Chapter 16 Quiz Fall 2012 ... Basic and diluted EPS.

advertisement

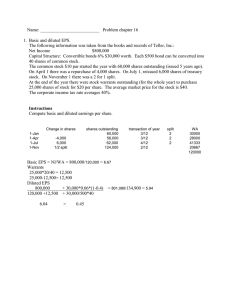

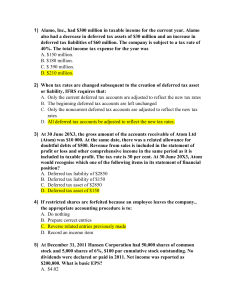

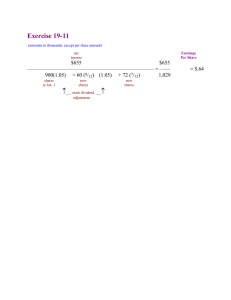

Chapter 16 Quiz Fall 2012 Name: __________________________ Basic and diluted EPS. Presented below is information related to Avatar Corporation. 1. Net Income [including an extraordinary gain (net of tax) of $60,000] 2. Capital Structure a. Cumulative 8% preferred stock, $120 par, 15,000 shares issued and outstanding $600,000 $1,800,000 b. $10 par common stock, 200,000 shares outstanding on January 1. On March 1, 60,000 shares were issued for cash. On August 1, 35,000 shares were purchased and retired. $2,354,160 c. The corporation has $850,000, 5-year, 15% bonds issued at par in 2009. Each $500 bond is convertible into 20 shares of common stock after 10/25/10. d. There were stock warrants for 9,000 shares of stock outstanding for the entire year. The warrants allowed the holder to purchase a share of stock for $30. 3. Other Information a. Average market price per share of common stock during entire year b. Income tax rate Instructions Compute basic and diluted earnings per share for the current year. Change in shares 60000 -35000 shares outstanding 200000 260000 225000 transaction of year 2/12 5/12 5/12 WA 33333 108333 93750 235416 Basic EPS: (600,000 – 144,000) / 235,416 = 1.94 Convertible Bonds: 850,000*15%*(1-30%) = 89,250 = 2.63 >1.94 (Antidilutive) 850,000/500*20 34,000 Options 9,000 * 30 = 270,000 / 60 =4500 9,000 - 4500 =4,500 Diluted EPS = (600,000- 144,000)/(235,416+4,500) = 456000/239916=1.9 $60 30%