Chapter 6 Valuation Techniques MGT 3412 Fall 2013

advertisement

Chapter 6

Valuation Techniques

MGT 3412

Fall 2013

University of Lethbridge

Learning outcomes

• Understand compounding and discounting

• Capital Investment Project Decision NPV(DPV)

and IRR criteria

• Decision trees and Scenario Analysis

• Practical issues (mutually exclusive, capital

rationing, real vs. nominal cash flows

• DPV technique for bonds and stocks

Compounding and discounting

•

•

•

•

•

Simple vs compounded interest - Future Value

Mathematics of compounding

Multiple period compounding

Discounting and Present Value

Formulas and Financial Calculator

Investment Valuation

• NPV – discounted cash flow valuation

– Estimate cash flows

– Estimate discount rate (depends on risk!)

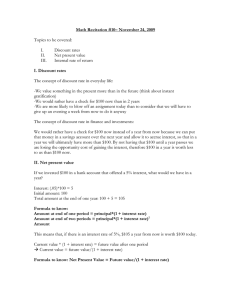

Figure 1 : Cash flows for Vito’s Deli

0

$ 1100

$ 1210

1

2

- $ 2100

© K. Cuthbertson and D. Nitzsche

Time

Figure 2 : NPV and the discount rate

NPV

Internal rate

of return

0

8% 10%

12%

© K. Cuthbertson and D. Nitzsche

Discount (loan) rate

Table 2 : Different cash flow profiles

Projects

Cash flows

Project A (normal)

(-100, 150)

Project B (Rolling Stones

concert)

Project C (Open Cast Mining)

(100, -150)

(-100, 245, -150)

© K. Cuthbertson and D. Nitzsche

Figure 3 : Project A, normal cash flows

Cash flows = { -, -, -, … +, +, …, +}

NPV

Invest if IRR > cost of borrowing , r

0

r

Loan rate or

discount rate, r

IRR= 50%

© K. Cuthbertson and D. Nitzsche

Figure 4 : Project B, Rolling Stones concert

Cash flows = { +, +, …, -, - , - }

NPV

Invest if IRR < cost of borrowing , r

IRR=50%

0

r

Loan rate or

discount rate, r

© K. Cuthbertson and D. Nitzsche

Figure 5 : Project C, open-cast mining

Cash flows = { -,-,-, …+,+, +, …,-,-, -}

NPV

Multiple IRR = 20% and 25%

r = loan rate

0

20%

25%

© K. Cuthbertson and D. Nitzsche

Loan rate or

discount rate, r

Table 3 : Scale problem

Cash flow Cash flow

at t=0 ($) at t+1 ($)

Project A

-10

15

NPV ($)

(r = 10%)

3.64

Project B

-80

110

20

© K. Cuthbertson and D. Nitzsche

IRR (%)

37.5

50

Figure 6 : Mutually exclusive projects

NPV

NPVL > NPVE

Switching point

NPVL < NPVE

0

8.71%

33.15%

18.36%

Discount (loan) rate

Project E

Project L

© K. Cuthbertson and D. Nitzsche

Figure 7 : Decision tree

Abandon

AV1 = 50

pu = 0.75

U

Do not abandon

NPV1U = 150

pu|u

pd|u

S

pd = 0.25

D

UU

UD

Abandon

AV1 = 50

pu|d

DU

Do not abandon

NPV1D = 40

pd|d

We have the choice to abandon the project at ‘U’ or ‘D’.

© K. Cuthbertson and D. Nitzsche

DD

Table 6 : Investment appraisal – other methods

Year 0 Year 1 Year 2 Year 3 Year 4

Cash flow, CF

Discount factor,

d

PV

-1000

500

500

700

0

1

0.869

6

435

0.756

1

378

0.497

2

348

-

-1000

NPV = 161

Payback period = 2 years

Discounted payback = 2 – 3 years

© K. Cuthbertson and D. Nitzsche

-