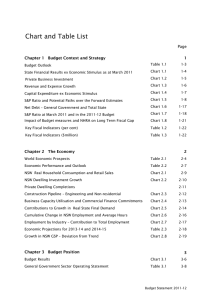

Chart and Table List Page Overview

advertisement

Chart and Table List Page Overview Budget Result: 2013-14 Budget compared with 2014-15 Budget Chart 1 ii Budget Result excluding impacts of Commonwealth Budget and amendments to AASB 119 Chart 2 iii General Government Sector Net Debt Chart 3 iii 1 Chapter 1 Fiscal Strategy and Budget Priorities Budget Aggregates Table 1.1 1-3 Budget Result:2013-14 Budget Compared with 2014-15 Budget Chart 1.1 1-4 Budget Result excluding impacts of Commonwealth Re-profiling and amendments to AASB 119 Chart 1.2 1-4 Chart1.3 1-7 Total Expenses Variations – Budget less Actual Chart 1.4 1-8 General Government Net Debt Chart 1.5 1-9 Budget Result – With and Without Savings Measures Chart 1.6 1-10 Revenue and Expense Growth Chart 1.7 1-10 Net Debt – Comparison Between Australian Jurisdictions Chart 1.8 1-11 Commonwealth share of NSW Health funding Chart 1.9 1-16 Chart 1.10 1-17 Key Fiscal Indicators NSW 2003-04 to 2017-18 (per cent) Table 1.2 1-18 Key Fiscal Indicators NSW 2003-04 to 2017-18 ($ million) Table 1.3 1-19 Expenses and Revenue growth Changes in the fiscal gap since the 2013-14 Budget 2 Chapter 2 The Economy Economic Performance and Outlook Table 2.1 2-2 Real State Final Demand Growth Chart 2.1 2-3 Mining Investment (Real) – Share of Output Chart 2.2 2-5 Growth in House Prices and Real Retail Turnover - NSW Chart 2.3 2-6 Residential Work Yet to be Done (Real) – 4 quarter moving average Chart 2.4 2-7 Underlying Dwellings Requirement Chart 2.5 2-8 Mining Capital Spending – New South Wales and Australia Chart 2.6 2-9 Non-Mining Investment Share of Nominal GSP Chart 2.7 2-10 Employment to Population Ratio – New South Wales and Australia Chart 2.8 2-11 NSW Participation Chart 2.9 2-12 NSW participation of 25-54 age group Chart 2.10 2-12 NSW participation of 55+ age group Chart 2.11 2-12 World Economic Prospects Table 2.2 2-15 Economic Projections for 2016-17 and 2017-18 Table 2.3 2-16 Budget Statement 2014-15 Chapter 3 Support Economic Growth 3 Components of growth in Gross National Income (GNI) per capita Chart 3.1 3-5 Size of sectors and their contributions to growth Table 3.1 3-6 Size of NSW industries and their multifactor productivity performance Chart 3.2 3-7 Growth in GDP and GNI per capita 1980-2013 Chart 3.3 3-10 Chapter 4 Budget Position 4 General Government Sector – key financial aggregates Table 4.1 4-3 Revenue and Expense Growth Chart 4.1 4-4 Budget Reconciliation of 2013-14 Budget to 2014-15 Budget Table 4.2 4-5 General Government Sector Operating Statement Table 4.3 4-7 General Government Capital Expenditure Chart 4.2 4-11 Capital Expenditure by Government Purpose Code Chart 4.3 4-13 General Government Sector Balance Sheet Table 4.4 4-15 Projected General Government Financial Assets by Category at 30 June 2014 Chart 4.4 4-16 Projected General Government Non-financial Assets by Category at 30 June 2014 Chart 4.5 4-17 Projected General Government Liabilities by Category at 30 June 2014 Chart 4.6 4-18 Comparison of Net Debt across Jurisdictions at 30 June Chart 4.7 4-19 General Government Net Debt as at 30 June Chart 4.8 4-20 General Government Sector Cash Flow Statement Table 4.5 4-22 ABS GFS General Government Sector Cash Surplus/Deficit Table 4.6 4-23 Summary of revenue and expense sensitivities Table 4.7 4-24 Chapter 5 General Government Expenditure 5 Total Expenses: Budget less Actual 1995-96 to 2013-14 Chart 5.1 5-3 Expense Reconciliation Table 5.1 5-5 General government sector expenses Table 5.2 5-6 Annual expense growth rates, 2003-04 to 2017-18 Chart 5.2 5-7 Total expenses as a percentage of GSP, 2009-10 to 2017-18 Chart 5.3 5-8 Savings Measures Table 5.3 5-10 Composition of Expenses 2014-15 Chart 5.4 5-12 Total 4 year average growth in employee expenses (ex Superannuation) Table 5.4 5-12 Composition of Total Expenses 2014-15: by policy area Chart 5.5 5-16 Expenses in major policy areas, 2010-11 to 2014-15 Chart 5.6 5-17 6 Chapter 6 General Government Revenues Total Revenue and Nominal GSP Growth, 2000-01 to 2017-18 Chart 6.1 6-4 Revenue Measurers Announced in the 2014-15 Budget Table 6.1 6-4 Reconciliation Statement – Revenue Estimates, 2013-14 to 2016-17 Table 6.2 6-8 Composition of Total Revenue, New South Wales, 2014-15 Chart 6.2 6-9 General Government Sector Summary of Revenues Table 6.3 6-10 Main Sources of Variation in 2013-14 Revenue Estimates Table 6.4 6-11 Budget Statement 2014-15 Composition of Tax Revenue, 2014-15 Chart 6.3 6-12 Taxation Revenue Table 6.5 6-13 Growth of Residential Transfer Duty, Transactions and Home Prices Chart 6.4 6-14 Growth of Residential Transfer Duty, Volumes and Prices Chart 6.5 6-16 Growth in Residential Volumes by Price Band Chart 6.6 6-17 Number of Dwelling Commencements, Completions and Building Approvals Chart 6.7 6-18 First Home Owner Grants for New Homes Table 6.8 6-19 Growth of Payroll Tax, Employment and Hours Worked (monthly data, % change tty) Chart 6.9 6-21 Grant Revenue Table 6.6 6-24 Sale of Goods and Services Table 6.7 6-25 Interest Income Table 6.8 6-25 Dividends and Income Tax Equivalent Revenue Table 6.9 6-27 Other Dividends and Distributions Table 6.10 6-27 Influences on 2013-14 Budget Forecast versus 2013-14 Revised Estimate Chart 6.10 6-28 Royalties Table 6.11 6-29 Fines, Regulatory Fees and Other Revenue Table 6.12 6-29 Major Tax Expenditure by Type Table 6.13 6-31 Concessions by Function Table 6.14 6-32 7 Chapter 7 Federal Financial Relations Commonwealth Payments to New South Wales Table 7.1 7-2 Composition of Commonwealth Payments to New South Wales 2014-15 Chart 7.1 7-3 State Revenue by Source, 2012-13 Chart 7.2 7-4 Federal-State Vertical Fiscal Imbalance, 2012-13 Chart 7.3 7-5 State Shares of Commonwealth Payments, 2014-15 Table 7.2 7-6 National Agreement and Other Payments to New South Wales Table 7.3 7-8 National Partnership Payments to New South Wales Table 7.4 7-10 GST Revenue Payments to New South Wales Table 7.5 7-14 GST as a proportion of GDP, 2000-01 to 2012-13 Chart 7.4 7-15 Household Net Saving and Consumption Ratio Chart 7.5 7-16 2014 Update – Major Changes in NSW Relativity Table 7.6 7-17 New South Wales Per Capita Relativity Chart 7.6 7-18 GST Redistribution – Actual Payments Compared to Equal per Capita Payments 2000-01 to 2014-15 Chart 7.7 7-19 Major National Partnerships Agreements Table 7.7 7-24 Expiring and Discontinued National Partnership Agreements Table 7.8 7-27 Budget Statement 2014-15 8 Chapter 8 Asset and Liability Management General Government Sector – Net Debt and Net Financial Liabilities Table 8.1 8-2 General Government Sector Net Debt – Budget forecast for 2014-15 compared to Budget forecasts for 2013-14 Table 8.2 8-3 General Government Net Debt Trend Chart 8.1 8-4 General Government Sector Capital Program – Sources of funds Table 8.3 8-6 General Government Sector Capital Program – 2010-11 and 2014-15 Chart 8.2 8-6 General Government Sector – Interest Expense as a Percentage of Budget Revenue Chart 8.3 8-7 NSW and Commonwealth 10 Year Bond Yields – 2010 to 2014 Chart 8.4 8-8 General Government Sector – Insurance Liability and Asset Estimates Table 8.4 8-11 General Government Sector – Superannuation Assets Table 8.5 8-13 General Government Sector – Superannuation Liabilities (AASB 119) Table 8.6 8-14 General Government Sector – Superannuation Liabilities AASB 119 and AAS 25 Estimates Table 8.7 8-16 Total State Sector – Unfunded Superannuation Liabilities and funding forecasts to 2030 Chart 8.5 8-17 General Government Sector – Superannuation Liabilities, Expenses and Cash Flows Table 8.8 8-18 Total State Sector – Net Debt Net Financial Liabilities and Net Worth Table 8.9 8-20 Chapter 9 Public Trading Enterprises 9 EBITDA – Commercial PTEs Chart 9.1 9-6 Commercial PTEs and PFEs – Dividends and tax Table 9.1 9-7 Capital Expenditure by Sector - Commercial Table 9.2 9-8 Capital Expenditure by Sector - Commercial Chart 9.2 9-9 Electricity Networks EBITDA Chart 9.3 9-11 Budget Support for transport PTEs and farebox revenue Table 9.3 9-17 Chapter 10 Uniform Financial Reporting 10 General Government Sector Operating Statement Table 10.1 10-9 General Government Sector Balance Sheet Table 10.2 10-11 General Government Sector Cash Flow Statement Table 10.3 10-12 Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) Table 10.4 10-13 General Government Sector Taxes Table 10.5 10-13 General Government Sector Grant Revenue and Expense Table 10.6 10-14 General Government Sector Dividend and Income Tax Equivalent Income Table 10.7 10-15 General Government Sector Expenses by Function Table 10.8 10-15 General Government Sector Purchases of Non-financial Assets by Function Table 10.9 10-16 Public Non-financial Corporation Sector Operating Statement Table 10.10 10-17 Public Non-financial Corporation Sector Balance Sheet Table 10.11 10-19 Public Non-financial Corporation Sector Cash Flow Statement Table 10.12 10-20 Budget Statement 2014-15 Derivation of ABS GFS Public Non-financial Corporation Sector Cash Surplus/(Deficit) Table 10.13 10-21 Non-financial Public Sector Operating Statement Table 10.14 10-21 Non-financial Public Sector Balance Sheet Table 10.15 10-23 Non-financial Public Sector Cash Flow Statement Table 10.16 10-24 Derivation of ABS GFS Non-financial Public Sector Cash Surplus/(Deficit) Table 10.17 10-25 Loan Council Allocation Estimates Table 10.18 10-25 Appendix A: Statement of Significant Accounting Policies and Forecast Assumptions A Key economic performance assumptions Table A.1 A-5 Superannuation Assumptions – Pooled Fund/State Super Schemes Table A.2 A-8 Budget Statement 2014-15