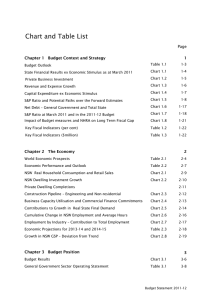

CHART AND TABLE LIST

advertisement

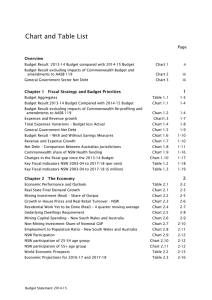

CHART AND TABLE LIST Page Chapter 1 Budget Position Budget Results 2007-08 to 2013-14 1-1 General Government Sector Operating Statement Table 1.1 1-5 General Government Sector Operating Statement 2009-10 Estimated Results Table 1.2 1-10 General Government Capital Expenditure 2006-07 to 2013-14 Chart 1.1 1-11 General Government Sector Balance Sheet Table 1.3 1-13 General Government Sector Cash Flow Statement Table 1.4 1-15 2009-10 Budget – Summary of Variations Table D-1 D-1 Sensitivity of Fiscal Aggregates to Changes in Economic Parameters Table F-1 F-4 Business and Consumer Confidence Chart 2.1 2-3 Growth in Real State Final Demand Chart 2.2 2-4 Revised 2009-10 estimates for NSW Economy Table 2.1 2-5 World Economic Prospects Table 2.2 2-8 Economic Performance and Outlook Table 2.3 2-10 Chapter 2 The Economy Terms of Trade 2-12 Contributions to Terms of Trade: New South Wales 2-13 Real Gross State Income 2-13 Cumulative Change in NSW Employment 2-15 NSW Labour Underutilisation 2-16 NSW Output and Employment Chart 2.3 2-17 Economic Projections for 2012-13 and 2013-14 Table 2.4 2-18 Growth in NSW GSP difference from trend Chart 2.4 2-19 Budget Statement 2010-11 Page Chapter 3 Fiscal Strategy Net Lending in Australia and Major Overseas Economies Chart 3.1 3-2 Revisions to Budget Result Estimates Chart 3.2 3-4 State Infrastructure Spending Chart 3.3 3-12 Capital Investment and Net Lending Result in the General Government Sector Chart 3.5 3-13 Net Debt – General Government and Total State Chart 3.6 3-14 Net Financial Liabilities – General Government and Total State Chart 3.7 3.15 Net Debt and Unfunded Superannuation Liabilities as a share of Total Revenue (non-financial public sector) Chart 3.8 3-17 Change in S&P Ratio between Budgets Chart 3.9 3-18 Key Fiscal Indicators NSW 2002-03 to 2013-14 (per cent) Table 3.1 3-21 Key Fiscal Indicators NSW 2002-03 to 2013-14 ($m) Table 3.2 3-22 Real Wage Growth Chart 4.1 4-11 Summary of Expenses Table 4.1 4-16 Total Expenses by Type 2010-11 Chart 4.2 4-17 Employee Expenses Table 4.2 4-18 Expenses by Policy Area, 2010-11 Chart 4.3 4-21 Growth in Expenses by Policy Area Table 4.3 4-22 Public Transport Share of Adult Journeys to Work and Study Chart 4.4 4-29 Composition of Total Revenue, New South Wales, 2010-11 Chart 5.1 5-2 Tax Measures Announced in the 2010-11 Budget Table 5.1 5-3 State Revenue Per Capita – 2000-01 to 2012-13 Chart 5.2 5-3 Annual Hotel Gaming Machine Duty Rates Table 5.2 5-5 Previously Announced Tax Measures Starting in the 2010-11 Budget or the Forward Estimates Period Table 5.3 5-6 Summary of Revenues Table 5.4 5-8 Composition of Tax Revenue, 2009-10 Chart 5.3 5-9 Taxation Revenue Table 5.5 5-10 Chapter 4 General Government Expenses Chapter 5 General Government Revenues Budget Statement 2010-11 Page Transfer Duty – Effect of the 2008-09 Downturn Chart 5.4 5-12 Grant Revenue Table 5.6 5-14 Sale of Goods and Services Table 5.7 5-15 Interest Income Table 5.8 5-16 Dividends and Income Tax Equivalent Revenue Table 5.9 5-17 Other Dividends and Distributions Table 5.10 5-18 Fines, Regulatory Fees and Other Revenue Table 5.11 5-18 Major Tax Expenditures by Type Table 5.12 5-20 Tax Expenditures by Function Table 5.13 5-21 Concessions by Function Table 5.14 5-22 Detailed Estimates of Tax Expenditures Tables E1 to E14 E2 to E25 Detailed Estimates of Tax Concessions Tables E26 to E15 to E20 E30 Chapter 6 Federal Financial Relations Composition of Australian Government Payments to New South Wales, 2010-11 Chart 6.1 6-2 Australian Government Payments to New South Wales Table 6.1 6-3 National Agreement and Other Payments to New South Wales Table 6.2 6-9 National Partnership Payments to New South Wales Table 6.3 6-10 Australian Government GST Estimates Chart 6.2 6-13 2010 Review – Major Factors Affecting NSW Relativity Table 6.4 6-14 2010 Review – Method Changes and GST Distribution Table 6.5 6-17 GST Revenue Per Capita, 2010-11 Table 6.6 6-19 State Population-based GST Cross Subsidies, 2010-11 Table 6.7 6-19 NSW Population-based GST Cross Subsidy, 2010-11 Table 6.8 6-20 Cumulative GST cross subsidies – Population-based Chart 6.3 6-20 State GST-generated Cross Subsidies, 2010-11 Table 6.9 6-21 NSW GST-generated Cross Subsidy, 2010-11 Table 6.10 6-21 Cumulative GST Cross Subsidies – GST-generated Chart 6.4 6-22 Budget Statement 2010-11 Page Chapter 7 Liability Management Total state sector net financial liabilities Table 7.1 7-2 Net financial liabilities – by sector Chart 7.1 7-3 General government net financial liabilities Table 7.2 7-4 Public trading enterprise net financial liabilities Table 7.3 7-5 Total state sector net debt Table 7.4 7-6 Net debt – by sector Chart 7.2 7-7 Non-financial public sector – capital program funding sources Table 7.5 7-7 Interest expense as a percentage of total revenue Chart 7.3 7-8 NSW-Commonwealth Bond Spread Chart 7.4 7-9 General government sector net debt Table 7.6 7-10 General government sector – capital program funding sources Table 7.7 7-11 Interest expense as a percentage of revenue Chart 7.5 7-11 Public trading enterprise sector net debt Chart 7.6 7-12 Public trading enterprise sector net debt Table 7.8 7-13 Public trading enterprise sector – capital program funding sources Table 7.9 7-13 State Super scheme membership projection to 2050 Chart 7.7 7-14 Total state sector contributions and benefits Table 7.10 7-16 General government sector unfunded superannuation liabilities (AASB 119) Table 7.11 7-18 Changes in general government unfunded liability estimates Table 7.12 7-19 State Super general government sector unfunded liabilities – AASB 119 and actuarial funding basis Chart 7.8 7-20 General government sector unfunded superannuation liability forecasts – AASB 119 and actuarial funding basis Table 7.13 7-21 General government sector insurance estimates Table 7.14 7-23 TMF gross outstanding claims liabilities Chart 7.9 7-24 Total TMF premiums by line of business Chart 7.10 7-25 State gross financial assets Table 7.15 7-28 Asset portfolio average forecast investment returns Table 7.16 7-29 General government forecast investment income for State Super and the TMF Table 7.17 7-30 State gross financial liabilities Table 7.18 7-30 Budget Statement 2010-11 Page Chapter 8 Public Trading Enterprises Adjusted Net Operating Surplus Chart 8.1 8-5 PTE Sector Capital Expenditure Chart 8.2 8-7 PTE Capital Expenditure by Sector Table 8.1 8-8 Commercial PTE Capital Expenditure and Gearing Chart 8.3 8-10 Budget Support for the PTE Transport Sector Table 8.2 8-20 General Government Sector Operating Statement Table 9.1 9-10 General Government Sector Balance Sheet Table 9.2 9-13 General Government Sector Cash Flow Statement Table 9.3 9-16 Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) (a) Table 9.4 9-18 General Government Sector Taxes Table 9.5 9-19 General Government Sector Grant Revenue and Expense Table 9.6 9-19 General Government Sector Dividend and Income Tax Equivalent Income Table 9.7 9-21 General Government Sector Expenses by Function Table 9.8 9-21 General Government Sector Purchases of Non-financial Assets by Function Table 9.9 9-22 Public Non-financial Corporation Sector Operating Statement Table 9.10 9-23 Public Non-financial Corporation Sector Balance Sheet Table 9.11 9-26 Public Non-financial Corporation Sector Cash Flow Statement Table 9.12 9-28 Derivation of ABS GFS Public Non-financial Corporation Sector Cash Surplus/(Deficit) Table 9.13 9-30 Non-financial Public Sector Operating Statement Table 9.14 9-31 Non-financial Public Sector Balance Sheet Table 9.15 9-34 Non-financial Public Sector Cash Flow Statement Table 9.16 9-37 Derivation of ABS GFS Non-financial Public Sector Cash Surplus/(Deficit) Table 9.17 9-39 Loan Council allocation estimates Table 9.18 9-40 Chapter 9 Uniform Financial Reporting Budget Statement 2010-11