EPS

advertisement

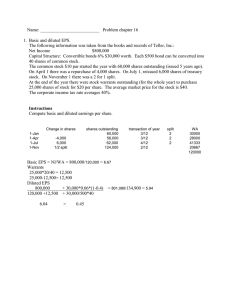

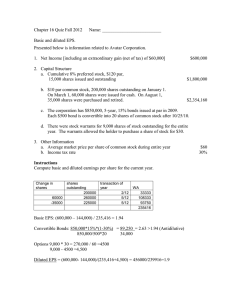

Earnings per Share - FAS 128 A. Simple Capital Structure Determine income applicable to common stock Determine weighted average # of common shares outstanding Divide income applicable to common stock by weighted average # of common shares outstanding Determination of weighted average number of common stock (wac) outstanding: X company, year 1 Example: 1-Jan 1-Apr 1-Jul 1-Oct 31-Dec # shares outstanding # of months outstanding/12 # shares outstanding 50000 75000 75000 90000 100000 25.00% 12500 25.00% 18750 25.00% 18750 25.00% 22500 0.00% weighted average number of shares outstanding: 72500 Alternative method: 1-Jan # shares outstanding additional issued # 0f months outstg/12 1-Apr 1-Jul 1-Oct 25000 3/4 18750 0 15000 1/4 3750 31-Dec Total 50000 1 50000 Net income preferred dividends income available for common stockholders weighted average number of common stock Earnings per share 0 10000 100000 $ 200,000 $ 20,000 $ 180,000 72500 $ 2.48 Additional issues: Stock splits and stock dividends are assumed to have occurred at the beginning of the year for computation of weighted average number of shares. For comparative multi year presentation, they are assumed to have occurred at the beginning of the earliest year presented. 72500 Example: X company, year 2 no new stock is issued, but on July 1, year 2, the company issues a 10% stock dividend: # of shares before stock dividend stock dividend total number of shares 100000 10000 110000 restatement of year 1: 1-Jan # shares outstanding additional issued # 0f months outstg/12 alternatively: weighted average 3 of shares 1-Apr 1-Jul 1-Oct 0 1 55000 27500 3/4 20625 16500 1/4 4125 72500 1.1 79750 31-Dec Total 55000 Net income preferred dividends income available for common stockholders weighted average number of common stock Earnings per share # of shares 0 year 2 year 1 $ 300,000 $ 200,000 $ 20,000 $ 20,000 $ 280,000 $ 180,000 $ 2.55 110,000 $ 2.26 79,750 11000 110000 79750 Note: if shares are issued after stock split or stock dividend, they are not adjusted: Year 3: # of shares before 2:1 stock split total number of shares total number of shares Net income preferred dividends income available for common stockholders weighted average number of common stock Earnings per share # of shares 1-Apr 1-Jul 110,000 issued 220,000 10000 0.5 5000 225,000 Year 3 year 2 year 1 $ 500,000 $ 300,000 $ 200,000 $ 20,000 $ 20,000 $ 20,000 $ 480,000 $ 280,000 $ 180,000 $ 2.13 $ 225,000 1.27 $ 220,000 1.13 159,500 B. Complex Capital Structure In addition to common and preferred stock the company has any or all of the following: convertible preferred stock or debt stock options/warrants contingent shares Any of the above must be taken into consideration if and only if they are dilutive Dilutive Ifsecurities: included in the EPS calculation thye will reduce EPS Step 1: Determine income applicable to common stock: Step 2: Determine weighted average number of common stock outstanding: Step 3: Determine if any dilutive securities are outstanding Test to determine if securities are dilutive: convertible bonds/preferred stock a. Determine additional number of shares > increase denominator b. Determine interest expense (net of tax) or preferred dividends > increase numerator c. Compute EPS: if lower than basic EPS > securities are dilutive, must be included Warrants and options a. Determine amount of cash resulting from exercise of options/warrants b. Calculate # of treasury shares that could be purchased with the cash (average market price) c. Determine net additional number of shares (denominator) If the number is higher than under basic EPS > securities are dilutive (simple rule: if exercise price is lower than average market price of stock, securities are dilutive Contingent shares: May be contingent onpassage of time (merger situation) attainment of earnings or other goal If contingency has been met > include shares Example of complex capital structure: Common stock 100000 convertible into pref. stock ($100 par) 10000 8% 40000 shares of common stock convertible bonds $ 200,000 10% 4000 shares of common stock exercise market cash treasury stock net shares options 20000 45 50 900000 18000 2000 Net income preferred dividends income available to common stockholders EPS (basic) 600000 80000 520000 5.2 Test for dilution # shares a. convertible preferred stock net income common stock additional shares EPS 520000 80000 600000 $ 4.29 less than basic EPS, > dilutive, include b. Convertible bonds# shares common stock 100000 additional shares 4000 104000 EPS net income interest tax net $ 520,000 20000 35% 13000 $ 13,000 $ 533,000 $ 5.13 less than basic EPS, > dilutive, include c. Options common stock additional shares net income $ 520,000 $ $ 520,000 $ 5.10 less than basic EPS, > dilutive, include EPS 100000 40000 140000 # shares 100000 2000 102000 All together now: common stock additional shares, preferred additional shares, bonds additional shares, options fully diluted EPS # shares 100000 40000 4000 2000 146000 net income $ 520,000 $ 80,000 $ 13,000 $ $ 613,000 $ 4.20 C. Earnings per share disclosure requirements If applicable, EPS (basic and fully diluted) must be provided for Net operating income extraordinary items discontinued operations cumulative effect of change in accounting principles