Essentials Oils Trade Information Brief

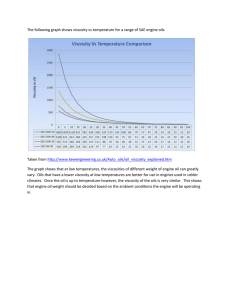

advertisement