Financial Exercises: Profit, ROI, and Cost Analysis

advertisement

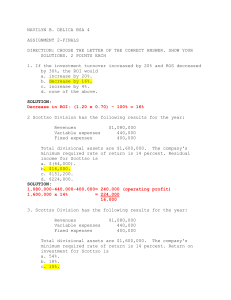

Exercises: MCQs Exercise A: You have the following items: Sales = 1,000 Material cost = 300 other costs = 500 --------------------------------------------------------------------------1) The net profit before tax is……………. A) 100 B) 500 C) 1000 D) 200 E) None of the above 2) If profit is decreased by 2%, the new sales =………….. A) 900 B) 970 C) 980 D) 890 E) 500 3) According to question number 2, the new material costs = ……….. A) 200 B) 294 C) 490 D) 500 E) 295 4) According to question number 2, the new other costs = ……………. A) 200 B) 294 C) 490 D) 500 E) 295 5) If material costs increase by 4, the new profit=……………… A) 196 B) 294 C) 490 D) 500 E) 295 6) The leverage effect is…………… A) 2:1 B) 3:1 C) 4:1 D) 1.5:1 7) If profit increased by 2%, the new sales=………….. A) 1000 B) 1030 C) 1500 D) 700 E) 2:3 E) 1020 8) According to question number 7, the new material costs =………….. A) 301 B) 306 C) 490 D) 500 E) 295 9) According to question number 7, the new other costs = ……………. A) 200 B) 294 C) 490 D) 510 E) 295 10) If material costs decreased by 4, the new profit =…………….. A) 301 B) 306 C) 204 D) 500 E) 295 _______________________________________________________________________ Exercise B: Assume the following data: Material costs = 70% of sales revenues. Inventory is 200,000 from the 800,000 in total assets. Profit = 100,000 Sales revenues= 1,000,000 -------------------------------------------------------------------------11) Other costs = …………….. A) 20,000 B) 240,000 C) 200,000 D) 2,000,000 E) 400,000 1 12) Profit margin= …………….. A) 9 % B) 2 % C) 10 % D) 1 % E) 5 % 13) Total assets turn over = ……………….. A) 1.25 B) 2.5 C) 3 D) 4 E) 5 14) ROI = ………………….. A) 10 % B) 11% D) 12 % E) 13 % C) 12.5 % 15) If the purchasing management has been able to obtain a 20% reduction in materials costs, the new profit is………………. A) 20,000 B) 240,000 C) 200,000 D) 2,000,000 E) 400,000 16) According to question number 15, inventory decrease by …………….. A) 160,000 B) 240,000 C) 200,000 D) 2,000,000 E) 40,000 17) According to question number 15, new total assets= …………….. A) 670,000 B) 600,000 C) 760,000 D) 700,600 18) According to question number 15, new profit margin = …………….. A) 20 % B) 25 % C) 30 % D) 24 % E) 40,000 E) 35 % 19) According to question number 15, new total assets turn over = …………………. A) 1.25 B) 2.5 C) 3 D) 1.32 E) 5 20) According to question number 15, New ROI = …………….. , and it increased by …………………. A) 31 % - 1.53% B) 31.58 % - 2 % C) 30 % - 10 % D) 31.58 % - 152.64 % E) None of the above 2