Practice Problems for Exam 2 (from Fall 1997 exam)

advertisement

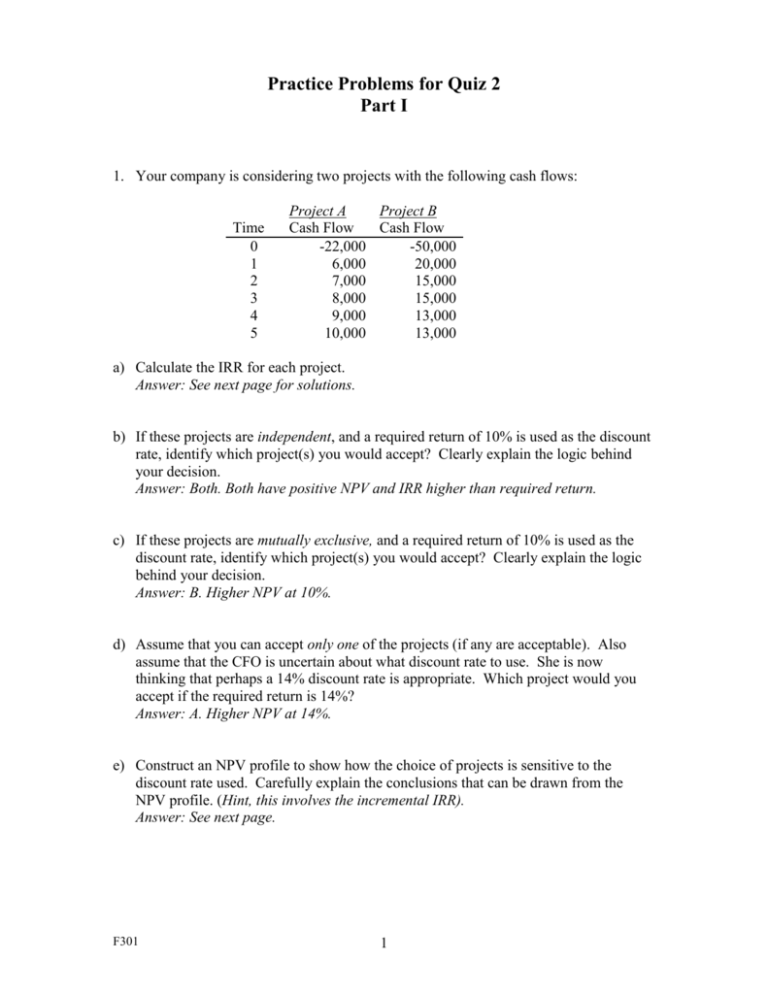

Practice Problems for Quiz 2 Part I 1. Your company is considering two projects with the following cash flows: Time 0 1 2 3 4 5 Project A Project B Cash Flow Cash Flow -22,000 -50,000 6,000 20,000 7,000 15,000 8,000 15,000 9,000 13,000 10,000 13,000 a) Calculate the IRR for each project. Answer: See next page for solutions. b) If these projects are independent, and a required return of 10% is used as the discount rate, identify which project(s) you would accept? Clearly explain the logic behind your decision. Answer: Both. Both have positive NPV and IRR higher than required return. c) If these projects are mutually exclusive, and a required return of 10% is used as the discount rate, identify which project(s) you would accept? Clearly explain the logic behind your decision. Answer: B. Higher NPV at 10%. d) Assume that you can accept only one of the projects (if any are acceptable). Also assume that the CFO is uncertain about what discount rate to use. She is now thinking that perhaps a 14% discount rate is appropriate. Which project would you accept if the required return is 14%? Answer: A. Higher NPV at 14%. e) Construct an NPV profile to show how the choice of projects is sensitive to the discount rate used. Carefully explain the conclusions that can be drawn from the NPV profile. (Hint, this involves the incremental IRR). Answer: See next page. F301 1 Project A Project B Difference cash flows cash flows (B - A) (22,000) (50,000) (28,000) 6,000 20,000 14,000 7,000 15,000 8,000 8,000 15,000 7,000 9,000 13,000 4,000 10,000 13,000 3,000 Time 0 1 2 3 4 5 IRR = 21.6% 17.3% 12.2% NPV @ 10% 7,606.52 8,799.39 14% 4,571.61 3,659.28 23% (711.91) (5,467.06) NPV profile: 10,000 8,000 6,000 4,000 2,000 Project A 0 Project B (2,000) (4,000) (6,000) (8,000) 8% 12% 16% 20% 24% Conclusions for mutually exclusive projects: At discount rates below 12.2% (the crossover rate or incremental IRR), choose B, because it has a higher NPV. At discount rates between 12.2% and 21.6% (which is A's IRR), choose A, because it has a higher NPV when using discount rates in that range. At discount rates above 21.6%, reject both projects. Above that rate, both projects have negative NPV. F301 2

![IRR = A + [(B-A) x NA NA –NB ] A B A NA NA IRR = A +](http://s2.studylib.net/store/data/018456319_1-4faaa9a471b68ef839761e9ccad4e453-300x300.png)