries, rent o Very few costs are completely fixed, most will change if there is a large change in activity • Relevant range – the range of activity within which assumption about variable and fixed cost behaviour are valid • Mixed costs – costs that contain both variable and fixed cost elements o Ex. total wages paid to sales staff (fixed salary plus variable commission) Cost Classification for Assigning Costs to Cost Objects • Cost object – any unit of analysis for which cost data are desired Direct Cost • Direct cost – a cost that can be easily and conveniently traced to the particular cost object under consideration Indirect Cost • Indirect cost – a cost that cannot be easily and conveniently traced to the particular cost object under consideration • To be directly traced to a cost object such as a particular product, the cost must be caused by the cost object • Common cost – a cost that is incurred to support a number of cost objects but cannot be traced to any of them individually Cost Classifications for Decision Making Differential Cost and Revenue • Differential cost – a difference in cost between any two alternatives • Differential revenue – a difference in revenue between any two alternatives • Can be used by companies to determine the most favourable business strategy Opportunity Cost • Opportunity cost – the potential benefit that is given up when one alternative is selected over another • Opportunity costs are not usually entered in the accounting records of an organization, but they must be explicitly considered in many decisions managers make Sunk Cost • Sunk cost – any cost that has already been incurred and that cannot be changed by any decision made now or in the future • Since sunk costs cannot be changed and thus will never differ under any alternative courses of action being considered, they are not differential costs o And because only differential costs are relevant in a decision, sunk costs should always be ignored