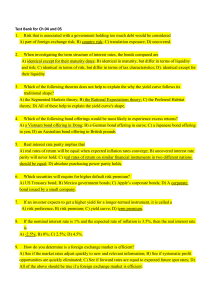

PRINCIPLES OF FINANCE FIN 3403 Interest Rates

advertisement

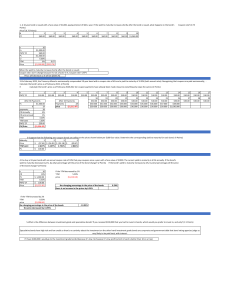

PRINCIPLES OF FINANCE FIN 3403 Interest Rates Following are the yields on five Treasury bonds that mature September 6 of the given year. Assume that today is September 7, 2005. Maturity Date September 2006 September 2007 September 2008 September 2009 September 2010 Yield 3.7 3.7 3.8 3.9 4.0 These bonds do not have a maturity risk premium (MRP) associated with them. 1. Plot the yield curve for these bonds. Briefly explain what the shape of the yield curve might indicate about interest rates in the future. 4.05 4.00 3.95 Yield (%) 3.90 3.85 3.80 3.75 3.70 3.65 3.60 3.55 1 2 3 4 5 Yeasrs to Maturity 2. Compute the expected inflation rate for the period from September 2007 to September 2008. Show your computations. Assume that the real risk-free rate, k*, is 2 percent. 3 Year Bond YTM 3.8% (Rate in Year 1) (Rate in Year 2) (Rate in Year 3) 2(3.7%) (Rate in Year 3) (matures in 2008) 2 3 Rate in Year 3 3(3.8%) 2(3.7%) 11 .4% 7.4% 4.0% k k * IP IP k k * 4% 2% 2% 3. Compute the expected interest rate for the period from September 2009 to September 2010—that is, compute the 1-year rate for this period. Show your computations. 5 Year Bond YTM (Rate in Year 1) (Rate in Year 2) (Rate in Year 3) (Rate in Year 4) (Rate in Year 5) (matures in 2010) 5 4 (Rate in Year t) Rate in Year 5 t 1 5 4(3.9%) (Rate in Year 5) 4 .0 % 5 Rate in Year 5 5(4.0%) - 4(3.9%) 20.0% - 15.6% 4.4%