Basic Financial Statements

advertisement

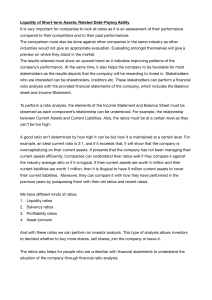

(Accounting 101) There are 3 basic types of financial statements that each corporation produces: 1. Balance Sheet 2. Income Statement 3. Cash Flow Statements 1. 2. 3. The balance sheet is comprised of three sections: Assets – things of value that a company holds in its possession. Liabilities-what the company owes to others (banks, suppliers, tax authorities, employees) Equity-retained earnings and money contributed by shareholders. Assets = Liabilities + Equity The Balance Sheet name comes from the fact that this equation must remain in balance. Real corporate balance sheets can look more intimidating because corporations tend to include more titles. Examine the Loblaw Balance Sheet from their 2014 Annual Report. You will notice more specific categories (current assets, current liabilities), but the basic equation is the same. Tells us how a company has generated revenue (and hence income) as well as what it’s expenses were for a particular period of time (usually one year). The Income Statement usually has two sections: Operating Items and Non-Operating Items. Look at Dollarama’s Statement “Consolidated Statement of Comprehensive Income” http://www.investopedia.com/video/play/in troduction-income-statement/ The Cash Flow Statement allows us to see whether a company is running into difficulty with access to cash. Companies may land a giant new contract (new revenue), but they may not have received cash for this yet. Much like how you have a job, but may have no money because you have not been paid yet. Liquidity: How easily assets can be converted into cash. Example: A house is less liquid than the cash in your bank account. 1. Current Ratio: This ratio tells us how easily a company can pay for short-terms debts. Formula: 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑅𝑎𝑡𝑖𝑜 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 Leverage: The amount that a company depends on borrowed money is called “leverage” 2. Debt Ratio: Tells us whether a company is highly leveraged or not. Formula: 𝐷𝑒𝑏𝑡 𝑅𝑎𝑡𝑖𝑜 = 𝑇𝑜𝑡𝑎𝑙 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 Inventory is a fancy word to describe the goods that a company can sell. 3. Inventory Turnover: Tells us how quickly a company replaces (turns-over) their inventory. Companies that sell perishable goods (grocery stores) have high inventory turnover. Formula: 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 = 𝑆𝑎𝑙𝑒𝑠 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 4. Net Margin: Tells us the percentage of each dollar that a company earns (revenue) that is turned into actual profit. Formula: 𝑁𝑒𝑡 𝑀𝑎𝑟𝑔𝑖𝑛 = 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 5. Return on Investment (ROI) : Allows us to compare the efficiency of our investment compared to other investments. Return on Investment Explained Formula: 𝑅𝑂𝐼 = 𝐺𝑎𝑖𝑛 𝑓𝑟𝑜𝑚 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 −𝐶𝑜𝑠𝑡 𝑜𝑓 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 1. 2. Fill out your “cheat sheet” on Financial Ratios In the Preferred Direction Column – tell me whether it is better for each ratio to be “high” or “Low” and why. Go through and calculate all the ratios using the Dollarama Statements Provided. For ROI, assume you bought 1000 shares of Dollarama on Feb. 3, 2014 and Sold all 1000 on January 31, 2015.