Roland George Investment Program

advertisement

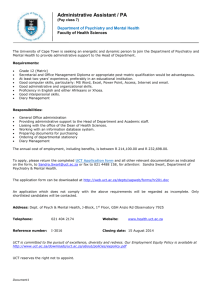

Roland George Investment Program Ultra Clean Technology Jennifer Beebe Company: Ticker: Market Cap: Industry: P/E: P/B: Ultra Clean Technology Recent Price: UCTT Fair Price: $262 Million 52 Week High/Low: Semiconductor Equipment Beta: 32.91 Forward P/E: 2.54 Avg Daily Volume: Recommendation: BUY 3,000 shares $11.42 $28.00 5.85-13.25 1.39 10.48 247,670 Market Analysis October 2006 has provided excitement on Wall Street. The Dow closed over 12,000 for the first time on Thursday, October 19, 2006.1 This record breaking high came only days after mixed news regarding economic indicators was released. In the month of September the growth of new jobs missed analysts’ estimates and at the same time the unemployment figure dropped .01% to 4.6%.2 Investors are watching interest rates closely as well. The latest inflation figures released were 1-2% over the Fed’s “comfort rate”; analysts disagree over whether the next move from the Fed will be up or down. 3 In sharp contrast to 2005 oil prices have been falling, leaving consumers more discretionary spending. While the Dow is at an all time high, other indexes are not agreeing. These conflicting factors leave investors debating whether or not we are entering a bullish market. Industry Analysis The semiconductor equipment industry is part of the information technology sector. This industry is responsible for “the design, manufacture, and packaging of semiconductors”.4 Currently in this industry, there are conflicting indicators on its future. The North American Philadelphia Stock Exchange is down 6.73% year to date.5 This decrease in value may lead investors to believe that this industry will not offer them strong returns. Several forecasts, on the other hand, show both an increase in demand for silicon and an increase in worldwide semiconductor revenues. In 2006 the industry is expected to see an 18% increase in the demand for silicon showing that the industry has a healthy future.6 iSuppli Corporation released a study stating that worldwide revenues are expected to rise for the next five consecutive years. 7 This study did not fail to mention the dramatic decrease in growth for the past two years. They referred to fiscal year 2005 and 2006 as the “double bottom” and firmly state they expect to see a comeback with double digit growth in 2007. This market bottom presents an opportune time to enter. 1 http://www.dailynews.com/business/ci_4519711 http://www.thestreet.com/markets/economics/10313489.html 3 http://money.cnn.com/2006/10/19/news/economy/inflation/index.htm?postversion=2006102006 4 http://semiconductorbases.net/ 5 http://money.cnn.com/data/markets/philsemi/ - pulled 10/20/2006 6 http://wps2a.semi.org/wps/portal/_pagr/103/_pa.103/248?dFormat=application/msword&docName=P039732 7 http://www.linuxelectrons.com/News/EDA/20060406121625934 2 Company Analysis Fundamental Analysis Ultra Clean Technology (UCT) was founded in 1991, with headquarters in Menlo Park, CA, by Mitsubishi Corporation.8 In 1992 they began production of semiconductor capital equipment. That is, they manufacture the machines that are used in semiconductor manufacturing. Today UCT is a preferred supplier to two of the top ten chip equipment makers in the industry, Applied Materials, Inc. (ticker: AMAT) and Novellus Systems, Inc. (ticker: NVLS). In 2002 the young company was acquired by Francisco Partners. Under their new owners UCT was able to open a new manufacturing facility in Shanghai, China. The product portfolio of UCT has become more diverse since their inception. Currently they pride themselves in manufacturing five different subsystems to assist in the production of semiconductors. 9 These five subsystems are: Gas Delivery Systems Frame Assemblies Top Plate Assemblies Chemical Delivery Systems Catalytic Steam Generation Systems The company is undoubtedly most known for their Gas Delivery Systems. To solidify their position in this market even more UCT is in the midst of having their Predator™ IGS patented.10 This new technology will be sure to give them even more of an edge; it allows for the meeting or exceeding of industry standards at a reduced weight and cost. This gives their customer more flexibility in manufacturing. In recent news, after being acquired in 2002, UCT was able to acquire Sieger Engineering, Inc. in June of 2006.11 Sieger was also involved in the manufacture of semiconductor subsystems, as well as the medical industry. The transaction was completed with the exchange of $16 million cash, 2.47 million shares of common stock, and the assumption of $15 million of debt. Sales for UCT are expected to rise 91% year over year for fiscal year 2006. 12 Sales of 2005 $126 M have been realized already in 2006.13 A key contributing factor to this booming sales growth is the company’s product diversification plan. They are seeing sales from their gas delivery systems grow and at the same time revenues from their other 2006 business 2004operations are growing. To illustrate this please refer to figure 1. 2005 Gas Delivery Systems 1 2 Other Products 2004-$184M Figure 1 – Total Revenue Breakdown 8 2005-$148M http://www.uct.com/about/background.html http://www.uct.com/products/whatUCTdelivers.html 10 http://www.uct.com/products/predator.html 11 http://www.uct.com/investors/inews/2006/062906.html 12 http://www.smartmoney.com/stockscreen/index.cfm?story=20060912intro&afl=yahoo 13 http://finance.yahoo.com/q/is?s=UCTT 9 2006-$282M (EST) With strong performance and a quality product UCT sales can be expected to rise into 2007. With a continued commitment to product diversification UCT could see a 20% to 30% increase in sales for fiscal year 2007. Earnings for UCT in fiscal year 2006 have increased substantially. Total EPS in 2005 were $0.12 and 2004 saw $0.59 in earnings.14 Already in 2006 quarter one and quarter two have provided $0.35 in earnings. Figure 2 shows historic income statements and the pro forma income statement for quarters three and four of the current year. According to these statements UCT is expected to see a total of $0.81 in earnings. Revenue1 COGS2 Gross Profit Q4 (EST) 83,080 66,464 16,616 2006 Q3 (EST) 73,280 58,624 14,656 Q2 68,469 57,759 10,710 Q1 57,195 33,518 8,191 2005 Q4 Q3 38,781 27,540 33,518 24,967 5,263 2,573 Operating Expenses R & D3 G & A4 Operating Income 1,039 7,477 8,100 916 6,595 7,145 733 4,762 5,215 598 3,845 3,748 429 4,172 662 495 3,002 (924) Other Income EBIT Interest Expense5 EBT Income Tax Expense6 8,100 848 7,252 2,466 7,145 928 6,217 2,114 5,215 36 5,179 1,222 3,748 487 3,261 1,130 62 724 724 41 30 (894) (894) (328) Net Income 4,787 4,103 3,957 2,131 683 (566) 0.25 0.21 0.22 0.13 0.04 (0.03) EPS 1 Assuming sales target of $282 million achieved. Assuming average of 80% of sales. 3 Assuming continued 1.25% of sales. 4 Assuming continued 9% of sales. 5 Assuming 8% interest on debt. 6 Assuming 29% effective tax rate. 2 Figure 2 - Pro Forma Income Statement for 2006 Q3 and Q4 Technical Analysis UCT has consistently outperformed both the NASDAQ and the semiconductor equipment industry; however, there is a strong correlation with UCT and these two benchmarks. All three see the same timing of tops and bottoms. While UCT’s stock price is up 74% over last year the price still remains low. With semiconductor sales’ growing internationally this is a good time to enter the market before the price of UCT goes any higher. With these two benchmarks, the NASDAQ and semiconductor equipment industry, expected to see increased growth through year end 2007 UCT will undoubtedly follow suit. Figure 3, on the following page, shows the percentage change in price for UCT, NASDAQ, and the industry since January 1, 2006. 14 ULTRA CLEAN HOLDINGS, INC. , Annual Report, 2005 Figure 3 - Chart provided by Baseline Risk Analysis There are three major sources of risk when investing in UCT. These risk factors are summarized below: UCT is a young company with limited financials. With an IPO in quarter 1 of 2004 UCT is a very young company.15 Fiscal year end 2006 will provide investors with only their third annual report. Outstanding lawsuit against Celerity Inc. On September 2, 2005 UCT filed suit against Celerity, Inc. claiming that their technology did not infringe on Celerity’s patents.16 On September 13 Celerity submitted a counter claim that UCT was infringing on seven patents. To date there has not been a verdict on the case. Majority of revenue comes from a very limited customer base. In 2005 Applied Materials, Inc., Lam Research, and Novellus Systems, Inc. alone accounted for 89% of UCT’s sales.17 If any of these customers experiences a dramatic drop in sales it will adversely affect UCT’s sales. Valuation Analysis CAPM for required rate of return: K = krf + B(km+krf) = .047+1.39(.10+.047) = 12% Malkiel’s Model using EPS P*= 15 .12(1+5.75) (1+.12) + ( 21.8(1.09)(1+.35)2 (1+.12)2 (1+.12)2 ) = $28.00 http://premium.hoovers.com/global/msn/index.xhtml?pageid=10021&PDate=Q:2004:1 ULTRA CLEAN HOLDINGS, Annual Report, 2005 17 ULTRA CLEAN HOLDINGS, 10-Q, August 14, 2006 16 Holt's Model Industry: Semiconductor Equipment Pessimistic Scenario: UCTT earnings grow 20% year over year. PE UCTT = ( 1+.20+0 1+.20+0 ) 2 = 1.0000 = 1.1736 = 1.3611 PE SEMIQ UCTT Fair P/E = (1.00)(21.8) = 21.80 UCTT FY2007 EPS = $1.09 Fair Value = $23.76 Anticipated Scenario: UCTT earnings grow 30% year over year. PE UCTT = ( 1+.30+0 1+.20+0 ) 2 PE SEMIQ UCTT Fair P/E = (1.27)(21.8) = 25.48 UCTT FY2007 EPS = $1.09 Fair Value = $27.89 Optimistic Scenario: UCTT earnings grow 40% year over year. PE UCTT = ( 1+.40+0 1+.20+0 ) 2 PE SEMIQ UCTT Fair P/E = (1.46)(21.8) = 29.67 UCTT FY2007 EPS = $1.09 Fair Value = $32.34 Fair Price: $28.00* *All calculated prices were given equal weight. Recommendation UCT is at an exciting point in their company history. They are facing an industry promising increased demand over the next several years and they are solidifying their position as a leader in the market place. With their swelling sales and strong earnings UCT will offer investors a strong return over the next 15 months. Due to the weakened projections for 2006 in the industry stock prices have been beaten down making this an ideal time to invest. UCT will soon be on many analysts’ lists of stocks to watch. Before this happens it is my recommendation that the Roland George Investment Portfolio acquires 3,000 shares of UCTT.