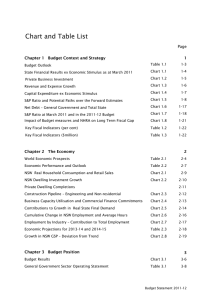

Chart and Table List Page Overview

advertisement

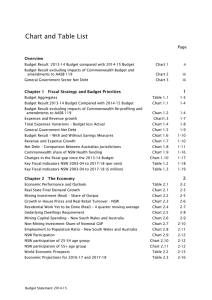

Chart and Table List Page Overview Budget Result Chart 1 i General Government Net Debt Chart 2 iii 1 Chapter 1 Fiscal Strategy and Budget Priorities Budget Aggregates Table 1.1 1-3 Traditional Aggregates Table 1.2 1-3 Total Expense Variations – Budget less Actual Chart 1.1 1-4 Trend Revenue and Expense Growth, 2007-08 to 2016-17 Chart1.2 1-5 General Government Net Debt Chart 1.3 1-6 Savings Measures Table 1.3 1-10 Traditional Budget Result – With and Without Savings Measures in the last three Budgets Chart 1.4 1-10 Total State Infrastructure Investment by Funding Source Table 1.4 1-12 State-Funded General Government Infrastructure Program including Public Transport and SICEEP Chart 1.5 1-12 NSW Building Approvals – private total annualised Chart 1.6 1-24 Numbers and Proportion of First Home Buyers purchasing a new home Chart 1.7 1-25 Changes in the fiscal gap since the 2012-13 Budget Chart 1.8 1-29 Key Fiscal Indicators NSW 2003-04 to 2016-17 (per cent) Table 1.6 1-30 Key Fiscal Indicators NSW 2003-04 to 2016-17 ($ million) Table 1.7 1-31 Chapter 2 The Economy 2 Economic Performance and Outlook Table 2.1 2-2 World Economic Prospects Table 2.2 2-3 NSW Dwelling Investment Share of Domestic Demand Chart 2.1 2-9 NSW Non-residential Building and Engineering Construction Chart 2.2 2-10 NSW Merchandise Exports / NSW Service Export Indicators Chart 2.3 2-11 NSW Service Export Indicators Chart 2.4 2-11 NSW Employment by Industry – share of Total Employment Chart 2.5 2-12 Economic Projections for 2015-16 and 2016-17 Table 2.3 2-13 Budget Statement 2013-14 Chapter 3 Support Economic Growth 3 GSP and GSP per capita growth Chart 3.1 3-2 Labour productivity growth (GSP per hour worked) Chart 3.2 3-3 Real Infrastructure investment Chart 3.3 3-4 Average test results for surveyed 15 year olds, 2009 Chart 3.4 3-6 Chapter 4 Budget Position 4 Budget Aggregates Table 4.1 4-3 Budget Reconciliation Statement Table 4.2 4-4 General Government Sector Operating Statement Table 4.3 4-8 State Funded Infrastructure Investment including General Government, SICEEP and Public Transport PTEs Chart 4.1 4-10 General Government Sector Cash Flow Statement Table 4.4 4-12 ABS GFS General Government Sector Cash Surplus/Deficit Table 4.5 4-13 General Government Sector Balance Sheet Table 4.6 4-14 Sensitivity of Fiscal Aggregates to Changes in Economic Parameters Table 4.7 4-16 Chapter 5 General Government Expenditure 5 Total Expenses – Budget less Actual Chart 5.1 5-3 Forward estimates in the 2009-10 to 2013-14 Budgets Chart 5.2 5-4 Expense growth, 2000-01 to 2016-17 Chart 5.3 5-5 Reconciliation Statement – Expenses Table 5.1 5-6 Savings Measures Table 5.2 5-7 Employee Expenses Table 5.3 5-9 Comparison of Pay increases in Public and Private Sectors Chart 5.4 5-9 Summary of expenses by Operation Statement category Table 5.4 5-10 Expenses as a proportion of GSP Table 5.5 5-11 Composition of Expenses 2013-14: by type Chart 5.5 5-11 Employee expenses Table 5.6 5-12 Capital Expenditure by GPC policy area Chart 5.6 5-15 Expenses by Policy Area; Level, Share and Four year Average Growth Table 5.7 5-16 Composition of Total Expenses 2013-14: by policy area Chart 5.7 5-17 Budget Statement 2013-14 Chapter 6 General Government Revenues 6 Revenue Estimate Changes (Four years to 2014-15) Chart 6.1 6-2 Reconciliation Statement – Revenue Estimates, 2012-13 to 2015-16 Table 6.1 6-4 Main Sources of Variation in 2012-13 Revenue Estimates Table 6.2 6-5 Tax Revenue Measures Announced in the 2013-14 Budget Table 6.3 6-6 Composition of Total Revenue, New South Wales, 2013-14 Chart 6.2 6-9 Summary of Revenues Table 6.4 6-10 Composition of Tax Revenue Chart 6.3 6-11 Taxation Revenue Table 6.5 6-12 Growth of Residential Transfer Duty, Transactions and Home Prices Chart 6.4 6-14 Growth of Payroll Tax, Employment and Hours Worked Chart 6.5 6-15 Grant Revenue Table 6.6 6-18 Sale of Goods and Services Table 6.7 6-19 Interest Income Table 6.8 6-20 Dividend and Income Tax Equivalent Revenue Table 6.9 6-21 Other Dividends and Distribution Table 6.10 6-10 Influences on 2012-13 Budget Forecast versus 2012-13 Revised Chart 6.6 6-22 Royalties Table 6.11 6-23 Fines, Regulatory Fees and Other Revenue Table 6.12 6-23 Major Tax Expenditures by Type Table 6.13 6-25 Concessions by Function Table 6.14 6-27 Chapter 7 Federal Financial Relations 7 Australian Government Payments to New South Wales Table 7.1 7-2 Composition of Australian Government Payments to New South Wales 2013-14 Chart 7.1 7-2 Federal-State Vertical Fiscal Imbalance, 2011-12 Chart 7.2 7-3 State Shares of Australian Government Payments 2013-14 Table 7.2 7-5 GST Revenue Payments to New South Wales Table 7.3 7-6 Australian Government GST Pool Estimates Chart 7.3 7-7 Household Net Saving and Consumption Ratios Chart 7.4 7-8 GST-taxable Consumption as a Share of Total Household Consumption Chart 7.5 7-8 2013 Update – Major Changes in NSW Relativity Table 7.4 7-10 Budget Statement 2013-14 GST Redistribution – Actual Payments Compared to Equal per Capita Payments Table 7.5 7-11 Intergovernmental Agreements with the NSW Government Table 7.6 7-14 National Agreement and Other Payments to New South Wales Table 7.7 7-15 National Partnership Payments to New South Wales Table 7.8 7-17 Major National Partnerships, Implementation Plans and Project Agreements Table 7.9 7-20 Chapter 8 Asset and Liability Management 8 General Government Sector – Net Debt and Net Financial Liabilities Table 8.1 8-2 General Government Sector Net Debt – Budget forecast for 2013-14 compared to Budget forecasts for 2012-13 Table 8.2 8-3 General Government Sector – Interest Expense as a Percentage of Revenue Chart 8.1 8-4 NSW, Queensland and Commonwealth 10 Year Bond Yields – 2010 to 2013 Chart 8.2 8-5 General Government Sector – Insurance Liability and Asset Estimates Table 8.3 8-6 Non-financial Public Sector – Net Debt and Net Financial Liabilities Table 8.4 8-7 Non-financial Public Sector Net Debt – Budget forecasts for 2013-14 compared to Budget forecast for 2012-13 Table 8.5 8-8 Non-financial Public Sector – Net Financial Liabilities Chart 8.3 8-9 Total State Sector – Net Debt Net Financial Liabilities and Net Worth Table 8.6 8-10 General Government Sector – Superannuation Liabilities (AASB 119) Table 8.7 8-12 General Government Sector – Superannuation Assets Table 8.8 8-14 General Government Sector – Superannuation Liabilities AASB 119 and AAS 25 Estimates Table 8.9 8-16 General Government Sector – Superannuation Liabilities, Expenses and Cash Flows Table 8.10 8-17 9 Chapter 9 Public Trading Enterprises Commercial and Non-commercial PTEs Table 9.1 9-2 Adjusted Net Operating Surplus – Commercial PTEs Chart 9.1 9-4 Commercial PTE dividends Chart 9.2 9-5 Commercial PTE dividends and tax Table 9.3 9-5 Commercial PTE Capital Expenditure and Gearing Chart 9.3 9-6 Commercial PTE Capital Expenditure by Sector Table 9.3 9-7 Non-commercial PTE Capital Expenditure by Sector Table 9.4 9-15 Non-commercial PTE Capital Investment Chart 9.4 9-16 Budget Support for Transport Sector PTEs Table 9.5 9-19 Budget Statement 2013-14 Chapter 10 Uniform Financial Reporting 10 General Government Sector Operating Statement Table 10.1 10-9 General Government Sector Balance Sheet Table 10.2 10-11 General Government Sector Cash Flow Statement Table 10.3 10-12 Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) Table 10.4 10-13 General Government Sector Taxes Table 10.5 10-13 General Government Sector Grant Revenue and Expense Table 10.6 10-14 General Government Sector Dividend and Income Tax Equivalent Income Table 10.7 10-15 General Government Sector Expenses by Function Table 10.8 10-15 General Government Sector Purchases of Non-financial Assets by Function Table 10.9 10-16 Public Non-financial Corporation Sector Operating Statement Table 10.10 10-17 Public Non-financial Corporation Sector Balance Sheet Table 10.11 10-19 Public Non-financial Corporation Sector Cash Flow Statement Table 10.12 10-20 Derivation of ABS GFS Public Non-financial Corporation Sector Cash Surplus/(Deficit) Table 10.13 10-21 Non-financial Public Sector Operating Statement Table 10.14 10-21 Non-financial Public Sector Balance Sheet Table 10.15 10-23 Non-financial Public Sector Cash Flow Statement Table 10.16 10-24 Derivation of ABS GFS Non-financial Public Sector Cash Surplus/(Deficit) Table 10.17 10-25 Loan Council Allocation Estimates Table 10.18 10-26 Appendix A: Statement of Significant Accounting Policies and Forecast Assumptions A Key economic performance assumptions Table A.1 A-4 Superannuation assumptions – Pool Fund/State Super Schemes Table A.2 A-7 Budget Statement 2013-14