Chapter 9 Measuring Asset Returns Investments © K. Cuthbertson and D. Nitzsche

advertisement

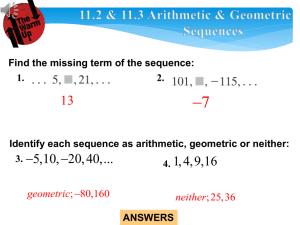

Chapter 9 Measuring Asset Returns Investments © K. Cuthbertson and D. Nitzsche Learning objectives Calculate asset returns – arithmetic mean, geometric mean, continuously compounded returns Sample statistics- mean, variance, standard deviation, correlation, covariance Random variable and probability distribution Normal distribution Central limit theorem © K. Cuthbertson and D. Nitzsche Measuring Asset Returns Nominal return, inflation and real return (Fisher Effect) Holding Period Return (annualized return) Returns over several periods Arithmetic average Geometric average Compounding frequency Table 1 : Compounding frequencies Compounding frequency Annually (q = 1) Quarterly (q = 4) Weekly (q = 52) Daily (q = 365) Continuously compounding TV = $100e(0.1(1)) (n = 1) Value of $ 100 at end of year (r = 10% p.a.) 110 © K. Cuthbertson and D. Nitzsche 110.38 110.51 110.5155 110.5171 Continuous Compounding Example $100e(0.1(1)) =110.5171 Continuously compounded 10% interest on 100 after a year will be 110.5171; (e is an irrational and transcendental constant approximately equal to 2.718281828) The inverse problem $100e(x(1)) =122.14 we take the difference of the natural logarithm ln(122.14 ) - ln(100) = ln(122.14/ 100)=.20 © K. Cuthbertson and D. Nitzsche Figure 1 : US real stock index, S&P500 (Jan 1915 – April 2004) 80 70 60 50 40 30 20 10 © K. Cuthbertson and D. Nitzsche Jan-03 Jan-95 Jan-87 Jan-79 Jan-71 Jan-63 Jan-55 Jan-47 Jan-39 Jan-31 Jan-23 Jan-15 0 Figure 2 : US real return, S&P500 (Feb 1915 – April 2004) 0.4 0.3 0.2 0.1 0 -0.1 -0.2 -0.3 -0.4 Feb-15 Feb-27 Feb-39 Feb-51 Feb-63 © K. Cuthbertson and D. Nitzsche Feb-75 Feb-87 Feb-99 Arithmetic Mean Return 8 The arithmetic mean return is the arithmetic average of several holding period returns measured over the same holding period: ~ Ri Arithmetic mean i 1 n ~ Ri the rate of return in period i n Geometric Mean Return 9 The geometric mean return is the nth root of the product of n values: ~ Geometric mean (1 Ri ) i 1 n 1/ n 1 Arithmetic and Geometric Mean Returns 10 Example Assume the following sample of weekly stock returns: Week Return 1 2 0.0084 –0.0045 3 0.0021 4 0.0000 Arithmetic and Geometric Mean Returns (cont’d) 11 Example (cont’d) What is the arithmetic mean return? Solution: ~ Ri Arithmetic mean i 1 n 0.0084 0.0045 0.0021 0.0000 4 0.0015 n Arithmetic and Geometric Mean Returns (cont’d) 12 Example (cont’d) What is the geometric mean return? Solution: 1/ n Geometric mean (1 Ri ) i 1 n 1 1.0084 0.9955 1.00211.0000 1/ 4 0.001489 1 Comparison of Arithmetic and Geometric Mean Returns 13 The geometric mean reduces the likelihood of nonsense answers Assume a $100 investment falls by 50 percent in period 1 and rises by 50 percent in period 2 The investor has $75 at the end of period 2 Arithmetic mean = [(0.50) + (–0.50)]/2 = 0% 1/2 Geometric mean = (0.50 × 1.50) – 1 = –13.40% Comparison of Arithmetic and Geometric Mean Returns (Cont’d) 14 The geometric mean must be used to determine the rate of return that equates a present value with a series of future values The greater the dispersion in a series of numbers, the wider the gap between the arithmetic mean and geometric mean Standard Deviation and Variance 15 Standard deviation and variance are the most common measures of total risk They measure the dispersion of a set of observations around the mean observation Standard Deviation and Variance (cont’d) 16 General equation for variance: 2 n Variance prob( xi ) xi x 2 i 1 If all outcomes are equally likely: n 2 1 xi x n i 1 2 Standard Deviation and Variance (cont’d) 17 Equation for standard deviation: Standard deviation 2 2 n prob( x ) x x i 1 i i Figure 3 : Histogram US real return (Feb 1915 – April 2004) 120 100 Frequency 80 60 40 20 0 -0.15 -0.11 -0.07 -0.03 0.01 © K. Cuthbertson and D. Nitzsche 0.05 0.09 0.13 Correlations and Covariance 19 Correlation is the degree of association between two variables Covariance is the product moment of two random variables about their means Correlation and covariance are related and generally measure the same phenomenon Correlations and Covariance (cont’d) 20 COV ( A, B) AB E ( A A)( B B ) AB COV ( A, B) A B Example (cont’d) 21 The covariance and correlation for Stocks A and B are: AB 1 (0.5% 0.0%) (2.5% 3.0%) (2.5% 2.0%) (0.5% 1.0%) 4 1 (0.001225) 4 0.000306 AB COV ( A, B) A B 0.000306 0.909 (0.018)(0.0187) Correlations and Covariance (cont’d) 22 Correlation ranges from –1.0 to +1.0. Two random variables that are perfectly positively correlated have a correlation coefficient of +1.0 Two random variables that are perfectly negatively correlated have a correlation coefficient of –1.0 Table 3 : Equity premium (% p.a.), 1900 - 2000 Over Bills Over Bonds Arith. Geom. Std. error Arith. Geom. UK 6.5 4.8 2.0 5.6 4.4 US 7.7 5.8 2.0 7.0 5.0 World (incl. US) 6.2 4.9 1.6 5.6 4.6 © K. Cuthbertson and D. Nitzsche Figure 4 : Mean and std dev : annual averages (post 1947) smallest “size sorted” decile Average Return (percent) 20 = NYSE decile “size sorted” portfolios 16 Equally weighted, NYSE 12 S&P500 Value weighted,NYSE 8 Corporate Bonds 4 T-Bills 0 4 largest “size sorted”decile Individual stocks in lowest size decile Government Bonds 8 © K. Cuthbertson and D. Nitzsche 12 16 20 24 28 32 40 45 Standard deviation of returns (percent) 50 Table 7 : UK stock market index and returns (2002-07) Year (June) 2002 FTSE100 Returns 2003 4031.17 -13.43% 2004 4464.07 10.74% 2005 5113.16 14.54% 2006 5833.42 14.86% 2007 6607.90 13.28% 4656.36 © K. Cuthbertson and D. Nitzsche Figure 5 : Uniform distribution (discrete and continuous) Continuous variable Discrete variable Probability Probability 1/6 1/(b-a) 1 2 3 4 5 © K. Cuthbertson and D. Nitzsche 6 a b Table 10 : Three scenarios for the economy State k Probability of State k, pk Return on Stock A Return on Stock B 1. Good 0.3 17% -3% 2. Normal 0.6 10% 8% 3. Bad 0.1 -7% 15% © K. Cuthbertson and D. Nitzsche Figure 6 : Normal distribution Probability One standard deviation above the mean 5% of the area 5% of the area -4 -3 -2 -1.65 © K. Cuthbertson and D. Nitzsche -1 0 1 2 +1.65 3 4 Figure 7 : “Students’ t” and normal distribution Students’ t-distribution (fat tails) Normal distribution N(0,1) 2 © K. Cuthbertson and D. Nitzsche 0 2 Figure 8 : Lognormal distribution, = 0.5, = 0.75 0.45 0.4 Probability 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 0 1 2 3 4 5 6 Price level © K. Cuthbertson and D. Nitzsche 7 Figure 9 : Central limit theorem © K. Cuthbertson and D. Nitzsche