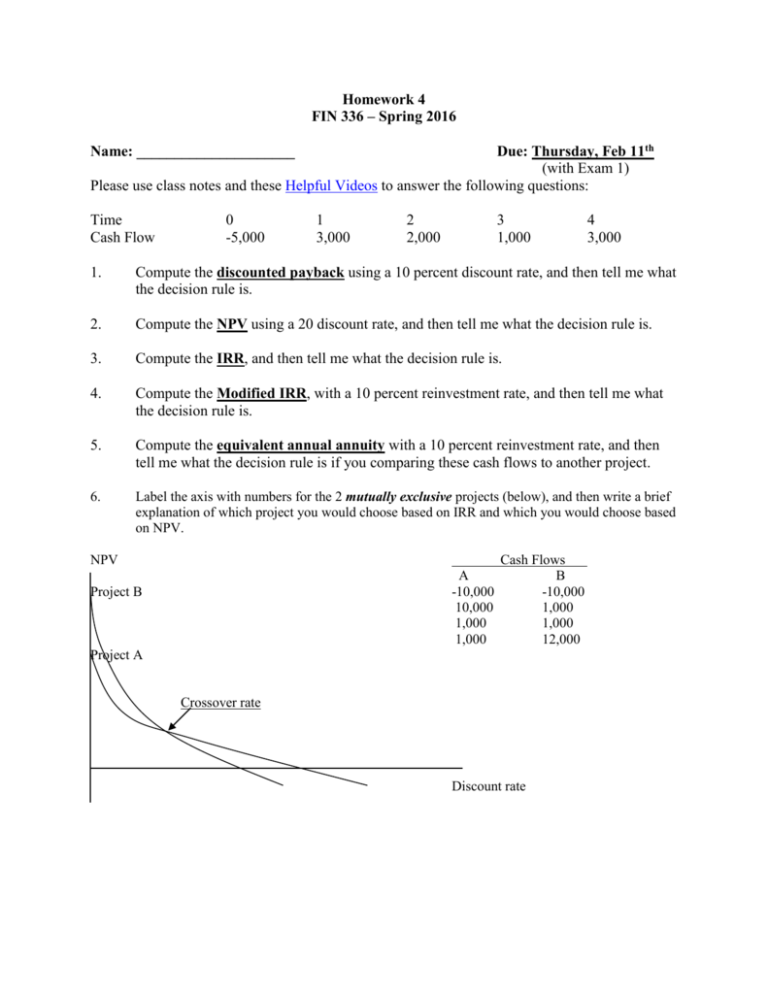

336 Homework 4

advertisement

Homework 4 FIN 336 – Spring 2016 Due: Thursday, Feb 11th (with Exam 1) Please use class notes and these Helpful Videos to answer the following questions: Name: _____________________ Time Cash Flow 0 -5,000 1 3,000 2 2,000 3 1,000 4 3,000 1. Compute the discounted payback using a 10 percent discount rate, and then tell me what the decision rule is. 2. Compute the NPV using a 20 discount rate, and then tell me what the decision rule is. 3. Compute the IRR, and then tell me what the decision rule is. 4. Compute the Modified IRR, with a 10 percent reinvestment rate, and then tell me what the decision rule is. 5. Compute the equivalent annual annuity with a 10 percent reinvestment rate, and then tell me what the decision rule is if you comparing these cash flows to another project. 6. Label the axis with numbers for the 2 mutually exclusive projects (below), and then write a brief explanation of which project you would choose based on IRR and which you would choose based on NPV. NPV A -10,000 10,000 1,000 1,000 Project B Cash Flows B -10,000 1,000 1,000 12,000 Project A Crossover rate Discount rate