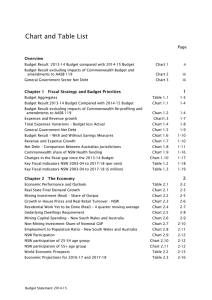

Chart and Table List Page

advertisement

Chart and Table List Page Chapter 1 Budget Context and Strategy 1 Budget Outlook Table 1.1 1-3 State Financial Results ex Economic Stimulus as at March 2011 Chart 1.1 1-4 Private Business Investment Chart 1.2 1-5 Revenue and Expense Growth Chart 1.3 1-6 Capital Expenditure ex Economic Stimulus Chart 1.4 1-7 S&P Ratio and Potential Paths over the Forward Estimates Chart 1.5 1-8 Net Debt – General Government and Total State Chart 1.6 1-17 S&P Ratio at March 2011 and in the 2011-12 Budget Chart 1.7 1-18 Impact of Budget measures and NHRA on Long Term Fiscal Gap Chart 1.8 1-21 Key Fiscal Indicators (per cent) Table 1.2 1-22 Key Fiscal Indicators ($million) Table 1.3 1-22 Chapter 2 The Economy 2 World Economic Prospects Table 2.1 2-4 Economic Performance and Outlook Table 2.2 2-7 NSW Real Household Consumption and Retail Sales Chart 2.1 2-9 NSW Dwelling Investment Growth Chart 2.2 2-10 Private Dwelling Completions 2-11 Construction Pipeline – Engineering and Non-residential Chart 2.3 2-12 Business Capacity Utilisation and Commercial Finance Commitments Chart 2.4 2-13 Contributions to Growth in Real State Final Demand Chart 2.5 2-14 Cumulative Change in NSW Employment and Average Hours Chart 2.6 2-16 Employment by Industry – Contribution to Total Employment Chart 2.7 2-17 Economic Projections for 2013-14 and 2014-15 Table 2.3 2-18 Growth in NSW GSP – Deviation from Trend Chart 2.8 2-19 Chapter 3 Budget Position 3 Budget Results Chart 3.1 3-6 General Government Sector Operating Statement Table 3.1 3-8 Budget Statement 2011-12 General Government Sector Infrastructure Investment Table 3.2 3-10 State Funded General Government and Public Transport Infrastructure Investment Table 3.3 3-11 State Funded General Government and Public Transport Infrastructure Investment Chart 3.2 3-11 General Government Sector Balance Sheet Table 3.4 3-13 General Government Sector Cash Flow Statement Table 3.5 3-15 Sensitivity of Fiscal Aggregated to Changes in Economic Parameters, 2010-11 Table 3.6 3-18 Chapter 4 General Government Expenses 4 Comparison of Real Wage Increases in Public and Private sectors Chart 4.1 4-9 Summary of Expenses Table 4.1 4-11 Total Expenses by Type 2011-12 Chart 4.2 4-12 Employee Expenses Table 4.2 4-13 Expenses by Policy Area, 2011-12 Chart 4.3 4-14 Growth in Expenses by Policy Area Table 4.3 4-15 Chapter 5 General Government Revenues 5 Composition of Total Revenue, NSW South Wales, 2011-12 Chart 5.1 5-1 Tax Measures Announced in the 2011-12 Budget Table 5.1 5-2 Revenue Effect of Previously Announced Decisions Table 5.2 5-4 Annual Club Gaming Machine Marginal Tax Rates Table 5.3 5-6 Summary of Revenues Table 5.4 5-8 Main Sources of variation in 2010-11 revenue estimates Table 5.5 5-9 Taxation Revenue Table 5.6 5-10 Composition of Tax Revenue, 2011-12 Chart 5.2 5-11 Transfer Duty Chart 5.3 5-12 Grant Revenue Table 5.7 5-15 Sale of Goods and Services Table 5.8 5-16 Interest Income Table 5.9 5-16 Dividends and Income Tax Equivalent Revenue Table 5.10 5-18 Other Dividends and Distributions Table 5.11 5-18 Royalties Table 5.12 5-19 Fines, Regulatory Fees and Other Revenue Table 5.13 5-20 Major Tax Expenditures by Type Table 5.14 5-21 Tax Expenditures by Function Table 5.15 5-22 Budget Statement 2011-12 Concessions by Function Table 5.16 Chapter 6 Federal Financial Relations 5-23 6 Australian Government Payments to New South Wales Table 6.1 6-2 Composition of Australian Government Payments to New South Wales, 2011-12 Chart 6.1 6-2 State shares of Australian Government Payments, 2011-12 Table 6.2 6-3 GST-related Payments to New South Wales Table 6.3 6-4 Australian Government GST Pool Estimates Chart 6.2 6-5 Consumption impacts on GST revenue Chart 6.3 6-6 2011 Update – Major Factors Affecting NSW Relativity Table 6.4 6-7 GST Cross Subsidies, 2011-12 Table 6.5 6-10 Cumulative GTS Cross Subsidies Table 6.6 6-10 NSW Total Specific Purpose Payments Table 6.7 6-11 National SPPs and Other Payments to New South Wales Table 6.8 6-12 National Partnership Payments to New South Wales Table 6.9 6-13 7 Chapter 7 Liability Management General Government Sector – Net Debt and Net Financial Liabilities Table 7.1 7-2 General Government Sector – Capital Program Funding Sources Table 7.2 7-3 General Government Sector – Interest Expense as a Percentage of Revenue Chart 7.1 7-4 Non Financial Public Sector – Net Debt And Net Financial Liabilities Table 7.3 7-5 Non – Financial Public Sector – Capital Program Funding Sources Table 7.4 7-6 Non-Financial Public Sector – Net Financial Liabilities Chart 7.2 7-6 Non-Financial Public Sector – Net Financial Liabilities and Net Debt Chart 7.3 7-7 Total State Sector – Net Debt Net Financial Liabilities and Net Worth Table 7.5 7-8 General Government Sector – Superannuation Liabilities Table 7.6 7-10 General Government Sector – Superannuation Liabilities Accounting Reporting and Actuarial Funding Basis Estimates Table 7.7 7-11 General Government Sector – Superannuation Assets Table 7.8 7-12 General Government Sector – Superannuation Liabilities, Assets and Unfunded Liabilities Table 7.9 7-13 General Government Sector – Superannuation Liabilities, Expenses and Cash Flows Table 7.10 7-13 Changes in General Government – Unfunded Superannuation Liability Estimates Table 7.11 7-14 General Government Sector – Insurance Asset and Liability Estimates Table 7.12 7-17 Budget Statement 2011-12 TMF Gross Outstanding Claims Liabilities Chart 7.4 7-18 Total TMF Premiums by Line of Business Chart 7.4 7-19 State Gross Financial Assets Table 7.13 7-21 Chapter 8 Public Trading Enterprises 8 Adjusted Net Operating Surplus Chart 8.1 8-2 PTE Sector Capital Expenditure Chart 8.2 8-5 PTE Capital Expenditure by Sector Table 8.1 8-6 Commercial PTE Capital Expenditure and Gearing Chart 8.3 8-8 Budget Result Impact of Electricity Transactions at 27 January 2011 Table 8.2 8-10 Budget Result Impact of Electricity Transactions Table 8.3 8-10 Budget Support for the PTE Transport Sector Table 8.4 8-21 Chapter 9 Uniform Financial Reporting 9 General Government Sector Operating Statement(a) Table 9.1 9-9 General Government Sector Balance Sheet(a) Table 9.2 9-11 General Government Sector Cash Flow Statement(a) Table 9.3 9-13 Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit)(a) Table 9.4 9-14 General Government Sector Taxes Table 9.5 9-14 General Government Sector Grant Revenue and Expense Table 9.6 9-15 General Government Sector Dividend and Income Tax Equivalent Income Table 9.7 9-16 General Government Sector Expenses by Function Table 9.8 9-16 General Government Sector Purchases of Non-financial Assets by Function Table 9.9 9-17 Public Non-financial Corporation Sector Operating Statement (a) Table 9.10 9-19 Public Non-financial Corporation Sector Balance Sheet (a) Table 9.11 9-20 Table 9.12 9-22 Derivation of ABS GFS Public Non-financial Corporation Sector Cash Surplus/(Deficit)(a) Table 9.13 9-23 Non-financial Public Sector Operating Statement(a) Table 9.14 9-24 Non-financial Public Sector Balance Sheet Table 9.15 9-26 Non-financial Public Sector Cash Flow Statement (a) Table 9.16 9-28 Derivation of ABS GFS Non-financial Public Sector Cash Surplus/(Deficit)(a) Table 9.17 9-29 Loan Council Allocation Estimates Table 9.18 9-30 Public Non-financial Corporation Sector Cash Flow Statement Budget Statement 2011-12 (a) (a)