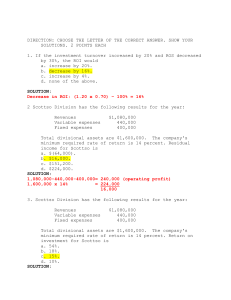

NAVILYN B. DELICA BSA 4 ASSIGNMENT 2-FINALS DIRECTION: CHOOSE THE LETTER OF THE CORRECT ANSWER. SHOW YOUR SOLUTIONS. 2 POINTS EACH 1. If the investment turnover increased by 20% and ROS decreased by 30%, the ROI would a. increase by 20%. b. decrease by 16%. c. increase by 4%. d. none of the above. SOLUTION: Decrease in ROI: (1.20 x 0.70) – 100% = 16% 2 Scottso Division has the following results for the year: Revenues Variable expenses Fixed expenses $1,080,000 440,000 400,000 Total divisional assets are $1,600,000. The company's minimum required rate of return is 14 percent. Residual income for Scottso is a. $(64,000). b. $16,000. c. $151,200. d. $224,000. SOLUTION: 1,080,000-440,000-400,000= 240,000 (operating profit) 1,600,000 x 14% = 224,000 16,000 3. Scottso Division has the following results for the year: Revenues Variable expenses Fixed expenses $1,080,000 440,000 400,000 Total divisional assets are $1,600,000. The company's minimum required rate of return is 14 percent. Return on investment for Scottso is a. 54%. b. 18%. c. 15%. d. 10%. SOLUTION: 1,080,000-440,000-400,000= 240,000/1,600,000= 15% 4 Monrovia Division has net income of $240,000 on sales of $3,200,000. If the investment is $1,600,000 what is ROS? a. 15.0% b. 7.5% c. 10.0 d. 2.0 SOLUTION: 240,000/3,200,000= 0.075 x 100= 7.5% 5. Scottso Division has the following results for the year: Revenues Variable expenses Fixed expenses $1,080,000 440,000 400,000 Total divisional assets are $1,600,000. The company's minimum required rate of return is 14 percent. Return on sales for Scottso is a. 1.5%. b. 15.0%. c. 22.2%. d. 67.5%. SOLUTION: 1,080,000-440,000-400,000= 240,000/1,080,000= 22.2% 6 Monrovia Division has net income of $240,000 on sales of $3,200,000. If the investment is $1,600,000 what is asset turnover? a. 15.0% b. 7.5% c. 10.0 d. 2.0 SOLUTION: 3,200,000/1,600,000= 2 7. Monrovia Division has net income of $240,000 on sales of $3,200,000. If the investment is $1,600,000 what is ROI? a. 15.0% b. 7.5% c. 10.0 d. 2.0 SOLUTION: 240,000/1,600,000= 15% 8 Alcatraz Division of XYZ Corp. sells 80,000 units of part X to the outside market. Part X sells for $40, has a variable cost of $22, and a fixed cost per unit of $10. Alcatraz has a capacity to produce 100,000 units per period. Capone Division currently purchases 10,000 units of part X from Alcatraz for $40. Capone has been approached by an outside supplier willing to supply the parts for $36. What is the effect on XYZ's overall profit if Alcatraz REFUSES the outside price and Capone decides to buy outside? a. no change b. $140,000 decrease in XYZ profits c. $80,000 decrease in XYZ profits d. $40,000 increase in XYZ profits SOLUTION: 10,000 UNITS X ( 36 OUTSIDE PRICE- 22 VC)= Decrease 140,000 9. Alcatraz Division of XYZ Corp. sells 80,000 units of part X to the outside market. Part X sells for $40, has a variable cost of $22, and a fixed cost per unit of $10. Alcatraz has a capacity to produce 100,000 units per period. Capone Division currently purchases 10,000 units of part X from Alcatraz for $40. Capone has been approached by an outside supplier willing to supply the parts for $36. What is the effect on XYZ's overall profit if Alcatraz ACCEPTS the outside price and Capone continues to buy inside? a. no change b. $140,000 decrease in XYZ profits c. $80,000 decrease in XYZ profits d. $40,000 increase in XYZ profits 10 If the investment turnover decreased by 20% and ROS decreased by 30%, the ROI would a. increase by 30%. b. decrease by 20%. c. decrease by 44%. d. none of the above. SOLUTION: Decrease in ROI: (0.80 x 0.70) – 1.00 = 44% 11 If the investment turnover increased by 10% and ROS increased by 20%, the ROI would a. increase by 10%. b. increase by 20%. c. increase by 30%. d. increase by 32%. 12. Durand Division has the following results for the year: Revenues Net income $470,000 130,000 Total divisional assets are $625,000. The company's minimum required rate of return is 12 percent. Residual income for Durand is a. $3,760. b. $55,000. c. $73,600. d. cannot be determined without further information. SOLUTION: 130,000- ( 625,000 X 12% )= 55,000 13 Durand Division has the following results for the year: Revenues Net income $470,000 130,000 Total divisional assets are $625,000. The company's minimum required rate of return is 12 percent. Return on investment for Durand is a. 9.0%. b. 18.3%. c. 20.8%. d. 27.7%. SOLUTION: 130,000/625,000= 20.8% 14. Durand Division has the following results for the year: Revenues Net income $470,000 130,000 Total divisional assets are $625,000. The company's minimum required rate of return is 12 percent. Return on sales for Durand is a. 9.0%. b. 18.3%. c. 20.8%. d. 27.7%. SOLUTION: 130,000/470,000= 27.7% 15 If residual income for Division Q of Company Z is negative, which of the following is true? a. Q's ROI is less than Z's minimum required ROI. b. Q's ROI equals Z's minimum required ROI. c. Q's ROI is higher than Z's minimum required ROI. d. None of the above. 16. Market-based transfer prices are best for a. the company when the selling division is operating below capacity. b. the company when the selling division is operating at capacity. c. the buying division if it is operating at capacity. d. the buying division. 17 The worst transfer-pricing method is to base the prices on a. market prices. b. budgeted variable costs. c. budgeted total costs. d. actual total costs. 18 All other things remaining constant, if a division doubles its investment turnover, its ROI will a. decrease. b. remain constant. c. increase. d. double. 19. Residual income a. is always the best measure of divisional performance. b. is not as good a measure of performance as ROI. c. overcomes some of the problems associated with ROI. d. cannot be used by divisions that deal with others in the same company. 20 If two divisions earn the same ROI and RI, which of the following is true? a. Their managers must be about equally skillful. b. Their incomes and investments must be the same. c. Both divisions are doing as well as they should be. d. All of the above.