Monetary Policy Quiz - Economics 202

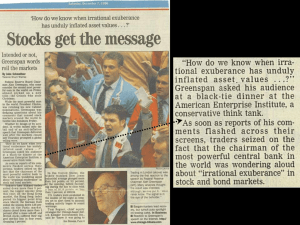

advertisement

Econ 202 In-class Week 7: Monetary Policy 19. The money multiplier equals a. 1/R, where R represents the quantity of reserves in the economy. b. 1/R, where R represents the reserve ratio for all banks in the economy. c. 1/(1+R), where R represents the reserve ratio for all banks in the economy. d. 1/(1+R), where R represents the largest reserve ratio among all banks in the economy. ____ 20. If the reserve ratio for all banks is 8 percent, then $4,500 of additional reserves can create up to a. $4,500 of new money. b. $48, 913 of new money. c. $56,250 of new money. d. $75,000 of new money. Scenario 29-1. The monetary policy of Salidiva is determined by the Salidivian Central Bank. The local currency is the salido. Salidivian banks collectively hold 100 million salidos of required reserves, 25 million salidos of excess reserves, 250 million salidos of Salidivian Treasury Bonds, and their customers hold 1,000 million salidos of deposits. Salidivians prefer to use only demand deposits and so the money supply consists of demand deposits. ____ 21. Refer to Scenario 29-1. Suppose the Central Bank of Salidiva loaned the banks of Salidiva 5 million salidos. Suppose also that both the reserve requirement and the percentage of deposits held as excess reserves stay the same. By how much would the money supply of Salidiva change? a. 60 million salidos b. 50 million salidos c. 40 million salidos d. None of the above is correct. ____ 24. The Fed increases the reserve requirement and makes open market purchases. Which of these by itself will increase the money supply? a. neither the increase in the reserve requirement nor the open market purchases b. both the increase in the reserve requirement and the open market purchases c. only the increase in the reserve requirement d. only the open market purchases