Mid-Term Quiz

Intermediate Accounting 2

Instruction:

You are given 5 problems in total. Each problem is marked differently depends on the difficulty level.

You are required to get 100% mark to pass the quiz. You can choose any problem randomly as long as it is 100% mark in total.

Problem 1 (60%)

Share dividends.

The equity section of Benton Corporation’s statement of financial position as of December 31, 2015 is as follows:

Equity

Share capital—ordinary, $5 par value; authorized, 2,000,000 shares; issued, 400,000 shares

Share premium—ordinary

$2,000,000

850,000

Retained earnings 3,000,000

$5,850,000

The following events occurred during 2016:

1. Jan. 5 10,000 shares of authorized and unissued ordinary shares were sold for $8 per share.

2. Jan. 16 Declared a cash dividend of 20 cents per share, payable February 15 to share-holders of record on February 5.

3. Feb. 10 20,000 shares of authorized and unissued ordinary shares were sold for $12 per share.

4. March 1 A 30% share dividend was declared and issued. Fair value per share is currently $15.

5. April 1 A two-for-one split was carried out. The par value of the shares was to be reduced to

$2.50 per share. Fair value on March 31 was $18 per share.

6. July 1 A 15% share dividend was declared and issued. Fair value is currently $10 per share.

7. Aug. 1 A cash dividend of 20 cents per share was declared, payable September 1 to stockholders of record on August 21.

Instructions

Journalize all the above transaction and prepare the equity section as of Dec 31, 2016.

Problem 2 (20%)

Rensing, Inc., has $800,000 of 8% preference shares and $1,200,000 of ordinary shares outstanding, each having a par value of $10 per share. No dividends have been paid or declared during 2014 and 2015. As of December 31, 2016, it is desired to distribute $488,000 in dividends.

Instructions

How much will the preference and ordinary shareholders receive under each of the following assumptions:

(a) The preference is noncumulative and nonparticipating.

(b) The preference is cumulative and nonparticipating.

(c) The preference is cumulative and fully participating.

(d) The preference is cumulative and participating to 12% total.

Problem 3 (20%)

Corporation issues 3,000 convertible bonds at January 1, 2015. The bonds have a three year life, and are issued at par with a face value of €1,000 per bond, giving total proceeds of €3,000,000. Interest is payable annually at 6 percent. Each bond is convertible into 250 ordinary shares (par value of €1). When the bonds are issued, the market rate of interest for similar debt without the conversion option is 8%.

Instructions

(a) Compute the liability and equity component of the convertible bond on January 1, 2015.

(b) Prepare the journal entry to record the issuance of the convertible bond on January 1, 2015.

(c) Prepare the journal entry to record the conversion on January 1, 2016.

(d) Assume that the bonds were repurchased on January 1, 2016, for €2,910,000 cash instead of being converted. The net present value of the liability component of the convertible bonds on January 1,

2016, is €2,850,000. Prepare the journal entry to record the repurchase on January 1, 2016.

Problem 4 (80%)

Below are capital structure information PT Molusca for 2011:

Debt:

18% Bonds Payable 1,000 bonds

15% Convertible bonds 1,000 bonds issued at par,

1 bond can be converted into 30 shares of ordinary shares

10% Convertible bonds 1,000 bonds issued at par,

1 bond can be converted into 25 shares of ordinary shares

20,000,000

30,000,000

25,000,000

Capital:

Share capital - Ordinary 100,000 shares @Rp 1000,- par value 100,000,000

Share premium - Ordinary 20,000,000

10% Share capital – Convertible preference shares 10,000 shares @Rp 5,000 par value.

Each share of P/S can be converted into 5 shares of ordinary shares

Share premium - Preference

50,000,000

5,000,000

Other Information:

Net income for 2011

The Company granted its employee 10,000 share options at par

27,679,167

Tax rate on taxable income 40%

Market price of ordinary share was Rp 1,200,- per share

Below are the information needed for EPS computation:

On April 1, sold 50,000 ordinary shares at Rp 60,000,000

On June 1, sold 9,000 shares of 12% Convertible Preferred Stock @Rp 5,000 par value, market value @Rp 5,500, whereas each share of P/S can be converted into 5 shares of ordinary shares.

On July 1, the company distributed share dividend 10% for all outstanding ordinary shares.

On September 1, 1,000 bonds of 10% convertible bond were converted into ordinary shares.

On Oktober 1, the company repurchased 10,000 of its ordinary shares.

On November 1, the company repurchased additional its 5,000 ordinary shares as treasury shares.

Instructions: Compute PT Molusca Basic and Diluted EPS for 2011!

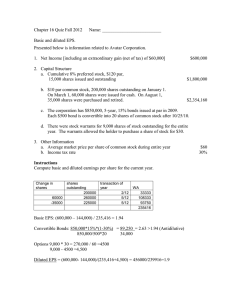

Problem 5 (40%)

Assume that the following data relative to Kane Company for 2012 is available:

Net Income

Transactions in Ordinary Shares

Jan. 1, 2012, Beginning number

Mar. 1, 2012, Purchase of treasury shares

June 1, 2012, Share split 2-1

Nov. 1, 2012, Issuance of shares

8% Cumulative Convertible Preference Shares

Sold at par, convertible into 200,000 ordinary shares

(adjusted for split).

Share Options

Exercisable at the option price of $25 per share. Average market price in 2012, $30 (market price and option price

Change

(60,000)

640,000

120,000 adjusted for split).

Instructions

(a) Compute the basic earnings per share for 2012. (Round to the nearest penny.)

(b) Compute the diluted earnings per share for 2012. (Round to the nearest penny.)

$2,100,000

Cumulative

700,000

640,000

1,280,000

1,400,000

$1,000,000

60,000 shares