Homework: Chapter 4 and 5 Problems BA3303 (Moore)

advertisement

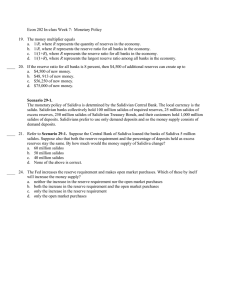

BA3303 (Moore) Homework Problems for Ch 4and 5 Homework: Chapter 4 and 5 Problems BA3303 – Moore – Due 21 September 2006 Name______________________ 1.Which of the following assets are the most liquid? a. money and antiques b. bonds and real estate c. savings accounts and checking accounts d. stocks and bonds 2.M-1 includes coins, currency, and ____. a. demand deposits b. savings accounts c. certificates of deposit d. time deposits 3.The assets of a typical commercial bank include a. commercial loans b. demand deposits c. common stock d. equity 4.A pension plan that grants mortgage loans a. is an example of a financial intermediary b. cannot suffer losses c. is called a savings and loan association d. is not a financial intermediary 5.A financial intermediary transfers a. savings to households b. savings to borrowers c. stocks to brokers d. new stock issues to buyers 6.Withdrawing cash from a checking account does not decrease a. the money supply b. demand deposits c. total reserves d. excess reserves 7.When commercial banks grant loans, a. the money supply is reduced b. the money supply is increased c. total reserves increase d. total reserves decrease -1- BA3303 (Moore) Homework Problems for Ch 4and 5 8.When a commercial bank receives a cash deposit, 1. 2. 3. 4. a. b. c. d. its required reserves increase its required reserves decrease its total reserves increase its total reserves decrease 1 and 3 1 and 4 2 and 3 2 and 4 9.The Federal Reserve increases reserves by a. selling securities b. buying securities c. raising reserve requirements d. raising the discount rate 10.The Federal Reserve a. is part of the U.S. Treasury b. is owned by member banks c. is the nation's largest commercial bank d. lends funds to corporations 11.By lowering the discount rate, the Federal Reserve a. discourages commercial banks from lending b. encourages commercial banks to borrow reserves c. discourages depositors from withdrawing funds d. contracts the money supply 12.The Federal Reserve may contract the money supply by 1. 2. 3. 4. a. b. c. d. selling securities buying securities raising reserve requirements lowering reserve requirements 1 and 3 1 and 4 2 and 3 2 and 4 -2- BA3303 (Moore) Homework Problems for Ch 4and 5 13.If the federal government runs a deficit and borrows from commercial banks, 1. total deposits are not affected 2. total deposits are increased 3. excess reserves are reduced 4. excess reserves are decreased a. b. c. d. 1 and 3 1 and 4 2 and 3 2 and 4 Show Computations for the Next Question 14.If the reserve requirement for demand deposits is 10 percent, what is the maximum change in the money supply that the banking system can create if a. the Federal Reserve puts $1,000,000 of new reserves in the banking system b. $1,000,000 in cash is deposited in checking accounts c. General Motors borrows $1,000,000 from an insurance company? 15.What is the effect on (1) demand deposits, (2) required reserves, and (3) excess reserves of banks given the following transactions? a. The general public builds up its holdings of cash by withdrawing funds in checking accounts. b. After Christmas the general public deposits cash in checking accounts in commercial banks. (How may seasonal changes in the public's need for cash alter banks' ability to lend?) c. Corporations borrow from commercial banks. d. State and local governments issue debt securities that are purchased by commercial banks. e. Homeowners borrow from commercial banks to finance home improvements. (Are there any differences on the expansion of the money supply in questions (c), (d), and (e)?) -3-