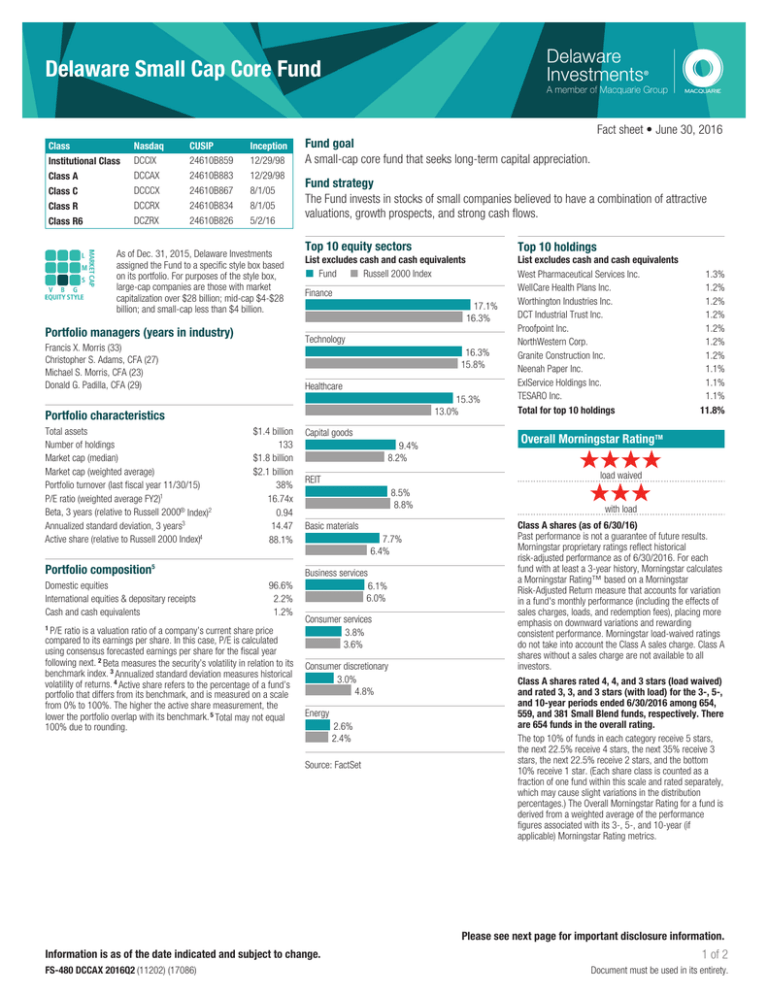

Delaware Small Cap Core Fund

Class

Institutional Class

Nasdaq

DCCIX

CUSIP

24610B859

Inception

12/29/98

Class A

DCCAX

24610B883

12/29/98

Class C

DCCCX

24610B867

8/1/05

Class R

DCCRX

24610B834

8/1/05

Class R6

DCZRX

24610B826

5/2/16

As of Dec. 31, 2015, Delaware Investments

assigned the Fund to a specific style box based

on its portfolio. For purposes of the style box,

large-cap companies are those with market

capitalization over $28 billion; mid-cap $4-$28

billion; and small-cap less than $4 billion.

Portfolio managers (years in industry)

Fund strategy

The Fund invests in stocks of small companies believed to have a combination of attractive

valuations, growth prospects, and strong cash flows.

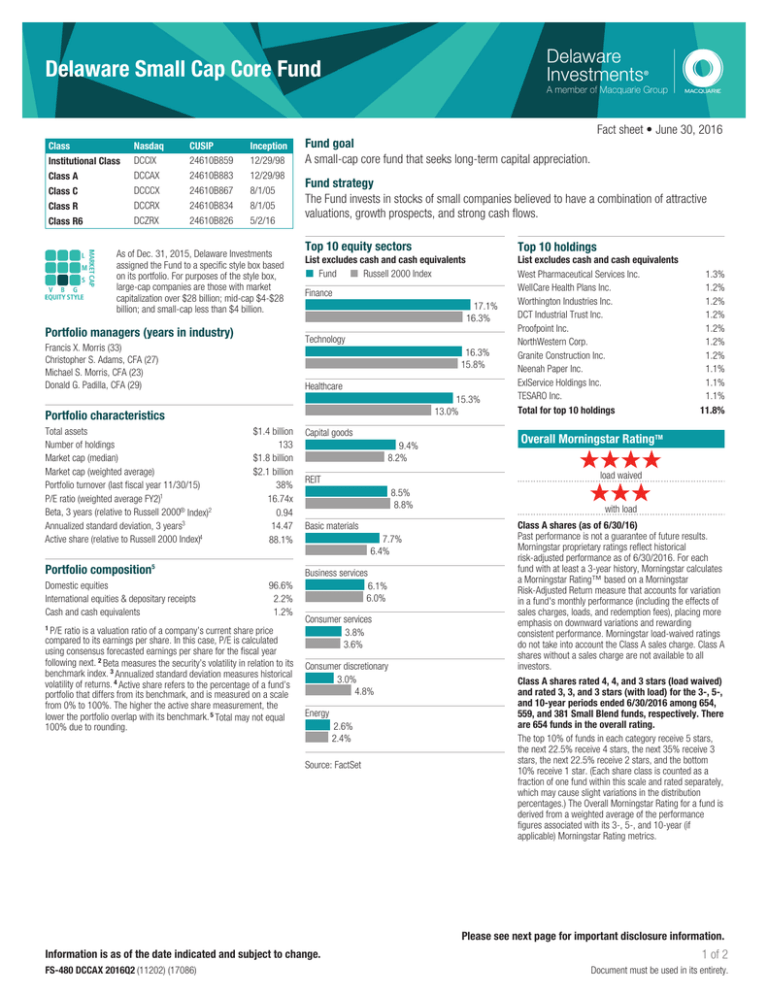

Top 10 equity sectors

Finance

17.1%

16.3%

16.3%

15.8%

Healthcare

15.3%

13.0%

Portfolio characteristics

Total assets

Number of holdings

Market cap (median)

Market cap (weighted average)

Portfolio turnover (last fiscal year 11/30/15)

P/E ratio (weighted average FY2)1

Beta, 3 years (relative to Russell 2000® Index)2

Annualized standard deviation, 3 years3

Active share (relative to Russell 2000 Index)4

$1.4 billion

133

$1.8 billion

$2.1 billion

38%

16.74x

0.94

14.47

88.1%

Portfolio composition5

Domestic equities

International equities & depositary receipts

Cash and cash equivalents

1

Top 10 holdings

List excludes cash and cash equivalents

n Fund n Russell 2000 Index

Technology

Francis X. Morris (33)

Christopher S. Adams, CFA (27)

Michael S. Morris, CFA (23)

Donald G. Padilla, CFA (29)

96.6%

2.2%

1.2%

P/E ratio is a valuation ratio of a company’s current share price

compared to its earnings per share. In this case, P/E is calculated

using consensus forecasted earnings per share for the fiscal year

following next. 2 Beta measures the security’s volatility in relation to its

benchmark index. 3 Annualized standard deviation measures historical

volatility of returns. 4 Active share refers to the percentage of a fund’s

portfolio that differs from its benchmark, and is measured on a scale

from 0% to 100%. The higher the active share measurement, the

lower the portfolio overlap with its benchmark. 5 Total may not equal

100% due to rounding.

Fact sheet • June 30, 2016

Fund goal

A small-cap core fund that seeks long-term capital appreciation.

Capital goods

9.4%

8.2%

REIT

8.5%

8.8%

Basic materials

7.7%

6.4%

Business services

6.1%

6.0%

Consumer services

3.8%

3.6%

Consumer discretionary

3.0%

4.8%

Energy

2.6%

2.4%

Source: FactSet

List excludes cash and cash equivalents

West Pharmaceutical Services Inc.

WellCare Health Plans Inc.

Worthington Industries Inc.

DCT Industrial Trust Inc.

Proofpoint Inc.

NorthWestern Corp.

Granite Construction Inc.

Neenah Paper Inc.

ExlService Holdings Inc.

TESARO Inc.

Total for top 10 holdings

1.3%

1.2%

1.2%

1.2%

1.2%

1.2%

1.2%

1.1%

1.1%

1.1%

11.8%

Overall Morningstar RatingTM

HHHH

load waived

HHH

with load

Class A shares (as of 6/30/16)

Past performance is not a guarantee of future results.

Morningstar proprietary ratings reflect historical

risk-adjusted performance as of 6/30/2016. For each

fund with at least a 3-year history, Morningstar calculates

a Morningstar Rating™ based on a Morningstar

Risk-Adjusted Return measure that accounts for variation

in a fund's monthly performance (including the effects of

sales charges, loads, and redemption fees), placing more

emphasis on downward variations and rewarding

consistent performance. Morningstar load-waived ratings

do not take into account the Class A sales charge. Class A

shares without a sales charge are not available to all

investors.

Class A shares rated 4, 4, and 3 stars (load waived)

and rated 3, 3, and 3 stars (with load) for the 3-, 5-,

and 10-year periods ended 6/30/2016 among 654,

559, and 381 Small Blend funds, respectively. There

are 654 funds in the overall rating.

The top 10% of funds in each category receive 5 stars,

the next 22.5% receive 4 stars, the next 35% receive 3

stars, the next 22.5% receive 2 stars, and the bottom

10% receive 1 star. (Each share class is counted as a

fraction of one fund within this scale and rated separately,

which may cause slight variations in the distribution

percentages.) The Overall Morningstar Rating for a fund is

derived from a weighted average of the performance

figures associated with its 3-, 5-, and 10-year (if

applicable) Morningstar Rating metrics.

Please see next page for important disclosure information.

Information is as of the date indicated and subject to change.

FS-480 DCCAX 2016Q2 (11202) (17086)

1 of 2

Document must be used in its entirety.

Delaware Small Cap Core Fund

Average annual total returns (%) as of June 30, 2016

2Q161

3.20

Institutional Class

YTD1 1 year 3 year

2.00 -4.53

9.85

Inception

5 year 10 year Lifetime

date

10.27

6.87

10.24 12/29/98

1.93

Class A (at NAV)

3.14

Class A (at Offer)2

-2.81

-4.70

9.58

10.01

6.60

-3.94 -10.19

7.42

8.70

5.98

Russell 2000 Index

3.79

2.22

Morningstar Small Blend

Category

Class R

2.43

3.11

10.07 12/29/98

9.70

-6.73

7.09

8.35

6.20

—

2.98

-5.78

6.37

7.62

5.87

—

1.75

-4.95

9.31

9.72

6.34

6.43

8/1/05

1

Returns for less than one year are not annualized.

2

Includes maximum 5.75% front-end sales charge.

5.87%

6.20%

6.87%

7.62%

8.35%

10.27%

7.09%

£ Morningstar Small Blend Category

-5.78%

-6.73%

-4.53%

1 year

6.37%

n Russell 2000 Index

9.85%

n Fund (Institutional Class)

1 year

3 year

5 year

10 year

Calendar year total returns (%)

Fund (Institutional Class)

2006

17.06

2007 2008 2009 2010

-4.52 -35.07 27.35 28.72

2011 2012 2013

0.58 15.62 43.24

2014

8.84

2015

-3.35

Fund (Class A at NAV)

16.87

Russell 2000 Index

18.37

-4.76 -35.24 26.95 28.49

0.33 15.30 42.86

8.58

-3.60

-1.57 -33.79 27.16 26.86

-4.18 16.35 38.82

4.89

Morningstar Small Blend

Category

-4.41

15.03

-1.10 -36.56 31.80 25.61

-4.07 15.46 37.39

3.79

-5.38

Performance

The performance quoted represents past

performance and does not guarantee future results.

Investment return and principal value of an

investment will fluctuate so that shares, when

redeemed, may be worth more or less than their

original cost. Current performance may be lower or

higher than the performance quoted. Performance

data current to the most recent month end may be

obtained by calling 800 523-1918 or visiting

delawareinvestments.com/performance.

Total returns may reflect waivers and/or expense reimbursements by

the manager and/or distributor for some or all periods shown.

Performance would have been lower without such waivers or

reimbursements.

Performance “at NAV” assumes that no front-end sales charge

applied or the investment was not redeemed. Performance “at offer”

assumes that a front-end sales charge applied to the extent

applicable.

Carefully consider the Fund’s investment objectives,

risk factors, charges, and expenses before investing.

This and other information can be found in the Fund’s

prospectus and summary prospectus, which may be

obtained by visiting

delawareinvestments.com/literature or calling 800

523-1918. For Defined Contribution Investment-Only,

call 800 266-3816. Investors should read the

prospectus and summary prospectus carefully before

investing.

Institutional Class shares, Class R shares, and Class R6 shares do

not reflect a sales charge and are available only to certain investors.

See the prospectus for more information.

Prior to Aug. 1, 2005, the Fund had not engaged in a broad

distribution effort of its shares and had been subject to limited

redemption requests. 12b-1 fees were waived for this period. Had

12b-1 fees been applied, performance would have been lower.

Expense waivers were in effect for the periods shown. Performance

would have been lower if waivers did not apply.

Expense ratio

Institutional Class

Gross

1.02%

Net

1.02%

Class A

1.27%

1.27%

Class C

2.02%

2.02%

Class R

1.52%

1.52%

Class R6

0.87%

0.87%

Investing involves risk, including the possible loss of principal.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors. • Investments in small and/or medium-sized companies typically exhibit greater risk and

higher volatility than larger, more established companies. • REIT investments are subject to many of the risks associated with direct real estate ownership, including changes in economic

conditions, credit risk, and interest rate fluctuations. • International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in

accounting principles, or economic or political instability in other nations. • Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility

and lower trading volume.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. TheRussell 2000 Index

measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index, representing approximately 10% of the total

market capitalization of that index. The Morningstar Small Blend Category compares funds that favor U.S. firms at the smaller end of the market-capitalization range. Some funds in this

category aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages.

©2016 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not

warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance

is no guarantee of future results.

All third-party marks cited are the property of their respective owners.

Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

Delaware Investments • 2005 Market Street • Philadelphia, PA 19103-7094

Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s investment manager, Delaware Management

Company (DMC), and the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide. DMC, a series of

Delaware Management Business Trust, is a U.S. registered investment advisor.

Neither Delaware Investments nor its affiliates noted in this document are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The

obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL). MBL does not guarantee or otherwise provide assurance in respect of the obligations

of these entities, unless noted otherwise.

Not FDIC Insured • No Bank Guarantee • May Lose Value

FS-480 DCCAX 2016Q2 (11202) (17086)

2 of 2

©2016 Delaware Management Holdings, Inc.

Document must be used in its entirety.