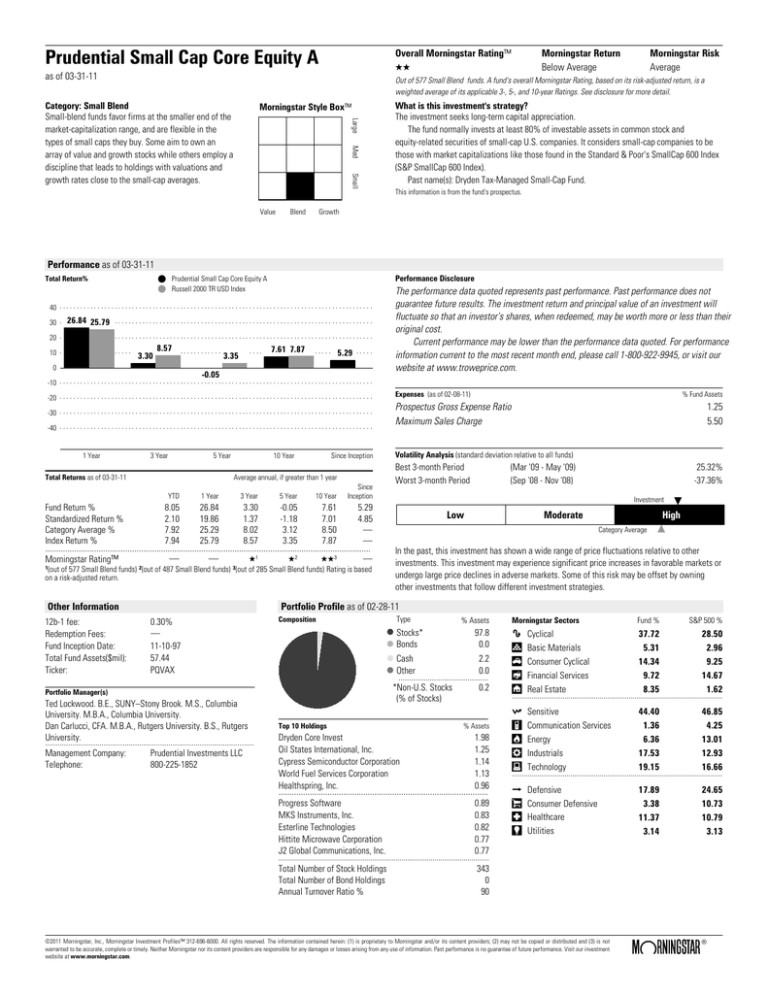

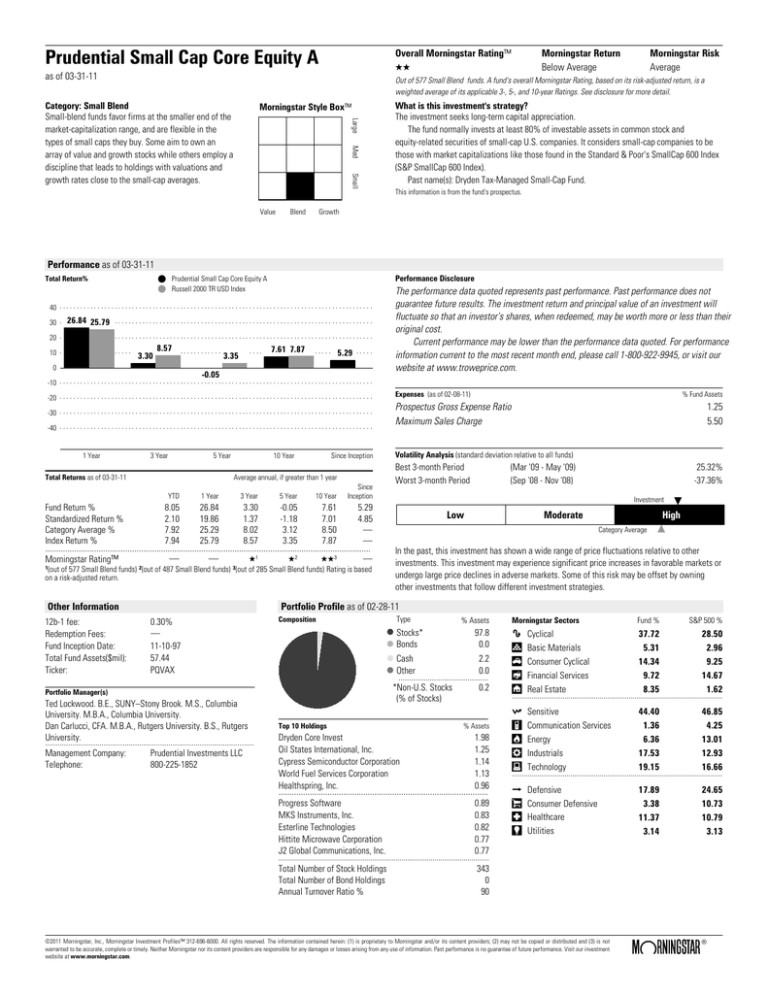

Overall Morningstar Rating™

QQ

Prudential Small Cap Core Equity A

as of 03-31-11

Morningstar Return

Below Average

Morningstar Risk

Average

Out of 577 Small Blend funds. A fund's overall Morningstar Rating, based on its risk-adjusted return, is a

weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure for more detail.

Category: Small Blend

Small-blend funds favor firms at the smaller end of the

market-capitalization range, and are flexible in the

types of small caps they buy. Some aim to own an

array of value and growth stocks while others employ a

discipline that leads to holdings with valuations and

growth rates close to the small-cap averages.

Morningstar Style Box™

Large

Med

Small

What is this investment's strategy?

The investment seeks long-term capital appreciation.

The fund normally invests at least 80% of investable assets in common stock and

equity-related securities of small-cap U.S. companies. It considers small-cap companies to be

those with market capitalizations like those found in the Standard & Poor's SmallCap 600 Index

(S&P SmallCap 600 Index).

Past name(s): Dryden Tax-Managed Small-Cap Fund.

This information is from the fund's prospectus.

Value

Blend

Growth

Performance as of 03-31-11

Performance Disclosure

Prudential Small Cap Core Equity A

Russell 2000 TR USD Index

Total Return%

The performance data quoted represents past performance. Past performance does not

guarantee future results. The investment return and principal value of an investment will

fluctuate so that an investor's shares, when redeemed, may be worth more or less than their

original cost.

Current performance may be lower than the performance data quoted. For performance

information current to the most recent month end, please call 1-800-922-9945, or visit our

website at www.troweprice.com.

40

30

26.84 25.79

20

10

3.30

8.57

0

7.61 7.87

3.35

5.29

-0.05

-10

% Fund Assets

-20

Expenses (as of 02-08-11)

-30

Prospectus Gross Expense Ratio

Maximum Sales Charge

-40

1 Year

3 Year

5 Year

Total Returns as of 03-31-11

Fund Return %

Standardized Return %

Category Average %

Index Return %

10 Year

Since Inception

Average annual, if greater than 1 year

YTD

1 Year

3 Year

5 Year

10 Year

Since

Inception

8.05

2.10

7.92

7.94

26.84

19.86

25.29

25.79

3.30

1.37

8.02

8.57

-0.05

-1.18

3.12

3.35

7.61

7.01

8.50

7.87

5.29

4.85

.

.

..................................................................................................................................................

Q¹

Q²

QQ³

.

.

.

Morningstar Rating™

¹(out of 577 Small Blend funds) ²(out of 487 Small Blend funds) ³(out of 285 Small Blend funds) Rating is based

on a risk-adjusted return.

Volatility Analysis (standard deviation relative to all funds)

Best 3-month Period

Worst 3-month Period

(Mar '09 - May '09)

(Sep '08 - Nov '08)

25.32%

-37.36%

Investment

Low

Moderate

High

Category Average

In the past, this investment has shown a wide range of price fluctuations relative to other

investments. This investment may experience significant price increases in favorable markets or

undergo large price declines in adverse markets. Some of this risk may be offset by owning

other investments that follow different investment strategies.

Portfolio Profile as of 02-28-11

Other Information

12b-1 fee:

Redemption Fees:

Fund Inception Date:

Total Fund Assets($mil):

Ticker:

1.25

5.50

0.30%

.

11-10-97

57.44

PQVAX

Composition

Stocks*

Bonds

% Assets

97.8

0.0

Cash

2.2

Other

0.0

...........................................

*Non-U.S. Stocks

0.2

(% of Stocks)

Portfolio Manager(s)

Ted Lockwood. B.E., SUNY–Stony Brook. M.S., Columbia

University. M.B.A., Columbia University.

Dan Carlucci, CFA. M.B.A., Rutgers University. B.S., Rutgers

University.

....................................................................................................

Management Company:

Prudential Investments LLC

Telephone:

800-225-1852

Type

Top 10 Holdings

% Assets

Dryden Core Invest

Oil States International, Inc.

Cypress Semiconductor Corporation

World Fuel Services Corporation

Healthspring, Inc.

1.98

1.25

1.14

1.13

0.96

Progress Software

MKS Instruments, Inc.

Esterline Technologies

Hittite Microwave Corporation

J2 Global Communications, Inc.

0.89

0.83

0.82

0.77

0.77

Total Number of Stock Holdings

Total Number of Bond Holdings

Annual Turnover Ratio %

343

0

90

..............................................................................................

Morningstar Sectors

Fund %

S&P 500 %

Cyclical

Basic Materials

Consumer Cyclical

Financial Services

Real Estate

37.72

5.31

14.34

9.72

8.35

28.50

2.96

9.25

14.67

1.62

Sensitive

Communication Services

Energy

Industrials

Technology

44.40

1.36

6.36

17.53

19.15

46.85

4.25

13.01

12.93

16.66

Defensive

Consumer Defensive

Healthcare

Utilities

17.89

3.38

11.37

3.14

24.65

10.73

10.79

3.13

............................................................................................................

............................................................................................................

............................................................................................................

©2011 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed and (3) is not

warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future performance. Visit our investment

website at www.morningstar.com.