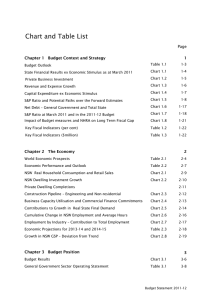

Chart and Table List Page

advertisement

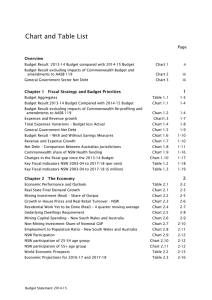

Chart and Table List Page Chapter 1 Budget Overview, Context and Strategy 1 Budget Outlook Table 1.1 1-2 Budget Turnaround Table 1.2 1-2 Commonwealth Budget Projections of National GST Pool Chart 1.1 1-4 Revenue and Expense Growth, 2007-08 to 2015-16 Chart 1.2 1-5 General Government Expense Growth Chart 1.3 1-6 Headline and Underlying Budget Result Chart 1.4 1-8 Total State Capital Expenditure Chart 1.5 1-9 General Government and Total State Net Debt Chart 1.6 1-10 S&P Ratio: impact of valuation assumptions and Government actions Chart 1.7 1-11 Infrastructure Investment Summary Table 1.3 1-16 State-Funded General Government Infrastructure Program including Public Transport Chart 1.8 1-18 Public Trading Enterprises’ Infrastructure Program excluding Public Transport Chart 1.9 1-18 Australian Government contribution to State Infrastructure Program Chart 1.10 1-19 Changes in the fiscal gap since the 2011-12 Budget Chart 1.11 1-28 Key Fiscal Indictors NSW 2002-03 to 2015-16 (per cent) Table 1.4 1-29 Key Fiscal Indicators NSW 2002-03 to 2015-16 ($million) Table 1.5 1-30 Chapter 2 The Economy 2 World Economic Prospects Table 2.1 2-6 Economic Performance and Outlook Table 2.2 2-10 NSW Real Household Consumption of Goods and Services Chart 2.1 2-11 NSW Dwelling Investment share of Domestic Demand Chart 2.2 2-13 NSW Non-residential Building and Engineering Construction Chart 2.3 2-14 NSW Merchandise Exports Chart 2.4 2-16 NSW Service Export Indicators Chart 2.5 2-16 NSW Employment by Industry – share of Total Employment Chart 2.6 2-18 NSW Job Vacancies as per cent of Labour Force Chart 2.7 2-18 Economic Projections for 2014-15 and 2015-16 Table 2.3 2-22 Budget Statement 2012-13 Chapter 3 Budget Position 3 Headline and Adjusted Budget Results Chart 3.1 3-3 Budget Results 2009-10 to 2015-16 Chart 3.2 3-6 General Government Sector Operating Statement Table 3.1 3-7 Reconciliation Statement – Expenses Table 3.2 3-9 General Government Sector Infrastructure Investment Table 3.3 3-10 State funded General Government Infrastructure Program including Public Transport Capital Expenditure Table 3.4 3-10 State Funded General Government and Public Transport Infrastructure Investment Chart 3.3 3-11 General Government Sector Balance Sheet Table 3.5 3-13 General Government Sector Cash Flow Statement Table 3.6 3-15 Sensitivity of Fiscal Aggregates to Changes in Economic Parameters, 2012-13 Table 3.7 3-19 Chapter 4 General Government Expenses 4 Forward Estimates in the 2008-09 to 2012-13 Budgets Chart 4.1 4-2 Total Expenses – Budget Versus Actual 2004-05 to 2011-12 Chart 4.2 4-3 Savings Measures Table 4.1 4-7 Treasurer’s Advance Chart 4.3 4-10 Four year Average Annual Nominal Growth in Expenses Chart 4.4 4-11 Summary of Expenses by Operating Statement Category Table 4.2 4-11 Composition of Total Expenses 2012-13: by type Chart 4.5 4-12 Expenses as a Proportion of GSP Table 4.3 4-12 Employee expenses Table 4.4 4-13 Comparison of Real Wage Increases in Public and Private Sectors Chart 4.6 4-15 Composition of Total Expenses 2012-13: by policy area Chart 4.7 4-18 Chapter 5 General Government Revenues 5 Composition of Total Revenue, NSW South Wales, 2012-13 Chart 5.1 5-1 Revenue Measures Announced in the 2012-13 Budget Table 5.1 5-2 Revenue Effect of Previously Announced Decisions Table 5.2 5-4 Summary of Revenues Table 5.3 5-7 Main Sources of Variation in 2011-12 Revenue Estimates Table 5.4 5-8 Composition of Tax Revenue, 2012-13 Chart 5.2 5-9 Taxation Revenue Table 5.5 5-10 Growth of Residential Transfer Duty, Transactions and Home Prices Chart 5.3 5-11 Budget Statement 2012-13 Growth of Payroll Tax, Employment and Hours Worked Chart 5.4 5-12 Grant Revenue Table 5.6 5-15 Sale of Goods and Services Table 5.7 5-16 Interest Income Table 5.8 5-17 Dividends and Income Tax Equivalent Revenue Table 5.9 5-18 Other Dividends and Distributions Table 5.10 5-18 Royalties Table 5.11 5-19 Fines, Regulatory Fees and Other Revenue Table 5.12 5-20 Major Tax Expenditures by Type Table 5.13 5-22 Concessions by Function Table 5.14 5-23 Chapter 6 Federal Financial Relations 6 Federal-State Vertical Fiscal Imbalance, 2010-11 Chart 6.1 6-2 Australian Government Payments to New South Wales Table 6.1 6-3 Composition of Australian Government Payments to New South Wales 2012-13 Chart 6.2 6-3 State Shares of Australian Government Payments 2012-13 Table 6.2 6-4 GST Revenue Payments Estimates Changes Chart 6.3 6-5 GST Revenue Payments to New South Wales Table 6.3 6-5 Australian Government GST Pool Estimates Chart 6.4 6-6 GST Pool: Actual and Trend Levels Chart 6.5 6-7 Household Net Saving and Consumption Ratios Chart 6.6 6-8 Taxable Consumption as a Share of Total Consumption Chart 6.7 6-9 Household Consumption Prices Chart 6.8 6-10 2012 Update – Major Factors Affecting NSW Relativity Table 6.4 6-11 GST Redistribution: Actual payments Compared to Population-based Payments Table 6.5 6-13 NSW Total Specific Purpose Payments Table 6.6 6-15 National SPPs and Other Payments to New South Wales Table 6.7 6-15 National Partnership Payments to New South Wales Table 6.8 6-16 National Disability Insurance Scheme Estimated Costs and Funding Table 6.9 6-19 7 Chapter 7 Liability Management General Government Sector – Net Debt and Net Financial Liabilities Table 7.1 7-2 General Government Sector – Capital Program Funding Sources Table 7.2 7-3 NSW, Queensland and Commonwealth 10 Year Bond Yields-2010 to 2012 Chart 7.1 7-4 General Government Sector – Interest Expense as a Percentage of Revenue Chart 7.2 7-5 Budget Statement 2012-13 General Government Sector – Insurance Asset and Liability Estimates Table 7.3 7-6 Non-financial Public Sector – Net Debt And Net Financial Liabilities Table 7.4 7-8 Non-financial Public Sector – Capital Program Funding Sources Table 7.5 7-9 Standards & Poor’s (S&P) Radio Chart 7.3 7-9 Non-financial Public Sector – Net Financial Liabilities Chart 7.4 7-10 Non-financial Public Sector – Net Financial Liabilities and Net Debt Chart 7.5 7-10 Total State Sector – Net Debt Net Financial Liabilities and Net Worth Table 7.6 7-12 General Government Sector – Superannuation Liabilities (Current AASB 119 Basis) Table 7.7 7-14 General Government Sector – Superannuation Liabilities Accounting Reporting and Actuarial Funding Basis Estimates Table 7.8 7-15 General Government Sector – Superannuation Assets Table 7.9 7-17 General Government Sector – Superannuation Liabilities, Expenses and Cash Flows Table 7.10 7-18 Chapter 8 Public Trading Enterprises 8 Commercial and Non-commercial PTEs Table 8.1 8-2 Adjusted Net Operating Surplus – Commercial PTEs Chart 8.1 8-4 Commercial PTE Sector Capital Expenditure and Gearing Chart 8.2 8-5 Commercial PTE Capital Expenditure by Sector Table 8.2 8-6 Reduction in Commercial PTE Capital Forecasts Since Last Budget Chart 8.3 8-6 Commercial PTE dividends and tax Chart 8.4 8-8 Adjusted Net Operating Surplus – Non-commercial PTEs Chart 8.5 8-18 Non-commercial PTE Capital Expenditure by Sector Table 8.3 8-19 Non-commercial PTE Capital Investment Chart 8.6 8-20 Budget Support for the PTE Transport Sector Table 8.4 8-23 Chapter 9 Uniform Financial Reporting 9 General Government Sector Operating Statement Table 9.1 9-9 General Government Sector Balance Sheet Table 9.2 9-11 General Government Sector Cash Flow Statement Table 9.3 9-12 Derivation of ABS GFS General Government Sector Cash Surplus/(Deficit) Table 9.4 9-13 General Government Sector Taxes Table 9.5 9-13 General Government Sector Grant Revenue and Expense Table 9.6 9-14 General Government Sector Dividend and Income Tax Equivalent Income Table 9.7 9-15 Budget Statement 2012-13 General Government Sector Expenses by Function Table 9.8 9-15 General Government Sector Purchases of Non-financial Assets by Function Table 9.9 9-16 Public Non-financial Corporation Sector Operating Statement Table 9.10 9-17 Public Non-financial Corporation Sector Balance Sheet Table 9.11 9-19 Public Non-financial Corporation Sector Cash Flow Statement Table 9.12 9-20 Derivation of ABS GFS Public Non-financial Corporation Sector Cash Surplus/(Deficit) Table 9.13 9-21 Non-financial Public Sector Operating Statement Table 9.14 9-21 Non-financial Public Sector Balance Sheet Table 9.15 9-23 Non-financial Public Sector Cash Flow Statement Table 9.16 9-24 Derivation of ABS GFS Non-financial Public Sector Cash Surplus/(Deficit) Table 9.17 9-25 Loan Council Allocation Estimates Table 9.18 9-26 Appendix D: Accounting principles followed in the Budget Papers Financial Impact of changes to AASB 119 Employee Benefits D Table D.1 D-3 Budget Statement 2012-13