43. If consumers suddenly had extra money at their disposal, most... would create a decrease in the supply of goods, causing...

advertisement

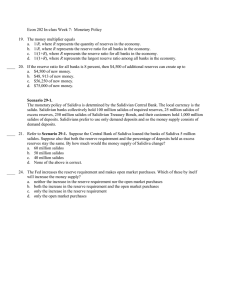

43. If consumers suddenly had extra money at their disposal, most would probably buy more goods. This would create a decrease in the supply of goods, causing their prices to rise. If the prices for all goods and services go up for a period of time, it can result in inflation. 44. A fractional-reserve system refers to the practice of reserving only part (a fraction) of a deposited quantity. In the United States, the Federal Reserve can control the money supply by adjusting the reserve requirements of member banks, thus adding or subtracting currency in circulation. 45. Primary reserves consist of cash on hand, deposits that may be due from other banks, and the percentage required by the Federal Reserve System. Secondary reserves include securities the bank purchases from the Federal government. Excess reserves are reserves held by a bank beyond its reserve requirements and are used to create money through business transactions. 46. Market forces determine most interest rates. Banks can charge whatever rates they choose, with the understanding that although high rates generate more income they also tend to drive away business. Economic conditions at large also help determine interest rates. For example, if demand for capital is high, interest rates tend to rise like any other prices. The inflation rate also affects interest rates, as savers and investors look for higher rates when they fear that inflation will erode the value of their earnings.