Release Date: 06-30-2016

Dreyfus IP Small Cap Stock Index Portfolio — Service Shares

Investment Strategy from investment’s prospectus

The investment seeks to match the performance of the Standard &

Poor's SmallCap 600 Index. To pursue its goal, the fund invests in a

representative sample of stocks included in the S&P SmallCap 600

Index, and in futures whose performance is tied to the index. The

Advisor attempts to have a correlation between its performance and

that of the index of at least.95, before fees and expenses. The S&P

SmallCap 600 Index is an unmanaged index composed of 600 domestic

stocks.

Category Description: Small Blend

Small-blend portfolios favor U.S. firms at the smaller end of the marketcapitalization range and are flexible in the types of small caps they buy.

Some aim to own an array of value and growth stocks while others

employ a discipline that leads to holdings with valuations and growth

rates close to the small-cap averages.

Operations

Fund Inception Date

Initial Share Class Inception Date

Advisor

Dreyfus Corp

Subadvisor

—

05-01-02

05-01-02

Fees and Expenses as of 04-29-16

Gross Prospectus Expense Ratio

Net Prospectus Expense Ratio

Waiver Data

Expense Ratio

Type

Contractual

0.63%

0.60%

Exp.Date

%

0.03

Portfolio Manager(s)

Thomas J. Durante, CFA. B.A., Fairfield University. Since 2003.

Richard A. Brown, CFA. M.B.A., California State University. Since 2010.

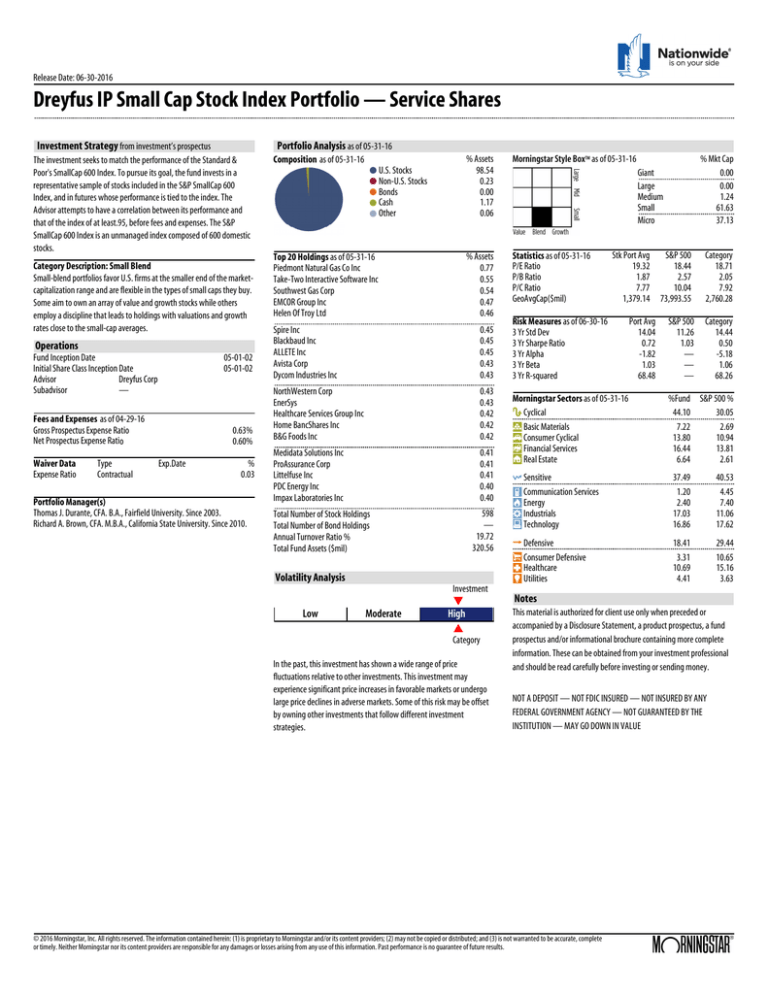

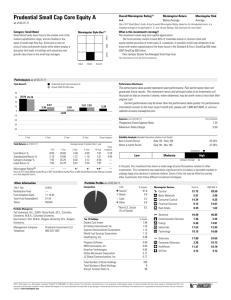

Portfolio Analysis as of 05-31-16

Composition as of 05-31-16

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

••

••

•

% Assets

98.54

0.23

0.00

1.17

0.06

Morningstar Style BoxTM as of 05-31-16

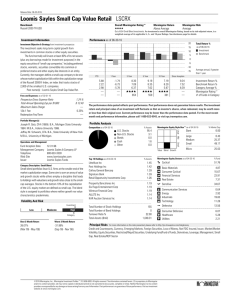

Top 20 Holdings as of 05-31-16

Piedmont Natural Gas Co Inc

Take-Two Interactive Software Inc

Southwest Gas Corp

EMCOR Group Inc

Helen Of Troy Ltd

% Assets

0.77

0.55

0.54

0.47

0.46

Statistics as of 05-31-16

P/E Ratio

P/B Ratio

P/C Ratio

GeoAvgCap($mil)

Spire Inc

Blackbaud Inc

ALLETE Inc

Avista Corp

Dycom Industries Inc

0.45

0.45

0.45

0.43

0.43

NorthWestern Corp

EnerSys

Healthcare Services Group Inc

Home BancShares Inc

B&G Foods Inc

0.43

0.43

0.42

0.42

0.42

Medidata Solutions Inc

ProAssurance Corp

Littelfuse Inc

PDC Energy Inc

Impax Laboratories Inc

0.41

0.41

0.41

0.40

0.40

598

—

19.72

320.56

Total Number of Stock Holdings

Total Number of Bond Holdings

Annual Turnover Ratio %

Total Fund Assets ($mil)

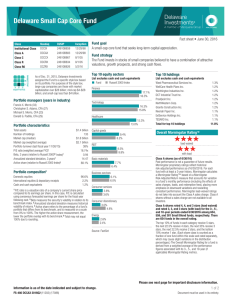

Volatility Analysis

% Mkt Cap

0.00

0.00

1.24

61.63

37.13

Giant

Large

Medium

Small

Micro

Stk Port Avg

19.32

1.87

7.77

1,379.14

Risk Measures as of 06-30-16

3 Yr Std Dev

3 Yr Sharpe Ratio

3 Yr Alpha

3 Yr Beta

3 Yr R-squared

Morningstar Sectors as of 05-31-16

Cyclical

Basic Materials

Consumer Cyclical

Financial Services

Real Estate

Port Avg

14.04

0.72

-1.82

1.03

68.48

S&P 500

18.44

2.57

10.04

73,993.55

Category

18.71

2.05

7.92

2,760.28

S&P 500

11.26

1.03

—

—

—

Category

14.44

0.50

-5.18

1.06

68.26

%Fund S&P 500 %

44.10

30.05

7.22

2.69

13.80

10.94

16.44

13.81

6.64

2.61

Sensitive

Communication Services

Energy

Industrials

Technology

37.49

1.20

2.40

17.03

16.86

40.53

4.45

7.40

11.06

17.62

Defensive

Consumer Defensive

Healthcare

Utilities

18.41

3.31

10.69

4.41

29.44

10.65

15.16

3.63

Investment

Low

Moderate

T

High

S

Category

In the past, this investment has shown a wide range of price

fluctuations relative to other investments. This investment may

experience significant price increases in favorable markets or undergo

large price declines in adverse markets. Some of this risk may be offset

by owning other investments that follow different investment

strategies.

Notes

This material is authorized for client use only when preceded or

accompanied by a Disclosure Statement, a product prospectus, a fund

prospectus and/or informational brochure containing more complete

information. These can be obtained from your investment professional

and should be read carefully before investing or sending money.

NOT A DEPOSIT — NOT FDIC INSURED — NOT INSURED BY ANY

FEDERAL GOVERNMENT AGENCY — NOT GUARANTEED BY THE

INSTITUTION — MAY GO DOWN IN VALUE

© 2016 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete

or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.